Adnoc Gas continues to capitalise on the growing demand

Adnoc Gas continues to capitalise on the growing demand

Adnoc Gas awarded $5.6 billion contracts in 2023, with a $3.6 billion contract awarded to commission new capacity and expand gas processing facilities in the UAE, enabling optimised supply to the Ruwais Industrial Complex, as part of its growth strategy.

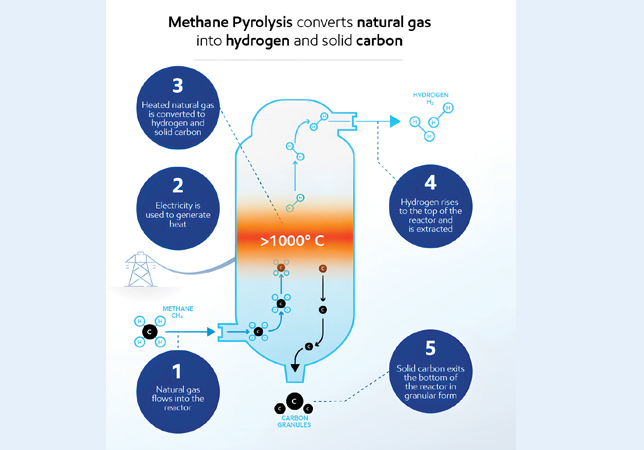

In addition, the company also awarded a $615 million contract for a carbon capture project. This follows the Q2 award of $1.34 billion in contracts for expanding its natural gas pipeline network as part of the Estidama programne, aimed at enabling the supply of higher volumes of natural gas to customers in the Northern Emirates.

Adnoc Gas continues to leverage opportunities arising from Adnoc’s integrated gas masterplan which links every part of the gas value chain in the UAE, ensuring a sustainable and economic supply of natural gas to meet local and international demand.

Further, Adnoc Gas continues to capitalise on the growing global demand for natural gas and has signed LNG supply deals valued between $9 billion and $12 billion this year.

These agreements, signed with reputable counterparties like Japan Petroleum Exploration Company, Indian Oil, PetroChina International and Jera Global Markets, further strengthen Adnoc Gas’ position as a global, stable and reliable LNG supplier with the capacity and capability to meet both local and international demand.

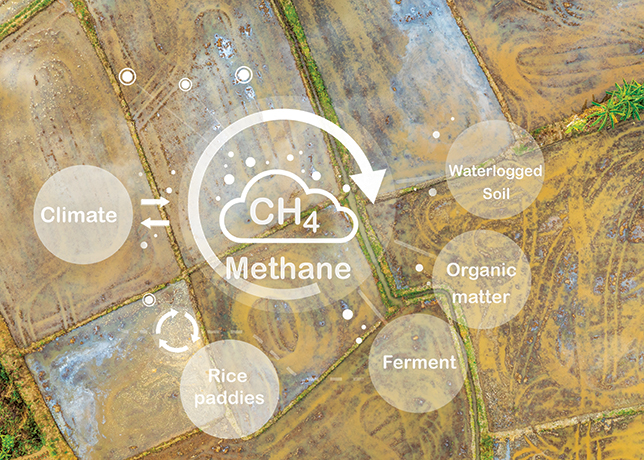

Adnoc Gas is fully aligned with the ambitions of Adnoc Group and the UAE to reduce greenhouse gas emissions.

According to Adnoc Gas, it is a key enabler in delivering the group’s 25 per cent emissions intensity reduction target by 2030, the UAE’s Net-Zero by 2050 ambition and Adnoc’s own Net-Zero by 2045 target.

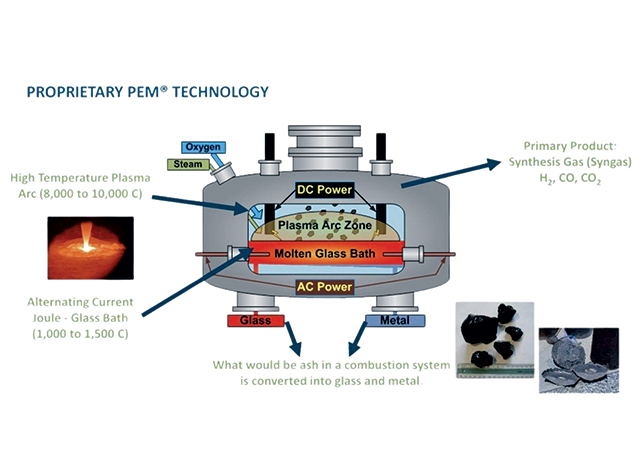

In line with the broader ESG strategy and as part of Adnoc’s accelerated decarbonisation plan, the company recently awarded a contract for the construction of carbon capture units, pipeline facilities and a network of wells for carbon dioxide injection at the Habshan gas processing plant, with a carbon emission reduction capacity of 1.5 million tons per annum.

Ahmed Alebri, CEO of Adnoc Gas, commented: "We have made significant progress, delivering on our growth strategy through substantial investments with $5.6 billion in contracts awarded in the first nine months of 2023. This includes the EPC contract awarded for the construction of carbon capture units, which is a significant milestone in our decarbonisation journey, helping us further decarbonise our operations in line with Adnoc’s bold Net-Zero by 2045 ambition.

Alebri added: "Expanding further into low carbon products, in the first nine month of the year, Adnoc Gas has concluded new LNG supply deals with a total value of $9-12 billion. We have expanded our international customer base through newly signed agreements with very reputable counterparties, mainly from Asia."

Adnoc Gas continued to deliver robust financial and operational performance in a volatile market environment marked by consumer and geo-political pressures. The company’s Q3 2023 revenue grew to $5.807 billion, representing an 8 per cent growth compared to Q2 2023, in line with the improving price environment and higher sales volumes.

Despite market volatility, the company maintained stable margins in line with its guidance and previous periods.

Further, Adnoc Gas continued to deliver on its growth strategy, focusing on increased efficiency to enable the export of higher-margin liquids.

The company’s Q3 2023 EBITDA improved to $1.863 billion, up 5 per cent compared to Q2 2023, while net income for the quarter increased by 13 per cent quarter-on-quarter to $1.116 billion.

These results underscore the business’ resilience and its ability to capitalise on optimisation and growth opportunities. A nine-month net income of $3.375 billion reflects the lower pricing environment compared to the same period of 2022.