Alfa Laval ... maintaining a strategic position in the market

Alfa Laval ... maintaining a strategic position in the market

The company could capitalise on its new contracts and strategic acquisitions to garner higher market share although increasing competition and supplier risks could limit its growth prospects, says a report

Alfa Laval manufactures heat transfer, separation and fluid handling products and solutions. The company is also involved in marketing and selling of these products. The company’s strong foothold in the market coupled with a diverse portfolio of offerings provides a competitive edge.

However, litigation and legal proceedings are a major cause of concern. The company could capitalise on its new contracts and strategic acquisitions to garner higher market share. Although, increasing competition and supplier risks could limit its growth prospects, says GlobalData in a strengths, weaknesses, opportunities and threats (SWOT) analysis of the company.

STRENGTHS

Strong research and development division: The continued investments in the research activities enable Alfa Laval to strengthen its product line and develop new products for the industry. The company has leading products in the area of heat transfer, separation technology, fluid handling and others. Its investments ensure that the company offers competitive products globally. Alfa Laval launches about 35 to 40 products annually. Some of the products launched in the year 2014, include Aqua Blue freshwater generator, tantalum-treated heat exchangers and PureSOx 2.0, among others.

In the financial year (FY) 2014, the company invested about SEK790 million ($92.79 million) around 2.3 per cent of its net revenue towards research and development (R&D) activities. The company has a base of more than 2900 patented products. Thus, these ideas combined with pioneering spirit have contributed to Alfa Laval’s strong global presence and lay the groundwork for profitable development of the business.

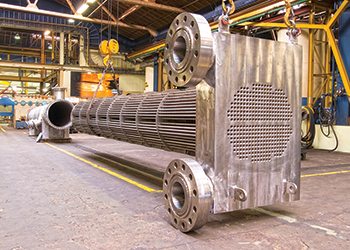

Heat transfer technology: Alfa Laval is a leading supplier of products and services in the field of heat transfer technology. The company supplies heat exchangers that can optimise energy use for heating, cooling, evaporation, refrigeration, ventilation, and condensation. Its product portfolio includes air heat exchangers, plate heat exchangers, shell and tube heat exchangers, thermal fluid systems, boilers and others.

In FY2014, the division generated a revenue of SEK16,587 million ($1,947 million) accounting to 47 per cent of overall sales of the company It caters to industries such as chemical, food, oil, gas and power production, marine, construction and others. In 2014, it accounted to more than 30 per cent of the world market.

Market leadership: A strong foothold in the market allows Alfa Laval to gain competitive advantage in terms of maintaining or increasing its prices and achieving economies of scale. The company is a global leader in three key technologies, namely, heat transfer, separation and fluid handling, which are important components of various industrial processes. Alfa Laval is a dominant player in providing heat transfer technology of which the division’s products accounts to more than 30 per cent of the global market.

The company’s products also dominates in separation technology which accounts to around 25 per cent to 30 per cent of the world market.; and the Fluid handling technology which shares about 10 per cent to 12 per cent of the global market share. Thus with such substantial share in the market, Alfa Laval was successful in generating around 47 per cent of sales through heat transfer solutions, around 21 per cent sales through its products using separation technologies, and 20 per cent sales through its products related to fluid handling solutions in FY2014.

WEAKNESSES

Legal proceedings: Involvement in litigation leading to legal proceedings will incur additional costs in connection with settlements to Alfa Naval affecting its profitability. The company is involved with litigations with customers. In December 2014, the company was named as a co-defendant in a total of around 816 asbestos-related lawsuits with a total of approximately 819 plaintiffs. Even though the company expects no material effect on its operations, but the outcome of these litigation are still pending and are unpredictable.

During the fiscal year 2013, the company made an investment of SEK205 million for the provision of litigation and settlements. Any adverse outcome would have a significant effect on Alfa Laval’s brand image, financial performance and results of operations.

OPPORTUNITIES

New contracts: Alfa Naval has been securing lot of contracts from several countries located across the world. In June 2014, the company secured an order for supplying compact heat exchangers for the caustic evaporation plant of AkzoNobel in Rotterdam, the Netherlands. The order is estimated to be worth over SEK120 million and deliveries are scheduled to be made by 2014 and 2015. During the same month, the company was awarded a contract for supplying compact welded heat exchangers to a coal liquefaction plant in China. The order is estimated to be worth SEK100 million and the delivery is scheduled for 2014.

