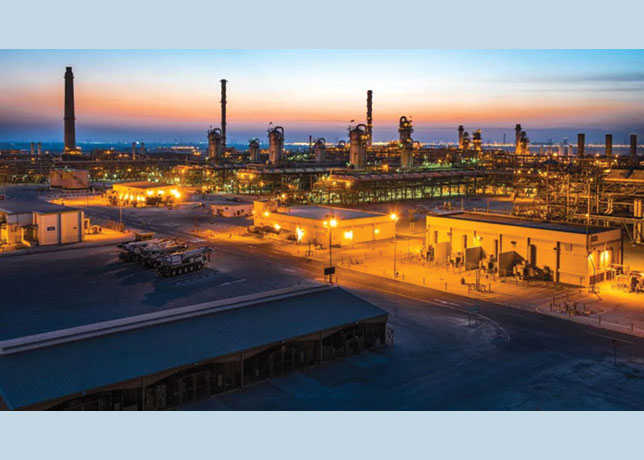

Abu Dhabi National Oil Company (Adnoc) and its Austrian chemicals partner Borealis plan an initial public offering of their petrochemicals joint venture Borouge, the latest step in the Abu Dhabi state energy group's asset monetisation programme.

Borouge, which is a specialty plastics firm that produces polyolefins, said on Wednesday it planned to list its shares on the Abu Dhabi Securities Exchange (ADX).

Borouge could be worth $20 billion, which means an IPO size of $2 billion, two sources familiar with the deal said.

Adnoc declined to comment on the valuation of Borouge.

The company, whose products are used in items such as cars and food packaging, said its offering will consist of approximately 3 billion existing shares, representing 10 per cent of the company's issued share capital.

The offer will begin May 23 and run to May 28 for retail investors and May 30 for institutional buyers, the company said in an intention to float (ITF) document. It expects its shares to be admitted for trading on the ADX on June 3.

"Adnoc continues to consistently unlock and maximise value across its integrated upstream and downstream asset base to drive sustainable growth for the benefit of Abu Dhabi and the UAE," said Sultan bin Ahmed al-Jaber, Adnoc's managing director and Group CEO.

Borouge said it plans to pay dividends to its shareholders biannually depending on factors such as its capital expenditure plans and market conditions.

For the financial year 2022, it plans to pay a dividend in September of $325 million and a further $650 million the following March. For the financial year 2023, it said it plans to pay a dividend of no less than $1.3 billion.

Adnoc Chief Executive Sultan al-Jaber has overseen a transformation strategy that the company embarked on more than four years ago, building an investment team to monetise assets and raise funds from international private equity groups.

Last year Adnoc listed its drilling business in Abu Dhabi's largest IPO to date. Fertiglobe, a joint venture between Adnoc and chemical producer OCI, also made its market debut last year, and Adnoc floated shares in its distribution business in 2017.

Gulf oil producers are following in the footsteps of Abu Dhabi with plans to raise tens of billions of dollars through sales of stakes in energy assets, capitalising on a rebound in crude prices to attract foreign investors.

Citigroup, First Abu Dhabi Bank, HSBC, and Morgan Stanley are acting as joint global coordinators, while Abu Dhabi Commercial Bank, Arqaam Capital, EFG-Hermes, Goldman Sachs Bank are joint bookrunners. --Reuters