Petrofac ... continuing to dominate

Petrofac ... continuing to dominate

The EPC contractor reported record year-end backlog of $18.9 billion, up 26 per cent from 2013 when orders stood at $15 billion. However, it said it expected a lower than forecast net profit of $460 million this year due to the fall in oil prices

Against the backdrop of falling oil prices and a consequent slump in the market, Petrofac, the top engineering, procurement and construction contractor in the Middle East and North Africa (Mena) region, has this year notched some of the Middle East’s most ambitious large scale projects.

In January, the London-listed EPC giant secured a $4 billion deal for the first phase of the Lower Fars heavy oil development programme in Kuwait. When fully operational the initial phase is expected to produce around 60,000 barrels of oil a day. Petrofac is leading a consortium with Greece- based Consolidated Contractors Company (CCC) as its partner.

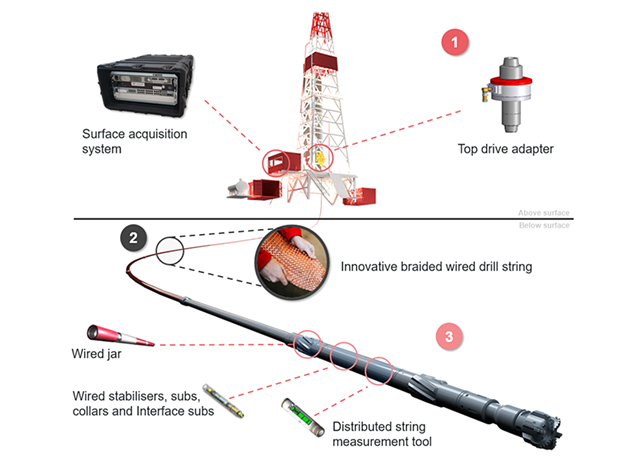

In February 2015, Petrofac entered into a Memorandum of Understanding (MoU) with McDermott International, Inc to jointly pursue opportunities in the deepwater subsea, umbilicals, risers and flowlines (SURF) sector.

The aim is to develop a first-class SURF market position targeting EPCI projects in the US Gulf of Mexico, Mexico, West Africa, Brazil, Mediterranean and North Sea. The agreement will provide both companies a wider geographic reach and enhanced access to world-class opportunities. It will also offer a broader range of assets to widen the potential market and optimize asset use.

In the same month, the company entered into two strategic contract agreements with Algerian state-owned Sonatrach. In the first contract, Petrofac will provide a range of multi-discipline engineering design and procurement services in support of Sonatrach’s upstream hydrocarbon development programme within the procedures that govern the tendering process.

The contract is of five year duration. Under the terms of the second agreement, Petrofac has signed a MoU with Sonatrach to establish an Algerian Joint Venture to undertake engineering and project execution of selected upstream and downstream developments.

In November, 2014 the firm bagged a second contract extension from South Oil Company (SOC) for support on its Iraq Crude Oil Expansion Project. The 12-month extension is worth around $106 million bringing the total value of the contract to more than $300 million since it was first awarded in 2012.

The company was also selected by BP in Iraq to provide general construction management services for the huge Rumaila oilfield. The potential value of the deal has been put at $500 million and will last for three years, with an option for further two-year extension.

Meanwhile, the EPC contractor reported record year-end backlog of $18.9 billion, up 26 per cent from 2013 when orders stood at $15 billion. However, it said it expected a lower than forecast net profit of $460 million this year due to the fall in oil prices.

Petrofac operates in over 29 countries worldwide. It carries out projects through an extensive network of 24 offices and 12 training centres across the world. The company’s major focus is on the UK Continental Shelf, Middle East and Africa, and Asia Pacific region. Wide market reach and focus on strategic regions would aid the company in securing additional contracts and investments.

Petrofac is well established presence in the region with a market share of 13 per cent. It has two operational centres in the UAE, with projects and support in Kuwait, Oman, Qatar, Saudi Arabia and Iraq. Its operations are mostly concentrated in the Middle East and North Africa where the costs of extracting hydrocarbons are relatively modest.

Mena is the source of the majority of it Petrofac’s backlog. In FY2014, the company received order intake of $6.3 billion, securing major new awards in Kuwait, Oman and Algeria. It reported around 42 per cent of its total revenue from the Mena region in FY2014.

Petrofac focuses on securing new contracts and extensions across the world. In October 2014, Petrofac secured a second contract extension from South Oil Company (SOC) for support on its Iraq Crude Oil Expansion Project. The 12-month extension, worth around $106 million, brings the total value of the contract to more than $300 million.

In the same month, the company has been awarded a contract to work with the Government of Nova Scotia to help it identify the best way forward to exploit its ultra-deepwater oil potential. It also secured a Duty Holder contract for two assets in the Southern North Sea from Faroe Petroleum. Under which it will continue to provide operations and facilities management to the Schooner and Ketch platforms located in the UK sector of the Southern North Sea.

