Source: Bloomberg, Company filings, GCC official statistics, ministries and government entities, MUFG Research

Source: Bloomberg, Company filings, GCC official statistics, ministries and government entities, MUFG Research

A new report believes the GCC countries are strategically positioned to become leading global clean energy hubs.

With global efforts towards the energy transition increasingly being recognised, regulators and policymakers in the GCC economies have incorporated decarbonisation plans into their national vision transformation programmes.

According to the Mitsubishi UFJ Financial Group’s (MUFG) ‘ESG Series: GCC region and the energy transition’ report, extensive investments are being undertaken in the region to decarbonise high-carbon emitting sectors in hydrocarbon production, power generation and industrial production, with the velocity of execution contingent on technological advancement and availability, as well as an increase in the private sector participation.

Having said that, a recalibration of the energy trilemma post-Covid from sustainability towards energy security and affordability, is witnessing GCC transition targets take a pragmatic approach that is pro-growth and pro-climate.

This just-and-orderly transition strategy that the GCC region is navigating recognises that sustainable systems are more value creating than traditional ones, but shutting down the old conventional economy too quickly threatens to push the price of building a cleaner new economy out of reach.

This two-pronged approach of addressing the energy transition and safeguarding energy security recognises the sheer complexity of ecosystems, demanding greater alignment and collaboration on everything from capital allocation to product design, public policy as well as behavioural changes on the demand-side of the equation.

'We hold conviction that the GCC region remains well positioned to capitalise on its comparative advantages of low-cost positioning across the energy value chain, geographical proximity to key import markets and its constructive regulatory backdrop to become a vital global decarbonisation vanguard,' the authors of the report said.

'These favourable characteristics, combined with a constructive macro backdrop for a region that remains in a league of its own, will enable these economies to strengthen their pedigree beyond conventional fossil fuel energy sources in becoming a global hub for both clean electrons (solar, wind, EVs and energy storage) and clean molecules (hydrogen, carbon capture and bioenergy), in our view.'

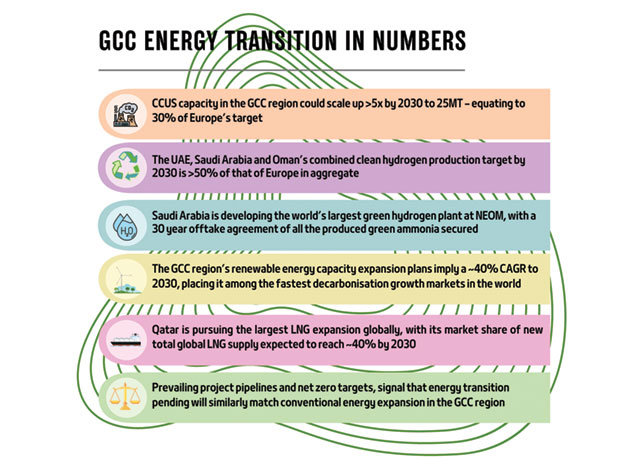

MUFG’s bottom-up project-by-project examination signals over $630 billion of investments necessary through to 2035 to facilitate the region to achieve its ambitious decarbonisation targets.

This quantum is led by four strategic areas that are at the centre of the GCC countries’ energy transition plans, namely, the burgeoning role of natural gas as a transition fuel; the development of attractive renewables capacities; an expansion in carbon sequestration and clean fuel offerings through a rising focus on clean technology investments; and investments in critical infrastructure and logistics to support the transition.

By Abdulaziz Khattak