IEA report projects global oil demand to grow by 1 mbpd

IEA report projects global oil demand to grow by 1 mbpd

The International Energy Agency (IEA) Oil Market Report (OMR) released in March 2025 reveals that global oil demand growth is set to accelerate to just over 1 mbpd this year, from 0.830 mbpd in 2024, reaching 103.9 mbpd. Asia accounts for almost 60 per cent of gains, led by China, where petrochemical feedstocks will provide the entirety of growth.

Amid an unusually uncertain macroeconomic climate, recent delivery data have been below expectations, leading to slightly lower estimates for Q4 2024 and 1Q25 growth at 1.2 mbpd y-o-y.

World oil supply rose by 240 kbpd in February to 103.3 mbpd, led by Opec+. Kazakhstan pumped at an all-time high as Tengiz ramped up, while Iran and Venezuela boosted flows ahead of tighter sanctions. Non-Opec+ production is set to rise by 1.5 mbpd in 2025, led by the Americas. Following a 770 kbpd output decline last year, Opec+ output could hold steady in 2025 if voluntary cuts are maintained after April, stated the IEA report.

Global crude runs dropped by 570 kbpd m-o-m to 82.8 mbpd in February, extending their decline from December’s five-year high of 84.3 mbpd. Throughputs are forecast to average 83.3 mbpd in 2025, up 570 kbpd y-o-y as lower OECD activity partly offsets a 930 kbpd annual increase in the non-OECD. Refining margins recovered in February, as falling crude prices lifted profitability in all regions, according to the report.

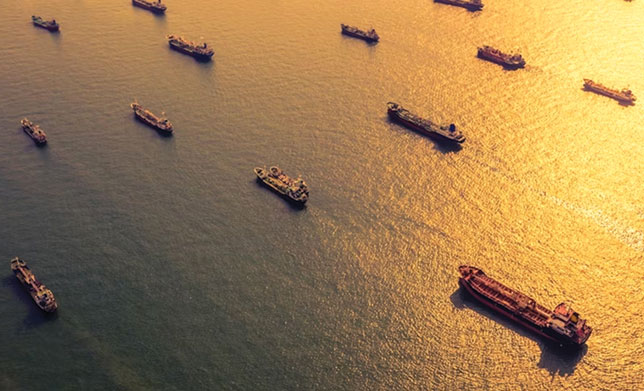

Global observed oil stocks fell by 40.5 million barrels (mb) in January, with 26.1 mb being products. Non-OECD crude stocks plunged by 45.3 mb, dominated by China where imports declined. Total OECD stocks rose by 11.2 mb, boosted by a 25 mb build in industry crude inventories. Oil on water fell by 6.7 mb, but preliminary data for February show total global oil stocks rebounded, lifted by an increase in oil on water.

Oil prices declined by about $7 per barrel in February and early March as macro sentiment soured amid escalating trade tensions, clouding the outlook for oil demand growth. Plans by Opec+ to start unwinding voluntary production cuts in April added to the expectation of comfortable crude balances in 2025.

The macroeconomic conditions that underpin our oil demand projections deteriorated over the past month as trade tensions escalated between the US and several other countries. New US tariffs, combined with escalating retaliatory measures, tilted macro risks to the downside. Recent oil demand data have underwhelmed, and growth estimates for Q4 2024 and Q1 2025 have been marginally downgraded to around 1.2 mbpd.