Exxon Mobil Corporation today (October 31) announced estimated third quarter 2019 earnings of $3.2 billion, or $0.75 per share assuming dilution.

Earnings included a favorable tax-related identified item of about $300 million, or $0.07 per share assuming dilution. Capital and exploration expenditures were $7.7 billion, including key investments in the Permian Basin.

Oil-equivalent production rose 3 percent from the third quarter of 2018, to 3.9 million barrels per day. Excluding entitlement effects and divestments, liquids production increased 4 percent driven by Permian Basin growth, while natural gas volumes increased 1 percent.

"We are making excellent progress on our long-term growth strategy,” said Darren W. Woods, chairman and chief executive officer.

"Growth in the Permian continues to drive increased liquids production and we are ahead of schedule for first oil in Guyana. The value of our position in Guyana improved further this quarter with an additional discovery, our fourth this year," he stated.

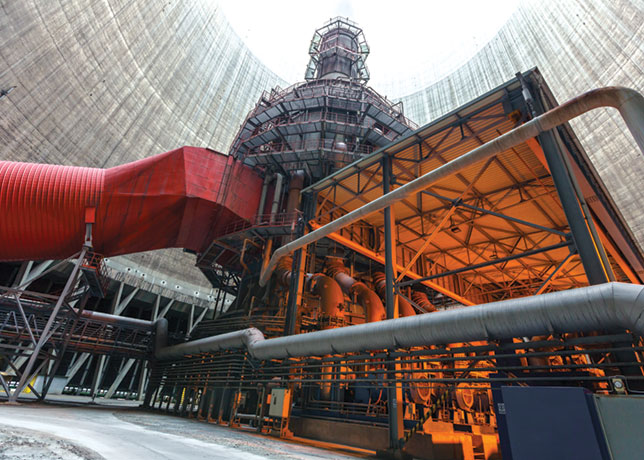

"We are also making good progress on our advantaged investments in the Downstream and Chemical. This quarter, we started production at our new high-performance polyethylene line in Beaumont," stated Woods.

"The competitiveness of our portfolio was further enhanced with the divestment of non-strategic assets, reaching almost a third of our 2021 objective of $15 billion," he added.-TradeArabia News Service