Energy diversification is at the top of the agenda, with several Mena countries integrating renewables in their generation mix to diversify the power mix and bolster power supply

The Arab Petroleum Investments Corporation (APICORP) has forecast a nine per cent increase in energy investments over the next five years in the Mena region, with the GCC accounting for 45 per cent of them.

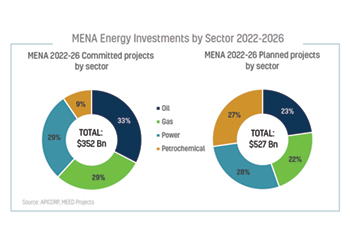

Its report, MENA Energy Investment Outlook 2022-2026, anticipates the total planned and committed investments in the region to exceed $879 billion in the said period, a $74-billion increase from last year’s five-year estimate.

Energy diversification is at the top of the agenda, with several MENA countries integrating renewables in their generation mix as part of a shared policy objective to diversify the power mix with low-cost, low-carbon energy sources and bolster power supply security.

APICORP’s analysis shows that right across the region, blue and green hydrogen will dominate the emerging hydrogen markets in the near term.

For the Mena region, and specifically the GCC and North Africa, the focus will be on exporting low-carbon hydrogen to demand centres in Europe and Southeast Asia via ammonia shipments.

In the renewables sector, Mena is expected to add 5.6 GW of installed capacity from renewables in 2022, nearly double the 3 GW in 2021. And by 2026, the region is expected to add 33 GW by installed capacity of renewables, with around 26 GW as utility and distributed solar PV.

Leading the charge of meeting renewables policy targets are Morocco and Jordan, with the former reaching almost 40 per cent of its installed capacity from renewable energy in 2021 and Jordan reaching nearly 20 per cent.

Other countries such as Saudi Arabia, UAE, Egypt, and Oman have relatively low renewable energy generation, but the share is expected to witness a significant increase with several planned and committed large-capacity projects in the pipeline.

APICORP forecasts the share of natural gas in power generation to grow from 70-75 per cent across MENA by 2024. Alternatively, oil-fired power is expected to drop from 24 per cent of total generation to around 20 per cent by 2024.

Nuclear power generation in Mena remains relatively modest, comprising 3 per cent of the total generation mix in 2021, led by the UAE.

Egypt’s first planned nuclear power plant - the 4.8 GW El Dabaa facility – is expected to come online in 2026.

Saudi Arabia and Jordan also announced their intent to add nuclear energy to their power mix during this decade.

The year 2021 also witnessed the birth of Mena’s first voluntary carbon trading scheme by the Saudi Stock Exchange (Tadawul), paving the way for the development of a formal carbon market for trading credits and offsets.

Under the recent net-zero pledges of the UAE, KSA, and Bahrain, carbon markets are expected to flourish in the region as hydrocarbon, petrochemical and heavy industry producers will need carbon trading platforms to offset part of their emissions especially in the hard-to-abate industries.

APICORP’s analysis points out that oil and gas companies are facing tighter financing conditions and addressing evolving regulatory frameworks while trying to contribute to socio-economic development and the provision of affordable energy.

Consequently, Mena governments continue to shoulder the main portion of hydrocarbon investments going forward to ensure the security of supply.

And while geopolitical risks could impact energy investments in the net-energy importing North Africa and Levant countries, the net-energy exporters like the GCC will continue to spearhead the increase in project expenditure thanks to the windfall of oil and gas revenues caused by the spike in prices driven by the Russian-Ukrain war.