Japan's top oil refiner, Eneos Holdings, plans to increase investment in low-carbon energy such as liquefied natural gas and sustainable aviation fuel, while slowing efforts in cleaner alternatives like hydrogen, its CEO said.

Under a new three-year business plan through March 2028, Eneos will invest 1.56 trillion yen ($10.7 billion), including 740 billion yen in strategic spending focused on low-carbon and decarbonised energy, such as renewables and carbon capture.

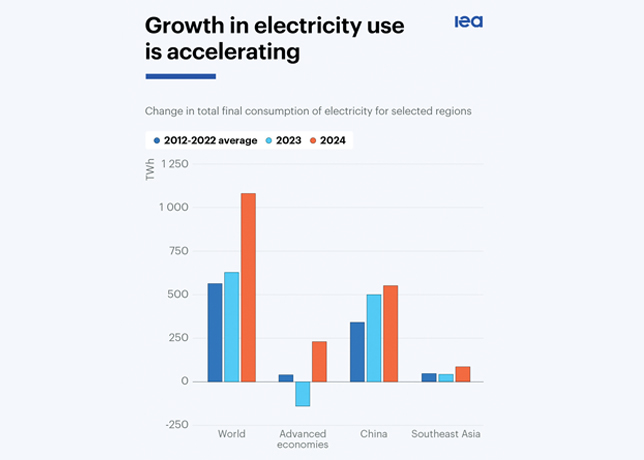

"We plan to reinforce and expand our LNG operations as demand is expected to grow through around 2040," CEO Tomohide Miyata told a news conference.

Spending over the period includes 310 billion yen in low-carbon energy, 250 billion yen in decarbonised energy, and 180 billion yen in oil and chemicals, on top of 820 billion yen to maintain its core refinery operations.

Eneos may also tap up to 1 trillion yen in management reserves for strategic investments, including in LNG, Miyata added.

Like its global peers, Eneos is shifting its business portfolio to align with the energy transition.

"But the trend toward a carbon-neutral society is slowing, and the full-scale bifurcation of the energy transition, previously expected around 2030, may be delayed," Miyata said, adding the company is in no rush to supply hydrogen and ammonia.

In the new plan, Eneos has removed its previous target of supplying up to 4 million metric tons of hydrogen by the fiscal 2040 year.

Instead, stable and affordable energy, including oil, has become more important amid rising energy security concerns, US policy risks, and the growing cost of decarbonisation technologies, Miyata said.

Eneos already holds stake in LNG projects in Asia, but Miyata said US projects, including Alaska LNG, could be considered if economically viable.

The refiner reported a 22 per cent decline in net profit for the year ended March 31 and forecast a 18 per cent drop for the current year.

It aims to raise its refinery run rate, excluding scheduled maintenance, to 90 per cent by fiscal 2027, up from 78 per cent in 2024. -Reuters