Oilfield equipment industry ... a capital intensive market

Oilfield equipment industry ... a capital intensive market

Increasing drilling activities on account of growing energy demand is expected to remain a key driving factor for this market. However, the cost intensive nature of the market due to risk and low reliability of operations is a major challenge to its growth

The global market for oilfield equipment is expected to reach $127.60 billion by 2020, according to a new study.

Transparency Market Research, in its latest report, states that the global demand for $90.6 billion world oilfield equipment industry will rise 3.8 per cent yearly through 2016 to $109 billion. Primarily driven by the surge in oil and gas production activities, the oilfield equipment market, the report, titled 'Oilfield equipment market – global and US industry analysis, size, share, growth, trends and forecast, 2012 – 2018,' states that, registering a compound annual growth rate (CAGR) of 3.8 per cent from 2012 to 2018, the oilfield equipment market is likely to grow from $93.74 billion in 2012 to $117.37 in 2018.

FEW MAJOR PLAYERS

The global market for oilfield market is highly fragmented with top four companies operating in the market accounting for just over 30 per cent of total market in 2013. The existence of several specialising niche vendor segments, scattered globally, has given rise to such market share distribution.

Some of the significant players in the oilfield equipment market are Weatherford International, Schlumberger, National Oilwell Varco, Halliburton, Aker Solutions, Cameron International, Eni, Baker Hughes, Zenith Oilfield Technology, Transocean, Abbot Group and FMC Technologies.With many small scale players present in oilfields equipment industry spread across various geographies, the market is fragmented in nature.

GROWTH DRIVERS

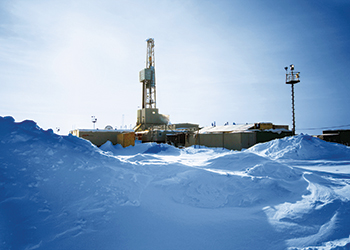

Increasing drilling activities on account of growing energy demand is expected to remain a key driving factor for the market. However, the cost intensive nature of the market due to risk and low reliability of operations is a major challenge to the growth of this market. Growth will be strongest in developing areas, where better infrastructure will benefit drilling activity. New, more expensive techniques to drill for unconventional reserves such as shale oil and oil sands will boost spending on oilfield equipment.

Factors such as the use of advanced technology and techniques such as improved oil recovery (IOR) and enhanced oil recovery (EOR), shift towards smaller unconventional oil and gas fields, growing demand for alternative sources of energy, and the need to reduce dependency on other nations for crude oil and natural gas are some of the key factors contributing to the growth of the oilfield equipment market. In contrast, geopolitical hurdles and strict regulatory policies threaten to stall the growth of the global market.

INDUSTRY INSIGHTS

Sudden surge of energy demand is being experienced globally. As a result, oil yielding activities have seen an increase in frequency and intensity leading to increase in use of required equipment. Rising oil and gas extraction activities for energy source production is expected to increase the usage of these equipment. High performance and reliable equipment are required to achieve results from extraction operations. Oilfield equipment have varying usage for the purpose of oil extraction from underground or under sea bed sources. Broad categories of these equipment are drilling equipment, pumps and valves and field processing and production machineries.

Other equipment are surveying machinery, derricks, etc. Major investments into developing reliability of these equipment are taking place, to improve productivity, recovery and efficiency of extraction operations. Not only firms but many governments have also been involved in encouraging these developments with an aim of improving self-dependency. Not only productivity but safety is also a key aspect in these operations. Strict guidelines are followed to ensure safety of involved workforce.

Technologies have been developed to enhance the safety features of these equipment. Shift towards other unconventional and small sources for energy extraction is expected to push market growth. The rental business model has been hindering the growth of this market with rotational use of limited resources.

Nevertheless, with growth of oilfields services market, this industry is also expected to grow. Many new equipment rental companies will increase the demand for oilfields equipment in the market. Oilfield equipment require large investments for technical support and manufacturing. Design and production of these equipment involves huge capital. It turns out to be a capital intensive market for the reasons of risks and low reliability issues associated with its drilling operations. Many small players are unable to make these investments, stunting the market growth.

The expertise level is high and developmental work progresses in complexity for safety, demanding skilled workforce. Geopolitical factors and regulatory policies threaten the quick growth rate of this market. With shift in focus to clean and renewable sources for energy, oil and natural gas extraction activities might experience a slow down over the forecasted period of time leading to slow down of oilfield equipment market as well.

