Idemitsu ... maximising synergies

Idemitsu ... maximising synergies

Idemitsu Kosan and Showa Shell Sekiyu officially announced a basic agreement to integrate their management around 2016, the latest step in an extended shakeout poised to leave Japan’s shrinking oil market with two major players.

“Showa Shell is our best partner for maximising synergy,” Idemitsu CEO Takashi Tsukioka told a news conference.

“We’ll build a solid domestic earnings base and expand into the rest of the world,” said Showa Shell CEO Tsuyoshi Kameoka.

Idemitsu has agreed to buy a 33.3 per cent stake in Showa Shell from Royal Dutch Shell, which owns 35 per cent of the company, for 169.1 billion yen ($1.35 billion). It aims to complete the purchase in the first half of 2016, once regulatory approval has been granted.

While a date for the integration has not been set, Tsukioka said the two companies hope to complete it as quickly as possible. The details of the arrangement will be discussed going forward. “We won’t be a subsidiary,” Kameoka explained. “We’re aiming to combine as equals.” A stock swap is likely under consideration.

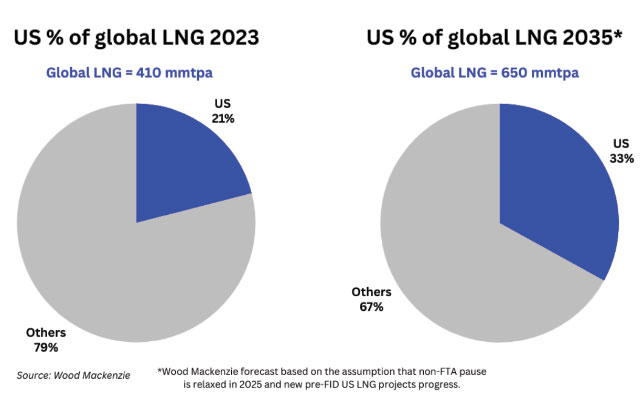

With the sale of its Showa Shell shares, Royal Dutch Shell will withdraw from oil refining and sales in Japan and focus on its chemical and liquefied natural gas operations. Saudi Aramco, an oil company run by Saudi Arabia with a roughly 15 per cent interest in Showa Shell, supports the integration. It will continue to hold its stake and supply crude oil.

Fiscal 2014 sales at Idemitsu and Showa Shell, Japan’s second- and fifth-largest oil wholesalers, totaled 7.62 trillion yen. A merger would put them closer to market leader JX Holdings, which logged sales of 10.88 trillion yen. The two companies also run 7,000 or so gas stations in Japan, accounting for more than 30 per cent of total domestic gasoline sales – nearly on a par with JX Nippon Oil & Energy’s 33 per cent share. Tsukioka said both Idemitsu and Showa Shell brands will be maintained for the time being.