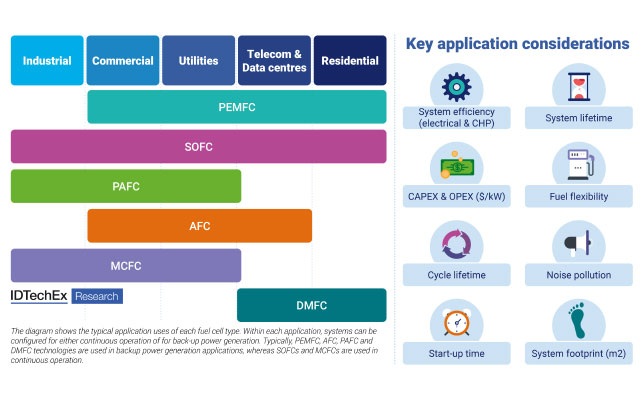

The increasing popularity of fuel cells for converting hydrogen and other gases into electricity is driven by decarbonisation efforts. Fuel cells, particularly Proton Exchange Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), are at the forefront of this technology, according to report by IDTechEx .

PEMFCs are primarily utilised in the transportation sector, especially in fuel cell electric vehicles (FCEVs), due to their quick start-up times, compact design, and high efficiency.

SOFCs, on the other hand, are more suited for continuous industrial and commercial applications, known for their efficiency and long operational periods.

According to IDTechEx, the stationary fuel cell market is projected to exceed $8 billion by 2035, driven by global decarbonisation targets. For instance, Europe aims to produce 10 million tonnes of renewable hydrogen by 2030 and deploy over 2.5 million fuel cells for combined heat and power by 2040.

The US targets carbon-pollution-free electricity by 2035, supported by tax incentives for hydrogen and fuel cell manufacturers, while China plans to have 50,000 fuel cell vehicles by 2025.

Despite the promise of green hydrogen produced via renewable energy-powered electrolysis its high production costs and limited availability pose challenges.

Additionally, the required infrastructure for hydrogen production and deployment is costly and complex. While liquefied natural gas serves as an alternative, it lacks the sustainability of green hydrogen.

IDTechEx forecasts a 16.7 per cent compound annual growth rate for the stationary fuel cell market through 2035, contingent on the widespread adoption of green hydrogen.

Ultimately, the environmental benefits of fuel cells are realised only when green hydrogen is utilised, as other fuels can result in carbon emissions during their lifecycle.