Cryptocurrency and more particularly Bitcoin has something very common with with oil and gas, an industry notorious for its greenhouse emissions. Wondering what and how?

First, a bit about this ‘currency’ that has taken the world by storm. Anyone – corporate, individual or government – realising its vast investment potentional is vying for a share. Even Tesla, the world’s sixth most valuable company, announced an investment of $1.5 billion in February last.

Bitcoin's price has skyrocketed touching a little over $57,567 a coin and a market cap of $1.08 trillion at the writing of this report.

The decentralised global digital currency works on an encrypted peer-to-peer method, and coins are created through a process called 'mining,' which uses computer processing capacity to form units (called blocks) of the cryptocurrency, writes Abdulaziz Khattak for OGN.

BITCOIN MINING IS A POWER GOBBLER

Bitcoin has an enormous ecological footprint because of mining; it has roughly the same carbon footprint annually as Hong Kong.

The energy used — most of the time returning without success — to mine the coins and the resulting greenhouse gas emission is higher than any form of currency.

It is estimated that 98 per cent of miners (approximately 4 million global computer systems) fail to win the block, despite using a huge amount of electricity. Miners have created powerful computer systems — whole data centres — to win their prize. It is a highly competitive domain, to say the least, and an inherently wasteful at that.

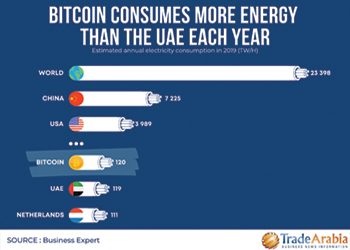

According to the Cambridge Centre for Alternative Finance, the annual energy expenditure of Bitcoin is 120.37 terawatt hour (1 TWh = 1 billion kWh), with an upper limit estimate of 289.5 TWh. It’s approaching that of the world’s 12th largest national consumer, the UK (300.5 TWh)

Each Bitcoin transaction uses around 657.39 kWh of electricity, the equivalent of 59 days of electricity for an average British household.

To further understand this in perspective, one Bitcoin transaction generates the CO2 equivalent of 706,765 swipes of a Visa credit card. It takes double the energy to mine $1 worth of Bitcoin than it does gold, copper or platinum. And the carbon footprint generated from a single Bitcoin transaction is equal to spending 52,043 hours on YouTube.

Meanwhile, Bitcoin’s e-waste footprint of 10.71 kilotons rivals that of Luxembourg, since Bitcoin mining is done with specialised (singular purpose) hardware.

Also, since the ecological footprint depends on the means of electricity production in any place, it’s worth mentioning that up to 65 per cent of the mining happens in China, which largely produces power from coal.

Chinese miners, therefore, account for 65 per cent of the energy consumption for mining, followed by North America at 7 per cent and the rest of the world at around 14 per cent.

Additionally, Bitcoin mining is also said to be responsible for health and climate impact. According to researchers in the US, it is estimated that 'in 2018, every $1 of Bitcoin value created was responsible for $0.49 in health and climate damages in the US'.

‘CARBON NEUTRAL’ CRYPTO

Since cryptocurrency is here to stay, it’s important to ensure that it is as green as possible. One way is to use renewable energy. There have been promising initiatives that could lead the way forward to sustainability.

Last month, Energy Web, Rocky Mountain Institute (RMI) and the Alliance for Innovative Regulation (AIR) announced the launch of the Crypto Climate Accord.

Inspired by the Paris Climate Agreement, the accord is a private sector-led initiative for the entire crypto community focused on decarbonising the cryptocurrency industry in record time by making it 100 per cent renewable.

It seeks to transition all blockchains to renewable energy by 2030 or sooner. It sets a 2040 target for the crypto industry to reach 'net zero' emissions, which would involve reducing pollution and turning to strategies that might be able to suck the industry’s historical carbon dioxide emissions out of the atmosphere.

States are also not far behind. Countries like Norway and Sweden are setting the trend for ‘carbon neutral’ crypto by leveraging their hydroelectric structure. Power cost in these countries has dropped to amongst the lowest in Europe.

Northern Data in January bought Hydro66's renewable-powered datacentre operating in the "Node Pole" region of Northern Sweden.

The Hydro66 site consists of six datacentre halls on a 2.5 hectare plot in the city of Boden, and has an average annual temperature of 1.3 deg C, and access to 100 per cent renewable power from hydroelectric plants.

In Norway, the firm has installed 21 modular containers in Lefdal, a former mine in Norway, using hydroelectric power and cooled by fjord water.

A silver lining seen in this more-work-less-gain effort is the accelerated development of technologies, whether it’s more computing power, datacentres, cooling techniques or even less sustainable energy sources, and especially since hardware used to mine cryptocurrencies becomes obsolete roughly every 1.5 years.

Microsoft is focusing on immersion cooling technology used in bitcoin mining as the most promising technology for future high-density datacentres. It is testing a setup in which servers are dunked in tanks of cooling fluid to manage rising heat densities.

Microsoft is one of many that would want a slice in the currency of the future or, at least, the infrastructure it runs on.