The GCC countries have a staggering $31.4 billion in ongoing mega projects of conventional power generation. Despite the massive investments, the ground level power supply struggles to keep with the pace of rapid developments, says a report

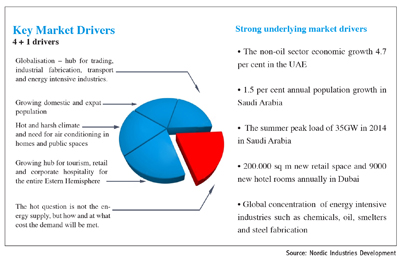

Middle East, the Arabian GCC countries in particular, are experiencing strong growth in almost all industry sectors, ranging from services, tourism, construction to energy intensive industries such as, chemical, aluminium, oil and gas refineries. Coupled with growing demographics due to expanding expatriate workforce and local communities, the Middle East is facing mounting challenges in producing and distributing the energy to fuel the economic growth in the future, says a report by Nordic Industries Development.

According to the report, the GCC countries have a staggering $31.4 billion in ongoing mega projects of conventional power generation. These include upgrades of existing power and desalination plants as well as new built power plants. The figure does not include the Barakah nuclear plant in the UAE, becoming operational in 2020s with the approximate cost of $20 billion.

Despite the massive investments, the ground level power supply struggles to keep with the pace of rapid developments.

The cost of burning fossil fuels and subsidising the consumption from national budgets forces regional countries to seek alternatives, sometimes faster and even more genuinely than in the rest of the world.

POWER & DESALINATION: BIG TICKET PROJECTS

It is estimated that GCC countries will need up to 35 Gigawatts (GW) extra power by 2020. In comparison, the world’s largest nuclear plant produces about 8 GW and China’s Three Gorges Dam about 18.4 GW.

Massive power plant projects are one side of the equation. Because of the scale of the projects, there are multiple actors in each and thus a myriad of purchasing channels and owners of different technological areas, it says in its report.

Typically the end client is a government power company such as Saudi SEC, Dubai’s Dewa or Saudi Marafiq, a designated utility company for industrial cities. The project itself is managed either as a turnkey project by a consortium or a turnkey deal by a multinational energy giant such as Samsung. Korean companies such as Kepco and Samsung have become increasingly successful in winning big power plant deals in the Middle East.

|

MOBILE GENERATION: BIGGEST MARKET

The missing capacity from national grids is bypassed by stationary and mobile generators. Diesel generators running 24 hours a day to produce electricity are a common sight and their sound is quite serious environmental nuisance. Even many “landmark” residential and commercial developments across the Arabian Peninsula can be powered by mobile diesel generators for years before being connected to municipal grids.

As Middle Eastern countries use their oil and gas to generate electricity, they are effectively losing the potential export revenue for their oil. In addition, national fuel subsidies add to the cost of “lost revenue”. The situation is far from ideal, says the report.

However, the reality is that diesel powered aggregates make a significant contribution to the energy supply in all Middle Eastern countries.

The Middle Eastern market is estimated to double in size within next six years, regional investments representing possibly about $2 billion in 2019 for GCC and roughly $4 billion for the Middle East and North America (Mena) region.

The option to tap in to the rental and emergency power by domestic fuels enables Middle Eastern countries to keep the pace with the demand and win time to look for more sustainable solutions of meeting the gap in the power generation.

RENEWABLES: SOLAR ENERGY

Solar energy is potentially abundant in the Mena region. So is the availability of wind power. However, the biggest challenge in the sector is that current large scale solar power or wind power farms don’t come even near the capacity of large scale conventional power plants or nuclear plants.

Traditionally Middle Eastern renewable projects have been focusing on a large scale photo voltaic and thermal steam power plants. However, in this case the large scale means just from 13 to about 100+ megawatts (MWs). This is very paltry performance in comparison that conventional power plant projects and upgrades in Saudi Arabia for example range from 1300 MW to 2800 MW.

Recent developments in the microscale and small scale power generation can potentially tip the scales in favour of better results. Solar and wind technologies for power generation and desalination of water by wind and solar power are reaching a point of being viable in commercial terms and reliability. In addition, the storage technologies by batteries and mechanic storage are experiencing break throughs in innovation.

It is very likely that the micro power and water generation in the Middle East has better chances to change the energy equation into more favourable direction than the large scale, initiatives, the report writes. However, this requires a change in culture because regional governments and companies prefer large scale grandiose developments.

But to put it simply, since domestic consumption of energy and water is the biggest segment in the Middle East, similarly the off grid production and energy efficiency can deliver the biggest impact at the lowest economical cost.