Yehia ... making sense of energy transition

Yehia ... making sense of energy transition

As energy transition increasingly becomes non-negotiable, this approach allows businesses to better manage their energy, and reduce costs and decarbonise at the same time, Ashraf Yehia, Managing Director – Eaton Middle East, tells OGN

The Middle East’s energy markets are expanding to include different forms of energy production, with hydrogen energy in the lead.

The UAE, Saudi Arabia, and Oman have set plans to produce more than 2 million tons of hydrogen per year in the next 15 years.

The power grid in the GCC is robust, and most of the countries here have demand management tools that make any power outage unlikely. It is fair to say that many businesses were unprepared for steep price hikes after the impact the pandemic had on everything in general.

However, it is important to note that some GCC countries will have clean energy sources fully feeding power grids.

Sultan Ahmed Al Jaber, the UAE Minister of Industry and Advanced Technology and Managing Director and Group CEO of Adnoc said at Adipec in November 2021 that Adnoc will be the first to implement this.

Data from Gulf News and Index Mundi, shows how gas and oil prices have remained somewhat stable for much of the past year, but when considering the past decade, the prices have increased ever since the pandemic, particularly after mid-2019. So it’s easy to see why some complacency has crept in.

WHAT’S CAUSING THE TURBULENCE?

The Covid-19 pandemic has caused unusual price fluctuations, which should begin to level out. But there is no quick cure for the ills that beset the region’s energy industry, as well as the global one.

|

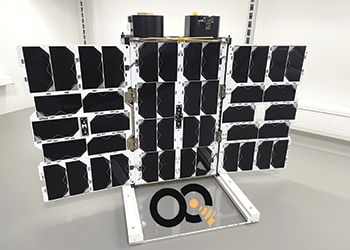

Eaton unites power needs with on-site renewable energy generation |

Several sectors such as the economy or the energy sector have a complex knot of problems that is unlikely to unravel quickly. This means price volatility cannot be fully predicted in the foreseeable future.

Recent and ongoing price spikes are to some extent connected with uneven ramping up of demand as countries across the GCC emerge from the pandemic crisis — each working to their own different recovery schedules. Natural gas prices have spiralled upward relatively from the beginning of the crisis till now.

Even though most of the GCC’s energy is produced from oil, there are plans to change that in the future. Recently, the UAE authorities announced their net-zero carbon emissions around 2050.

This will obviously allow companies to let go of natural gas resources and suppliers. This has the potential to shed light on potential partners to produce more unconventional and conventional reserves.

In addition, according to Al Jaber, these developments will aid the plan to achieve self-sufficiency.

Although the GCC countries as well as European ones have attempted to alleviate energy price pressure on both domestic and business users using a variety of methods, the fact remains that the underlying price trend for both gas and electricity has shifted upward.

EFFECT OF DECARBONISATION PROJECTS

Another strand of that knot of problems - and one which could prove difficult to loosen – is the need for public and private investment in decarbonisation projects to meet reduction targets that are either mandatory, or set to be mandatory globally, pushing more and more countries in the Middle East to put a plan to achieve that.

Governments from around the world have met recently at the United Nation’s COP26 climate talks in Scotland to agree on global targets for carbon emission reduction.

Inevitably, there has been discussion of the role that renewables such as wind, solar and hydro will play a big role in meeting the ever-growing demand for power.

Renewables will be key to decarbonisation in most countries, which is how that issue of grid resilience creeps into the frame.

The switch to renewables is likely to be uneven because the process of closing coal and gas-fired power stations will remove swathes of generation capacity quickly.

As new sources of power such as solar and wind farms are connected to the grid, problems can arise with grid capacity. This means that the physical infrastructure, the power lines themselves, must be upgraded to increase capacity to manage the new power supplies.

This is a time-consuming and expensive process especially for countries in the GCC that have spent the last decade focusing and building around the gas and oil sector.

Therefore, the switch to renewables or clean energy will require them to alter a huge part of their infrastructure and energy supplies.

Although most countries have mechanisms to cope with power shortages, such as interruptible electricity contracts that reduce demand from major uses when the need arises, it remains the case that switching to commercial renewable sources could be a bumpy ride, particularly as power demand rises due to the electrification of heat and transport.

SECTOR COUPLING CAN EASE THE STRAIN

Energy transition is increasingly non-negotiable, mandated in various forms by governments within and outside the GCC and EU, and across virtually every sector of the economy.

Buildings, transport, and industry are all affected, with the switch from fossil-fuelled vehicles to electric vehicles perhaps the most prominent.

Sector coupling is the term that describes how energy consuming sectors can be linked with energy producing sectors to make the most of all available power, particularly renewable power.

It is this linkage that can help businesses take a strategic approach to energy price volatility.

Our recently launched ‘Buildings as a Grid’ approach to energy transition unites the power needs of buildings and electric vehicles with on-site renewable energy generation, and it is based on sector coupling.

At an enterprise level, the Buildings as a Grid approach means businesses can use digitally-controlled energy storage to manage power and reduce costs within the confines of their building or site.

At its most basic, the approach involves taking off-peak energy from the grid and storing it for use when needed. This can be done quickly, without grid upgrades.

However, the approach is about much more than that. It is truly strategic because it paves the way for the energy transition.

It prepares the building for an energy future beyond fossil fuels. And because the exact shape of that future is still unclear, the approach is highly flexible.

Buildings as a Grid is not a single product, or even a single system - we call it ‘an approach’ because it will be different for every business that adopts it.

‘BEHIND THE METER’ MATTERS

The power industry refers to everything that is the responsibility of energy users as ‘behind the meter’. This can be anything from machinery to heating and lighting, and it includes EV charging and energy storage.

Behind the meter, businesses are in control. This is where they can define their own approach to energy management to save money, increase resilience, and boost carbon-efficiency.

Energy storage and on-site renewables are key tools they can choose to combat higher energy prices in the short term and build a greater degree of self-sufficiency in the mid-to-long term.

The switch to EVs will be a defining feature of this decade. BloombergNEF, the clean energy primary research provider, said in its Electric Vehicle Outlook 2020 report that the number of EVs globally is expected to jump from 8.5 million in 2020 to 116 million in 2030.

As more drivers switch to EVs, they will need charging wherever they go. This means premises that host business, commercial, educational, governmental, healthcare or leisure services, or similar, will need to provide EV charging, as will companies that own or manage residential apartment buildings.

Buildings as a Grid can manage bi-directional energy flows that include the flow of power between EVs and buildings to make the most of EV battery capacity.

This can be highly effective wherever there is extensive vehicle parking, and particularly valuable as part of an EV fleet charging strategy.

The uncertain energy outlook has left many business leaders pondering how to shield their businesses from price rises and power outages, and what they can do to manage energy and meet decarbonisation goals. Sector coupling is a route they can choose right now.