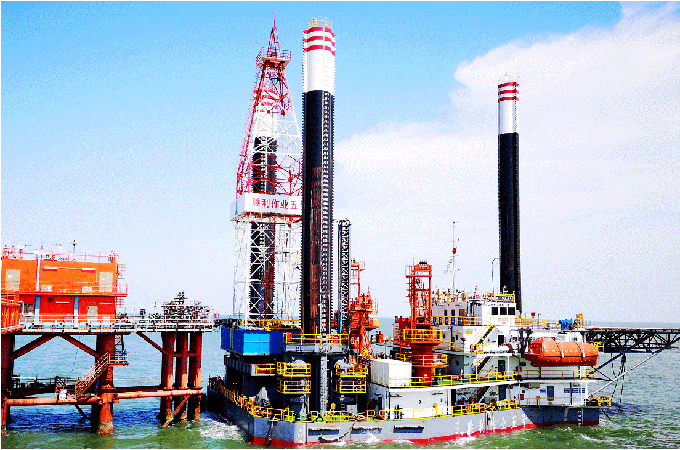

China Petroleum & Chemical, known as Sinopec, reported a 16.8 per cent decline in 2024 net profit, citing lower crude oil prices and the accelerated development of the new energy vehicle (NEV) industry.

Sinopec's Hong Kong-listed shares were down 3.3 per cent around 10:40 a.m. local time on Monday after falling as far as 4.5 per cent earlier in the day in their biggest one-day drop in five months. Its Shanghai-listed shares were down 1.4 per cent.

The world's largest oil refiner by capacity posted a net income of 50.3 billion yuan ($6.94 billion), based on Chinese accounting standards, a Shanghai Stock Exchange filing showed on Sunday.

"In 2024, international crude oil prices fluctuated downward, the domestic transportation industry accelerated the replacement of new energy ... (and) gross profit margin was significantly narrowed," Sinopec said in the filing.

"The company made every effort to expand the market and sales ... (and) continues to strengthen cost and expense control, and take multiple measures to cope with market changes."

The fall in net income compared with a decline of 9.9 per cent in 2023, also on falling oil prices.

The state oil and gas major's gasoline sales fell 0.7 per cent and diesel sales fell 4.8 per cent. Aviation fuel sales rose 7.3 per cent. The figures included both domestic sales and exports.

Refinery throughput fell 2.14 per cent to 252 million metric tons, equivalent to 5.04 million barrels per day. The company forecast a rise to 255 million tons this year.

In a research note early on Monday, Citigroup analysts said utilisation cutbacks on small, independent refiners may "incrementally benefit Sinopec's refining/marketing segments" but a surge in EV penetration and LNG-trucking may continue to displace gasoline and diesel use.

Sinopec expects crude oil production in 2025 to be 280.15 million barrels, or 767,530 bpd, and natural gas output of 1,450.3 billion cubic feet.

The company said it set aside provisions for asset impairment of 7.2 billion yuan ($993.3 million) in 2024 due to "market price fluctuations of some products, shutdowns or losses of individual production facilities".

Facing over-capacity and fiercer domestic competition, Sinopec's sales of plastics, synthetic rubber and fertiliser fell 6.9 per cent, 3.3 per cent and 47.3 per cent respectively. Chemical fibre was the only main product that recorded a growth, at 10 per cent, Sinopec said.

Sinopec said it plans capital spending of 164.3 billion yuan this year to cover key investment such as exploration and development. -Reuters