Prince Abdulaziz during the Saudi Media Forum in February 2025

Prince Abdulaziz during the Saudi Media Forum in February 2025

Saudi Arabia has aggressively expanded its energy sector, embracing oil, gas, renewables, and nuclear power to diversify and align with Vision 2030 goals amidst global challenges

Over the past year, Saudi Arabia has accelerated its transformation of the energy sector, aligning with its Vision 2030 objectives to diversify the economy and promote sustainability.

This period has seen significant developments in oil production, natural gas expansion, and a robust push toward renewable energy.

These efforts underscore the Kingdom's commitment to maintaining its position as a global energy leader while transitioning to a more sustainable and diversified energy portfolio.

In early 2024, the Kingdom decide to maintain its maximum sustainable capacity (MSC) at 12 million barrels per day (bpd), and not to continue increasing MSC to 13 bpd.

In the latter half of 2024, Saudi Arabia made strategic adjustments to its oil production policies.

Reports from September indicated that the Kingdom decided to abandon its previous target of maintaining oil prices at $100 per barrel.

The decision reflects Saudi Arabia's adaptation to an era of lower oil prices and its intention to increase production, aiming to boost output by an additional one million barrels per day by December 2025.

This move is part of a broader strategy to adjust to global market conditions and sustain its influence in the oil sector.

However, this strategy has not been without challenges. By December 2024, Saudi Arabia faced difficulties in maintaining its traditional dominance over the global oil market.

Internal disagreements within the Opec+ alliance and increased competition from other oil-producing nations, such as Brazil and Canada, have complicated the Kingdom's efforts to control production levels and stabilise prices.

Additionally, the resurgence of US shale production, bolstered by favourable policies from the re-elected Trump administration, has intensified supply pressures.

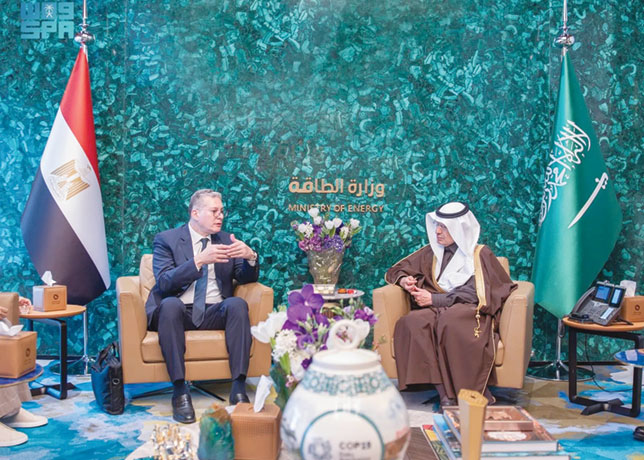

Addressing these challenges, Saudi Arabia's Energy Minister, Prince Abdulaziz bin Salman, emphasised the Kingdom's readiness to adjust oil production as needed.

He stated: 'We are ready to tweak upward, downward, whatever the market necessity dictates.' This flexibility aims to ensure market stability and reflects the Kingdom's commitment to responding proactively to global energy dynamics.

NATURAL GAS EXPANSION

In line with its diversification goals, Saudi Arabia has intensified efforts to expand its natural gas sector.

A cornerstone of this initiative is the development of the Jafurah gas field, the Kingdom's largest non-associated gas field.

Production at Jafurah is slated to commence in the third quarter of 2025, with expectations to reach an output of 2 billion cubic feet per day by 2030.

This project is pivotal for reducing domestic reliance on oil for electricity generation and for supporting the growth of the petrochemical industry.

The increased natural gas production will also facilitate the Kingdom's plans to produce blue hydrogen, aligning with global shifts toward cleaner energy sources.

Amin Nasser, Saudi Aramco CEO, highlighted the significance of this development, and said: 'Aramco is working with MidOcean, an LNG firm in which it took a 51 per cent stake, and looking at expanding our position globally in LNG.' This strategic move not only aims to meet domestic energy needs but also positions Saudi Arabia as a competitive player in the global liquefied natural gas market.

RENEWABLE ENERGY ADVANCEMENTS

Saudi Arabia has made remarkable strides in bolstering its renewable energy capacity. As of September 2024, the Kingdom had contracted 21 renewable energy projects, totaling 19 gigawatts (GW) in capacity.

Notably, the 700 megawatt (MW) Al-Rass solar plant became operational in August 2024, marking a significant milestone in the Kingdom's renewable energy journey.

These developments are part of a broader ambition to add 20 GW of renewable energy capacity annually, aiming to reach a total of 130 GW by 2030.

This aggressive expansion underscores Saudi Arabia's commitment to achieving a sustainable and diversified energy mix.

International collaborations have been instrumental in this renewable energy push. In December 2024, French energy giants EDF Renewables and TotalEnergies were awarded contracts to develop solar projects in Saudi Arabia.

EDF Renewables is set to build two solar parks with a combined capacity of 1.4 GW, while TotalEnergies will construct a 0.3 GW solar park in Rabigh Industrial City.

These projects are part of the Kingdom's fifth renewable tender round and reflect its strategy to partner with global leaders to accelerate the deployment of renewable energy infrastructure.

Saudi Arabia has been leveraging cutting-edge technologies to optimise energy production and improve efficiency.

AI and big data analytics are being employed to enhance oil exploration and refining processes.

Additionally, smart grid technologies are being integrated into the power sector to ensure better energy management and reduce wastage.

These advancements position Saudi Arabia at the forefront of energy innovation.

KINGDOM’S NUCLEAR AMBITIONS

The Kingdom has been exploring nuclear energy as part of its broader strategy to diversify its energy mix. Saudi Arabia plans to construct two large nuclear reactors, with additional smaller modular reactors in development.

The government has been in discussions with the US, Russia, and China for technological collaboration. Nuclear energy is expected to play a critical role in meeting future electricity demands and reducing carbon emissions.

FOREIGN INVESTMENTS

Saudi Arabia has been actively investing in foreign energy projects to diversify its revenue streams and strengthen its influence in global energy markets.

Saudi Aramco has ramped up investments in refining and petrochemical ventures in China and India, securing long-term demand for its crude oil.

Additionally, the Kingdom is pursuing joint ventures in liquefied natural gas (LNG) projects in the US and Australia, further expanding its energy portfolio.

These investments align with Saudi Arabia's strategy to remain a key player in both fossil fuels and emerging energy markets.

GLOBAL SHIFTS IN ENERGY SECTOR

With the re-election of Donald Trump, US policies favouring domestic oil production are expected to increase global supply, potentially driving down prices.

Saudi Arabia will likely adjust its production strategy to stabilise the market, leveraging its vast reserves and production capacity to balance supply fluctuations.

Additionally, the Kingdom may strengthen its ties with key energy partners to counteract potential market disruptions.

Saudi Arabia has been deepening its energy ties with Russia and China.

The Kingdom continues to collaborate with Russia within the Opec+ framework to coordinate oil production levels.

Meanwhile, its strategic energy partnerships with China have expanded, with several joint ventures in refining, petrochemicals, and renewable energy projects. These relationships are crucial for Saudi Arabia's long-term energy security and market positioning.

Saudi Arabia remains a pivotal player in the global energy landscape. While its oil dominance faces challenges, the Kingdom is actively investing in gas, renewables, and nuclear energy to ensure long-term sustainability.

Through strategic investments, technological advancements, and international collaborations, Saudi Arabia is positioning itself for a balanced and diversified energy future.

By Abdulaziz Khattak