Name of Client : Adnoc Gas

Estimated Budget : $4,500,000,000

Revised Budget : $5,500,000,000

Contract Value : $5,000,000,000

Facility Type : LNG Terminal, Offsite & Storage Tanks, Liquefied Natural Gas (LNG)

Sector : Gas

Main Contractor : JGC Corporation NMDC Energy Technip Energies

Location : Ruwais, Abu Dhabi, UAE

Award Date : 2024-Q1

Background

Abu Dhabi National Oil Company (Adnoc) has announced plans to develop a midstream/downstream facility located next to Fujairah Port initially. But the project has been relocated to Ruwais after a comprehensive evaluation of location options. The objective of the project is to construct a liquefied natural gas (LNG) export terminal that would have the capacity to process and ship up to 9.6 million tonnes per annum (mtpa) of LNG to crucial consumer markets of Pakistan, India, China, and other key markets in Asia like Japan and South Korea. The proposed facility is anticipated to more than double the UAE's current LNG production capacity. The Ruwais LNG plant is set to be the first LNG export facility in the Middle East and Africa region to run on clean power, making it one of the lowest-carbon intensity LNG plants in the world. The facility will leverage artificial intelligence and the latest technologies to enhance safety, minimise emissions and drive efficiency.

Project Scope

The project's scope encompasses the construction of an LNG export terminal designed to process and ship up to 9.6 million tonnes per annum (mtpa) of Liquefied Natural Gas (LNG). This includes the establishment of two mega LNG trains, various process units, and storage tanks, as well as an export jetty for loading cargoes and facilities for LNG bunkering. Additionally, the project will incorporate essential utilities, flare handling systems, and designs for electric-powered rotary equipment and compressors. Associated buildings will also be constructed alongside a 364-kilometre-long, 52-inch pipeline and marine dredging works to support the overall infrastructure.

Project Status

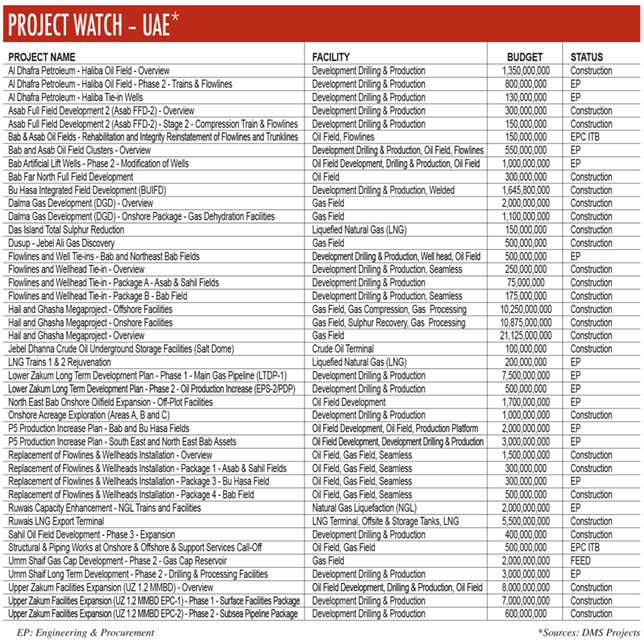

As of March 2025, an 86 per cent interest in Adnoc Gas is held by Adnoc. Also, construction is progressing. The LNG terminal is scheduled to start commercial operations in 2028.

Project Finance

Adnoc is the project client. In early March 2023, Adnoc Group appointed its subsidiary Adnoc Gas in charge of managing and executing the planned LNG export terminal project.

Shell, BP, Total Energies, and Mitsui (through its wholly owned subsidiary MBK Investment Management) will each take a 10 per cent stake in the project, with Adnoc retaining the 60 per cent majority stake.

In February 2025, Adnoc holds an 86 per cent stake in Adnoc Gas.

Project Schedules

Project Announced : 2Q-2020

EPC ITB : 1Q-2023

EP : 1Q-2024

Construction : 2Q-2024

Commissioning : 1Q-2028

Completion : 1Q-2028