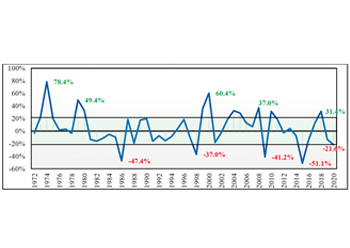

International oil price fluctuations from 1971-2020

International oil price fluctuations from 1971-2020

An AMF study suggests major changes in the economies of Arab oil-exporting countries to be able to withstand the effects of low oil prices and sustain real GDP

A slump in oil price has led to negative effects on the real GDP in the major Arab oil-exporting countries, a study by the Arab Monetary Fund (AMF) has found.

The study, entitled ‘Macro and Sectoral Implications of Oil Price Decrease on Oil-Exporting Countries’, traces average volatility over the period 1970-2020, writes Abdulaziz Khattak for OGN.

It assessed the effects of oil price on all other real sectors (other than the oil sector) in nine Arab oil exporting countries, namely Algeria, Bahrain, Iraq, Kuwait, Libya, Oman, Qatar, Saudi Arabia, and the UAE.

Oil remains an important determinant of economic activity in these countries. This calls for a need to build more economic resilience to avoid negative oil price shocks by diversifying fiscal revenues. The study showed real sectors to be generally more vulnerable to oil price fluctuations and that the demand and supply sectors are greatly affected by decrease in oil price.

The findings are important considering the current discouraging developments in the oil prices and continuous low global output.

According to the study, low or moderate levels shocks now have a tendency to persist over time compared to such developments in the past. This is mainly due to drastic changes in factors affecting both oil demand and supply.

On the supply side, a shared view points to the shale oil surge as a main driver contributing to reduced oil prices. Meanwhile, on the demand side, the main factors include low growth rates in major oil consuming countries. These factors contributed simultaneously to the collapse of oil prices starting from September 2014.

But besides the various geopolitical economic drivers, investment and explorations, speculation constitutes an important factor in oil price volatility. In fact, speculation could explain about one third of oil price volatility, the study showed.

PRICE SHOCK EFFECTS

Net importing countries benefit from negative oil price shocks, but they deprive the oil exporting countries from their principal source of revenue.

According to a World Bank report, Arab oil producing and exporting countries suffered substantial deficits (both fiscal and current account) due to the Covid-19 pandemic coupled with reduced oil prices.

The study said a decrease in oil price is generally likely to reduce the real GDP by affecting the three components of domestic demand: final consumption, government consumption and investment.

It also reported the negative impact of falling oil prices on manufacturing industries and the construction sector as well as important service categories namely, wholesale, retail trade, restaurants and hotels, transport, storage and communication.

A negative impact on real GDP was seen for all countries in the study except Bahrain, where the effect was overall positive.

Accordingly, the study showed negative impact on real manufacturing industries in Algeria and Oman for the first and second years; negative for Bahrain and Saudi Arabia in the first year and positive in second year; and negative in the second year for Iraq, Kuwait, Libya and Qatar.

The impact was negative on the construction sector for all countries in both years, except for Bahrain, where it was positive in the first year and negative in the second. Similarly, a negative impact was seen for the 'wholesale, retail trade, restaurants and hotels' in all countries except in Bahrain. Finally, the transport, storage and communication sectors suffered a clear negative impact particularly in the second year following the shock.

The study suggested diversification, including reforming the systems of taxation and energy subsidies, and increasing the private sector’s share in the economy, would create more non-oil revenues and gradually lead to decoupling changes in public spending from changes in oil prices.

It further suggested that tax revenues can be increased by diversifying the production structures. It also emphasised improving the investment environment (both domestic and foreign), which was the most vulnerable to oil price decrease.