SEGMENTS: DRILLING EQUIPMENT DOMINATES

Different types of equipment are used for performing different functions. These functions involve extraction, processing and transportation of oil extracted. The drilling equipment particular to oil extraction are drilling rigs or augers. An oil platform houses the massive drilling rigs for off shore operations. Augers or portable drilling rigs are used to reach small, inaccessible source locations especially swampy areas. Pumps and valves are used to direct the flow of oil from its source.

In addition, they are used to separate the water flow that accompanies extraction of oil. An oilfield being distant and isolated, transportation of oil with less wastage raises concerns. This is handled by setting up pipeline transport systems with the help of these pumps and valves. Several equipment are required for the treatment of crude material extracted from the oilfields. Major removable impurities are separated at the initial stage before its transportation to refineries.

On the basis of product type, the market for oilfield equipment is segmented into field machinery equipment, drilling equipment, pumps and valves, and others such as well surveying machinery and derricks. The segment of drilling equipment dominates the oilfield equipment market both globally and in the US.

Drilling equipment was the leading product segment and accounted for 73.7 per cent of total market revenue in 2013. In addition to being the largest product segment, drilling equipment is also expected to be the fastest growing product segment at an estimated CAGR of 4.2 per cent from 2014 to 2020. It was followed by field production machinery and pumps and valves which is expected to exceed a market worth $20 billion by 2020, at an estimated CAGR of 3 per cent from 2014 to 2020.

NORTH AMERICA: LARGEST MARKET

North America is the largest market for oilfield equipment owing to ever-increasing demand for crude oil. Rapid development in the exploration of unconventional energy sources and the subsequent surge in drilling activities in Canada and the US are expected to drive the North American oilfield equipment market over the forecast period. In 2011, North America held a 30 per cent share in the global market and with producers tapping unexplored reservoirs to keep up with the mounting demand for crude oil, this regional segment is sure to expand over the next couple of years.

In 2013, this region accounted for 39.5 per cent of total market revenue and is expected to grow at an estimated-below-market-average CAGR of 3.8 per cent. However, Asia Pacific is expected to be the fastest growing regional market for oilfield equipment at an estimated CAGR of 4.5 per cent from 2014 to 2020. Asia Pacific is expected to record rapid growth on account of increasing exploration activities mainly in China and India to meet the growing energy demand.

Increased consumption of energy in emerging APAC economies is one of the most significant factors driving this market. According to the CIA World Factbook, India and China are both ranked among the top five oil consumers in the world. This is likely to boost the demand for oilfield equipment from Asia Pacific.

With its extensive oil and natural gas reserves, Middle East and Africa are expected to contribute significantly to the global oilfield equipment market and are expected to grow at an estimated CAGR of 4.2 per cent from 2014 to 2020.

Middle East countries form a prominent share of the consumer market with their extensive oil resources and extraction businesses. North America and Europe utilise products from this market for crude oil and natural gas extraction operations to meet their extensive demands. Growing economies of Asia Pacific are also driving growth of this market by utilization of the equipment for extraction of oil along its vast resource rich coastline.

OER MARKET WORTH $53,706M BY 2019

The oilfield equipment rental (OER) market will grow from an estimated $26,818 million in 2014 to $53,706 million by 2019 with a CAGR of 14.9 per cent from 2014 to 2019, says another study. The North American region holds the largest market for oilfield equipment rental, driven largely by the number of drilling and exploration and production (E&P) activities in the US North America, due to its growing energy needs and flourishing conventional and unconventional drilling and oilfield service industry is the major growth engine for this market.

The oilfield equipment rental industry is fragmented and offers several opportunities for consolidation and growth in efficiency through an increase in economies of scale. The rental facility has reduced the entry barrier and exit barriers in the industry. Renting equipment are much more feasible viable for new comers than buying purchasing costly equipment. Hence, the perception of buyers has shifted from buying towards renting equipment. This is a major driver of the oilfield equipment rental market.

Top five players of the OER market are the suppliers of equipment for oilfield service. Weatherford International Ltd (Ireland) rents its equipment under the drilling tools segment whereas Halliburton (US) maintains oilfield rental companies in the form of Boots & Coots (US) and PWR Rentals (US). Schlumberger (US) too has Thomas Oil Tools as its rental subsidiary, Chesapeake (US) has Great Plains Oilfield Rentals (US), and Superior Energy Services (US) has a number of rental companies in its portfolio.