Pakistan’s efforts to close the gap between local demand and supply of oil and gas is promising for energy companies, which can benefit from low operating costs and a high success rate, say oil and gas veterans Saud Khawaja and Mansoor Ghayur

Pakistan's growing oil and gas sector offers great opportunities for foreign and local companies as efforts are made to increase local production amid the need to significantly reduce the country’s burgeoning energy bill.

The country’s total domestic oil production of nearly 90,000 barrels per day (bpd) against a demand of around 600,000 bpd leaves a deficit of over 500,000 bpd. This shortfall is fulfilled through imports.

|

Khawaja ... inviting companies to invest in Pakistan’s oil and gas sector |

Pakistan’s natural gas production meanwhile stands at around 4 billion cubic feet daily (bcfd), with consumption being at around 6 BCFD, leaving a supply gap of about 2 bcfd. At the same time, it produces 1,521 metric tons daily of LPG.

As of June 30, 2019, total domestic production stood at slightly above 800,000 barrels of oil equivalent (BoE), while demand was approximately 1,700,000 BoE thus leaving a supply gap of 900,000 BoE.

In 2019, Pakistan imported oil and gas products worth over $16 billion. This represents the single largest foreign exchange burden on the country’s economy.

To close the large deficit gap between growing consumption demand and domestic oil and gas production, the country is inviting global and local companies to participate in oil and gas ventures in the country, says Mansoor Ghayur, Member Advisory Committee on Sectoral Strategy and Policy, Pakistan’s Ministry of Energy, and Member of Prime Minister of Pakistan’s Energy Task Force.

He tells Abdulaziz Khattak of OGN: "The country’s Ministry of Petroleum and Natural Resources has made a big push in recent months, conducting road shows and meetings in global oil and gas hubs, such as Canada, the US, Russia, China and the UAE.

"As a result, several global companies, including a ministerial level delegation from Russia along with Gazprom, have shown keen interest in Pakistan’s energy landscape."

Ghayur ... inviting companies to invest in Pakistan’s oil and gas sector

SECTOR OVERVIEW

As of June 30, 2019, Pakistan had 158 oil fields, 178 gas fields and 37 LPG fields. The largest oil fields include Nashpa, Mela and Makori East in the Khyber Pakhtunkhwa (KPK) province; Adhi in Punjab province; and Kunnar and Pasakhi in Sindh province. The largest gas fields are located in Sui, Uch, and Zin in Baluchistan province; and Mari and Qadirpur in Sindh province.

The country’s oil and gas landscape is poised for tremendous growth, says Saud Khawaja, Founder of Falcon Petroleum Consultants, Bahrain, and Member Board of Directors and Chairman Transformation Committee at Pakistan’s Oil and Gas Development Company Limited (OGDCL).

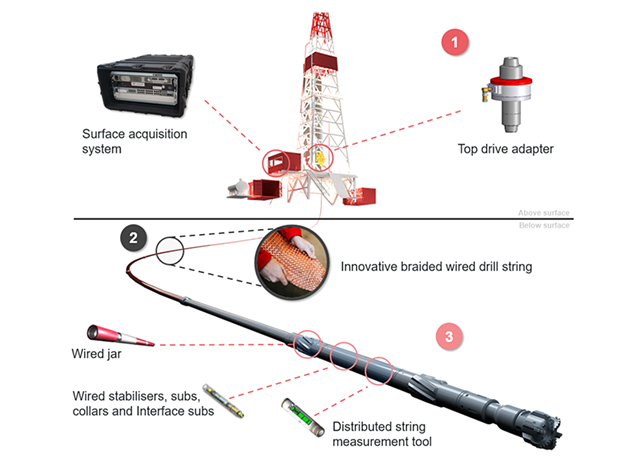

Remote locations, which were previously no-go areas, are now accessible for seismic surveys—fundamental requirements to acquire geophysical data and to determine high potential sweet spots for exploration and marking well locations.

"Local rig count in the 12-month period from January 2019 to 2020 increased 35 per cent, going up from 26 to 35 active rigs. This indicates the confidence level of oil and gas companies to drill more wells," says Khawaja.

