Oman LNG's net income fell by 21 per cent last year to $1.5 billion even though its output was robust at 11.5 million metric tons for a second consecutive year, it said.

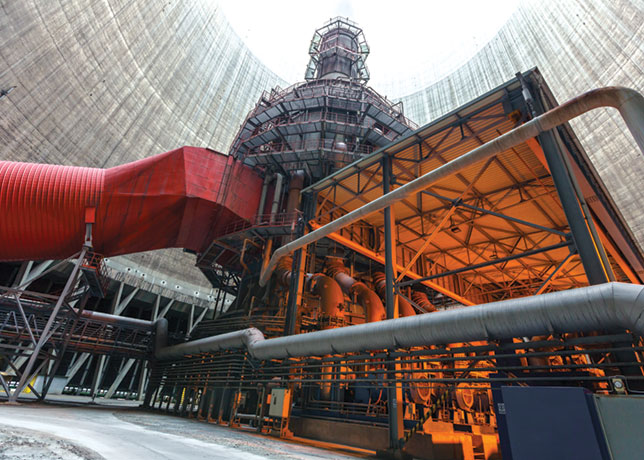

The liquefied natural gas output was slightly above its enhanced nameplate production capacity of 11.4 million tons per annum (mtpa), Oman LNG said in its 2023 annual report.

Revenues last year were $4.9 billion, down from $5.8 billion in 2022. The report did not give a reason for the fall but gas prices globally retreated last year after disruption caused by Russia's invasion of Ukraine triggered record prices in 2022.

Qalhat LNG, which merged with Oman LNG in 2013, had revenues of $2.4 billion last year, Oman LNG said. It did not disclose Qalhat's profit.

Oman LNG delivered 173 LNG cargoes last year, from 176 in 2022, and 31 natural gas liquids cargoes. Its sales comprised 94 per cent via contracts and 6 per cent spot sales.

"Oman LNG remained active in the spot market and contracts optimisation leveraging increased agility and deals that yielded over US$ 1 billion in upside," Oman LNG Chief Executive Hamed Al Naamany said in the report.

Oman LNG on Monday signed a deal to supply TotalEnergies, one of its shareholders, with 800,000 mtpa of LNG for 10 years from 2025, finalising an announcement in October that Oman LNG had agreed to extend supplies to shareholders for up to 10 years beyond 2024.

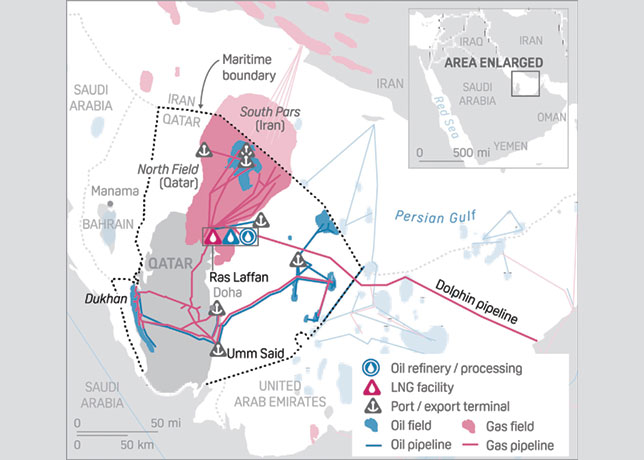

Founded in 1994 after the discovery of significant gas reserves, Oman LNG is 51 per cent owned by the Omani government, 30 per cent by Shell, 5.54 per cent by TotalEnergies, 5 per cent by Korea LNG, 2.77 per cent each by Japan's Mitsubishi Corporation and Mitsui, 2 per cent by Thailand's PTTEP and 0.92 per cent by Itochu Corporation.

The company also signed 10-year supply deals with Shell and Japan's largest power company JERA earlier this month, as well as deals with Germany's state-owned Secure Energy for Europe (SEFE) and Turkey's state gas grid operator Botas. -Reuters