In May, the company received an order worth SEK55 million for the delivery of air cooler systems to a US export terminal for natural gas liquids. It was also awarded an order to retrofit Alfa Laval PureSOx exhaust gas cleaning systems onboard four vessels for a customer in Germany.

The value of this order is estimated to be SEK75 million and the delivery is scheduled for 2015. In March 2014, Alfa Laval was awarded an order to supply Packinox heat exchangers to a refinery and petrochemical plant in Vietnam. The order was worth SEK55 million and is expected to be delivered by 2015. Having a number of projects in pipeline helps the company maintaining a strategic position in the market.

Strategic acquisitions: Strategic acquisitions strengthen Alfa Laval’s position in terms of both in terms of products and geography, resulting strong growth prospects. In April 2014, the company signed an agreement to acquire Frank Mohn, one of the leading manufacturers of submerged pumping systems to the marine and offshore markets.

The acquisition was intended to strengthen the company’s fluid handling portfolio by adding unique pumping technology, which will further enhance Alfa Laval’s position as one of the leading suppliers to the marine and offshore oil & gas markets. In November 2014, the company acquired the Korean company, CorHex Corp to strengthen its LNG solutions portfolio. CorHex Corp is a manufacturer of compact printed circuit heat exchangers (PCHE) which has applications in high-pressure LNG fuel gas.

Rising demand for HVAC equipment: Alfa Laval can benefit from the growing demand in the heating ventilation air conditioning (HVAC) equipment industry. Even in the presence of regulatory measures, such as the prohibition of CFCs in most countries and the rise of minimum efficiency requirement, findings still show that demand will increase to 8 per cent every year as more and more facilities worldwide use HVAC systems. According to a study, world HVAC market reaches $68.9 billion by 2014. The most popular HVAC equipment used in homes and commercial and industrial buildings are heat pumps, chillers, and unitary and packaged terminal air conditioners.

The large and growing installed base of Lennox equipment and systems continues to present the company with a powerful opportunity to increase service revenues by doing more for customers over the life of their buildings. The company can utilise this opportunity aggressively for its growth in the coming years.

THREATS

Changes in rules and regulations: The stringent policies of the government affect the regular operation of Alfa Laval. The company could also face risks related to the costs that it might incur due to varied reasons such as, to reduce emissions according to new or stricter environmental legislation, to restore land at previously or currently owned industrial sites, to arrange more effective waste disposal, to obtain prolonged or new concessions etc.

The government of Sweden, both on long and short term devise a policy with an objective to ensure reliable supplies of electricity and other forms of energy carriers at prices that are competitive with those of other countries. The Swedish Energy Agency and the Swedish Environmental Protection Agency are the regulatory authorities which take care of all energy related policies. Changes in regulatory rules or policies by these bodies may expose Alfa Laval to unprecedented liabilities and expenses and could materially affect the company’s revenues and earnings.

Intense competitive environment: Operating in highly competitive markets increases the pressure on Alfa Laval and limits its ability to maintain or increase its rates. The company competes with various major players in the market operating in specified areas. The company’s products in heat transfer division faces threats from products of companies including GEA Group, Hisaka Works, SPX Corporation among others.

The products of Alfa Laval based on the separation technology competes with products of companies including, GEA Group, Mitsubishi Kakoki Kaisha, and Gruppo Pieralisi, among others. Also the products working on the fluid handling technology competes with products of companies including, Fristam Pumpen, GEA Group, Hamworthy and many others. Thus, Alfa Laval faces threats from these highly established competitive firms. Additionally any entry or expansion plan executed by these firms could increase the pressure on Alfa Laval and further impact the company’s competitive ability.

Supplier risk: Alfa Laval is heavily dependent on deliveries of stainless steel, carbon steel, copper and titanium etc. for the manufacture of its products. The prices in some of these markets are volatile and the supply of titanium has occasionally been limited. There is also limited number of possible suppliers of titanium. The risk for severely increased prices or limited supply constitutes serious risks for the operations.

The company in order to limit its losses needs to pass on higher input prices to its end customer. Further, prices for stainless steel, carbon steel, copper and titanium is rising resulting in increasing procurement cost for the company. Thus, the company has to mitigate the risk needs to secure long-term supply at fixed prices from the suppliers.