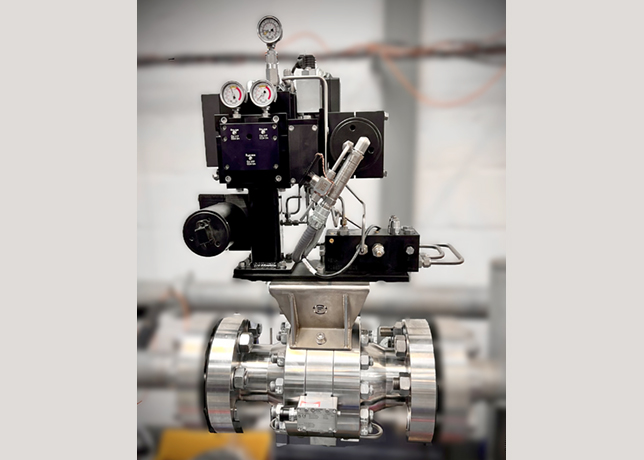

A survey conducted by Ghayur and Khawaja last year shows 50 drilling and workover rigs in the country, with hydraulic horse power (HHP) of 300, 650, 750, 1,000, 1,200, 1,500, 2,000, 2,500 and 3,500. This indicates a vibrant variety of well requirements, from ultra-shallow depth wells to medium, deep, and ultra-deep wells.

With the increase in planned well count by operating companies, it is expected that the rush to increase exploration and production will significantly push the rig count up.

OGDCL and Pakistan Petroleum Limited (PPL)—the two largest domestic exploration and production companies in Pakistan—expect to double their well count in 2020 for exploratory drilling, development drilling and working-over existing wells.

|

Pakistan’s rig count has gone up from 26 to 35 active rigs over the past 12 months. |

In addition, other local and foreign exploration and production companies are also looking at increasing their well count, adding to increased drilling activities and rig count.

There are currently seven local and five international companies actively operating in Pakistan. The local companies include OGDCL, PPL, Mari Petroleum Company Limited (MPCL), Pakistan Oilfields Limited (POL), Pakistan Exploration Private Limited (PEL), Dewan Petroleum Limited and Orient Petroleum Private Limited (OPL).

The international companies are Ente Nazionale Idrocarburi (ENI) from Italy, Magyar Olaj-es Gazipari from Hungary, Polskie Gornictwo Naftowe i Gazowinctwo from Poland, United Energy Pakistan Limited from China and Kuwait Foreign Petroleum Exploration (KUFPEC) from Kuwait.

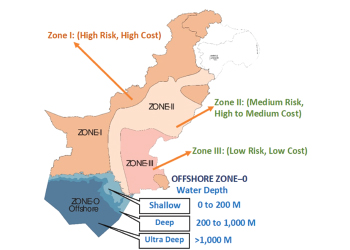

Currently, there are 11 exploratory wells being drilled in Pakistan. These include four wells in KPK, 3 in Punjab, 3 in Sindh, and 1 in Baluchistan. So far 2,604 wells have been drilled and 410 discoveries made. There are 124 active exploration licenses in the country.

In November 2018, the Pakistani government granted 10 exploration blocks after bidding. These included Cholistan, Shakar Ganj, and Punjab blocks in Punjab; Musakhel, Desert, and Khuzdar North blocks in Baluchistan; Block 28 North and Wali west blocks in KPK; and Sorah and Taung blocks in Sindh.

In 2020, Pakistan is planning biding for an additional 18 blocks.

COMPANIES AT ADVANTAGE

Considering the low cost of drilling and production in Pakistan, oil companies in Pakistan will be at an advantage and can make healthy profit margins, says Khawaja.

"If you look at domestic and foreign exploration and production companies in Pakistan, they all have strong balance sheets.

"The link of local oil prices to international prices, local gas price being more than double the Henry Hub Gas price ($4-6 per MMBTU) and the low cost of drilling and production are all factors that result in healthy after-tax returns in Pakistan," he elaborates.

In 2019, the three national oil and gas companies, OGDCL, PPL and MPCL cumulatively made $3.8 billion in revenues with $1.3 billion profits after tax.

Another important factor contributing to healthy profits in Pakistan is the lifting cost of hydrocarbons, being among the lowest in the world. For example, in 2019, the lifting cost per barrel stood at $3.43 for OGDCL, $2.17 for PPL and $1.47 for MPCL.

PPL and MPCL, primarily gas producers, have lower lifting cost due to cheap gas production from shallower horizons in the south of the country.

Further factors that could encourage companies to operate in Pakistan include a mature regulatory framework, 70 per cent untapped sedimentary area, low well density (3 wells per 1,000 sq km), 1,100 exploratory wells drilled, 1,450 development wells drilled, 90 oil and 310 gas/condensates discoveries, a 34 per cent success rate, and availability of skilled local human resources.

-is-one-of-the-world.jpg)

-(4)-caption-in-text.jpg)