Almost 98 per cent of the feedstock for global ammonia production originates from fossil fuels, of which 72 per cent is natural gas

Aammonia has the potential to play an important role in the transformation of the global energy system as a green and less-CO2 intensive energy source to meet the world’s growing energy demand.

And the Gas Exporting Countries Forum (GECF) member countries are well-positioned to support a sustainable supply of blue ammonia.

In its Global Gas Outlook 2050, GECF expects the demand for natural gas to increase by 50 per cent from 3,950 billion cu m (bcm) in 2019 to 5,920 bcm by 2050, thus making it an integral part of the world energy supply.

Gas producers perceive natural gas as a vector of the energy transition, notably hydrogen. In this regard, blue ammonia has also emerged as a prominent feedstock to boost a low-carbon economy, says Dr Hussein Moghaddam, Senior Energy Forecast Analyst, Energy Economics and Forecasting Department, at the GECF Secretariat

According to the Ammonia Energy Association (AEA), production levels of ammonia is currently approaching about 200 million tonnes per annum, out of which around 10 per cent is traded on the global market.

Almost 98 per cent of the feedstock for global ammonia production originates from fossil fuels, of which 72 per cent is natural gas.

The continuing growth in gas production and LNG inflow has enabled gas producers and industries to expand the production of blue ammonia, which is produced from natural gas feedstock and the released CO2 is captured by CCS/CCUS technologies.

Currently, ammonia enjoys the advantages of an existing broad user-base as it is the basis of fertiliser production. Besides, well-developed infrastructure and large-scale ammonia production facilities are available around the world, making its production more feasible.

Furthermore, recent advances in turbine engine technologies have led to the increased use of ammonia, either directly for combustion or indirectly by reforming it back into nitrogen and hydrogen as an industrial feedstock.

Compared to hydrogen, ammonia does not require cooling to extreme temperatures and also features a higher energy density than liquid hydrogen, making it more efficient to transport and store. In contrast a significant challenge for hydrogen is the high cost of storing systems, the purity requirement, and transportation. These advantages suggest that ammonia could readily be a competitive option as a solution for decarbonising the energy-intensive industry, particularly in the power generation and transport sectors.

In spite of this, ammonia faces certain challenges, such as its toxicity and corrosivity, due to the production of nitrogen oxide (NOx), flammability, and combustion in traditional engine and turbine, namely high ignition temperature and low flame velocity. Moreover, at the moment, producing green ammonia at the commercial scale is expensive given the capital costs of the electrolyser plant for hydrogen production.

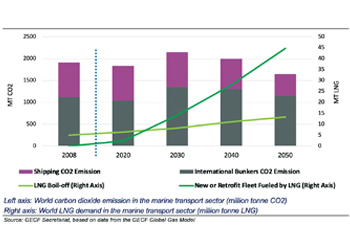

In this context, blue ammonia has emerged as one of the alternative fuels to support the shipping industry’s decarbonisation.

The other application of ammonia is in decarbonising coal-fired power plants. In this regard, Japan is aiming to increase the utilisation of ammonia to achieve the country's 2050 decarbonisation goal. About 10 per cent of Japan's power could be generated using 30 million metric tonnes per annum of blue ammonia.

As an opportunity for oil and gas producers, in September 2020, the world’s first shipment of blue ammonia was dispatched from Saudi Arabia to Japan, where it was used for power generation.

Separately, Russia and Japan plan to jointly study the possibility of transporting blue ammonia produced in Russia's Siberia for utilisation at coal-fired power generation plants in Japan.

Meanwhile, yet another potential usage of ammonia rests in fuelling the traditional vehicles running on an internal combustion engine (ICE).

The power sector, which would undergo perhaps the most drastic structural shift in this transition when considering the global 'greening the energy industry' drive, could greatly benefit from utilising ammonia - whether blue or green - in meeting its emissions obligations.

Dr Hussein says the widespread adoption of this energy source in the energy industry requires significant investment in terms of research and development and infrastructure along with the introduction of adequate policies, which would bring to the fore its myriad advantages.

'Accordingly, the GECF member countries, as the pivot of natural gas producers in the world, can penetrate blue ammonia markets for two reasons. First, they can benefit from vast natural gas resources in producing blue ammonia, which provides them with a competitive position in supplying the global demand.

'Second, they can leverage blue ammonia production as one of the carbon reduction policies in contribution to the low-carbon global economy. Therefore, it is projected that in coming years more GECF Members will optimise their ammonia production facilities for generating blue ammonia.'