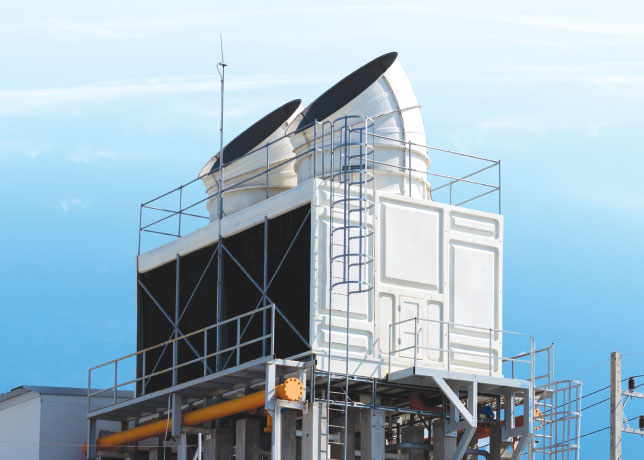

Adnoc Drilling, a subsidiary of the Abu Dhabi National Oil Company (Adnoc), is significantly expanding operations and fleet.

Last week, it added three high-spec jack-up rigs to its fleet. The Yas, Ramhan, and Salamah have arrived in UAE waters, ready to join the operational fleet.

A few days earlier, the company sent an upgraded jack-up rig, Al Danat, offshore. This rig, which was upgraded at a Dubai shipyard, is the first of several new rigs that will join Adnoc Drilling’s rapidly expanding fleet this year.

The Al Danat is a BMC-400 Pacific class rig type and can operate in water depths of up to 121 meters. It holds a crew of 150.

These rigs are part of the company's fleet expansion programme, which aims to deliver new rigs for its customers and solidify Adnoc Drilling's position as the owner of one of the world’s largest operational jack-up drilling fleets.

In 2022, Adnoc Drilling added 16 new rigs to its fleet and hired over 1,500 people from around the world, including the UAE.

The company plans to add a further 27 rigs by 2024 and hire 3,500 UAE nationals and expats by the end of 2023.

This expansion drive is part of the company's goal to drill the thousands of wells needed to increase Adnoc’s production capacity and deliver UAE gas self-sufficiency.

In addition, Adnoc Drilling secured a $980 million contract last year from Adnoc to hire two jack-up offshore rigs and their associated manpower and equipment.

This contract supports the expansion of Adnoc’s production capacity as it responds to the growing global demand for lower carbon intensity oil and gas.

Over 80 per cent of the award value will flow back into the UAE’s economy under Adnoc’s In-Country Value (ICV) programme, supporting local economic growth and diversification.

Looking ahead, Adnoc Drilling in its fiscal year 2023 guidance communicated in February 2023 said it aimed to deliver revenue of between $3 billion and $3.2 billion for the full-year period, with EBITDA of $1.35 billion and $1.5 billion at an industry-leading EBITDA margin of 45 per cent - 47 per cent, and net income of $0.85 billion-$1.0 billion.

The capital expenditure is forecast to be in a range of $1.3 billion-$1.75 billion this year, while the company plans to maintain the leverage ratio below 2.0x.

Adnoc Drilling announced a good Q1 result. Its net profit for Q1 2023 jumped 25 per cent to $219 million, supported by a 19 per cent increase in revenue to $716 million. Revenue growth was achieved across all segments, with offshore jack-up and oilfield services leading the way.

However, Q1 revenue was 2 per cent lower than Q4 2022 due to fewer calendar days and lower impact from reimbursement of cost escalation claims.--OGN/ TradeArabia News Service