During the month, in the Central North Sea, Petrofac has been selected to provide engineering and construction support worth up to $120 million for Chevron’s three operated assets, the Captain, Alba, and Erskine platforms.

It has also been awarded a contract in Iraq to provide general construction management services to BP Iraq NV (BP) on the Rumaila field near Basra. The contract, which runs for three years, with an option for further extension of two years, has a potential value of up to $500 million.

|

Saipem ... doing well in the region |

Petrofac is mostly engaged in carrying out government and other consortium projects that are secured through competitive bidding process. The company receives a large portion of order book from state and federal governments across Opec nations. Presently, numerous companies are contending for government projects, which are awarded to the company quoting the lowest price. Project prices are largely influenced by highly competitive market, which comprises small and large companies.

The current uncertainty in the global economy and stringent regulations may reduce the number of projects and in turn force the companies to bid for projects at a lower price. This may have a negative impact on the revenue of the company.

The company operates in a highly competitive market. The quality of services, availability, experience, price, technical knowledge and a reputation for safety are some of competitive factors in the markets in which the group operates.

Most of its competitors have better financial and technical resources, as a result of which they offer a broad range of well stimulation services in all the regions in which the group has operations. It faces competition from large national and international oilfield service companies, besides regional oilfield companies.

The group’s major competitors include Bechtel Corporation, Oil States International, Fluor Corporation and others. To sustain itself in the market the company needs to aggressively market its services with superior quality, safety and environmental care. Such highly competitive market could adversely impact the company’s operational and financial performance.

Another top EPC contractor, Saipem secured a number of high-profile contracts in the Middle East and beyond in 2014-15.

Saipem will work on an EPC contract relating to the expansion of the onshore production centres at the Khurais, Mazajili and Abu Jifan fields.

The construction of new facilities will allow to process additional 300,000 barrels per day from the Khurais field, while the installation of new satellite facilities will reinstate production of 200,000 barrels per day from the Abu Jifan and Mazalij fields.

The Khurais field is located about 150 km northeast of Riyadh and it is a giant oil field, 127 km long and covering an area of 2,890 sq km.

Umberto Vergine, Saipem’s CEO, says: "This new contract is the result of our successful project delivery in Saudi Arabia and strengthens our relationship with Saudi Aramco, a key client.

"Saipem is highly committed to the development of the strategic Saudi’s national resources." Furthermore, in drilling, Saipem secured a new contract for Perro Negro 7 jack-up, operating offshore in the Middle East, starting from November 2015 until the end of 2018.

Perro Negro 7 is a self-elevating drilling unit capable of operating in water depth up to 375ft. Saipem has also been awarded, by different clients, new contracts relating to nine onshore drilling rigs operating in the Middle East and in Latin America, with the value of contracts running into the billions.

In addition, through its subsidiary company Ersai Caspian Contractor, the organisation recently won a major new engineering and construction contract in the Caspian Region.

In a consortium with Daewoo Shipbuilding & Marine Engineering Co, it was awarded a $1 billion deal "This contract underlines our excellent track record in a key market for Saipem and I look forward to the continued development of our presence in the Caspian Region, working with our local partners to deliver a high quality service to some of our most important clients," says Vergine.

The scope of the contract includes yard engineering, fabrication and pre-commissioning activities as well as the load-out of 55,000 tonnes of pipe racks.

As the world’s largest shipbuilder, the significance of Hyundai Heavy in the region’s oil and gas industry certainly cannot be overstated.

One of its most recent orders include a $1.94 billion awards from Abu Dhabi Marine Operating Company (Adma-Opco) for the construction of fixed platforms in the Abu Dhabi Nasr field.

The project is scheduled for completion in the second half of 2019 and is estimated to raise the daily production capacity of the offshore field to 65,000 bpd from the current 22,000 bpd.

Hyundai Heavy was among the bidding companies for Kuwait’s $1.2 billion contract for the Mina Al Ahmadi refinery but lost to Spain’s Técnicas Reunidas.

The company is currently working on $3.3 billion order from Saudi Electricity Company to build the Shuqaiq Steam Power Plant projected to come online in 2017. The scope of work includes engineering, procurement, construction, testing and commissioning of the 2,640MW oil-fired steam power project in the Kingdom.

In May this year, the South Korean EPC giant signed a contract with Russia’s Gazprom to build a floating LNG terminal, due to be delivered by November 2017.

Meanwhile, Samsung Engineering is a mainstay of the EPC landscape in the Middle East and one of the industry’s best known and well trusted names. Part of its strength is its joint venture with the contracting giant Arabtec, and it looked like the company would consolidate yet more towards the end of last year when it announced a mega-merger with Samsung Heavy Industries.

However, this move was scuppered when – according to reports – the amount of stock buying requested from shareholders opposing the deal exceeded the ceiling agreed in the deal. The company also said the decision to cancel the merger was made to protect shareholder value.

-is-one-of-the-world.jpg)

-(4)-caption-in-text.jpg)