Mena will see a 178-fold increase in solar energy

Mena will see a 178-fold increase in solar energy

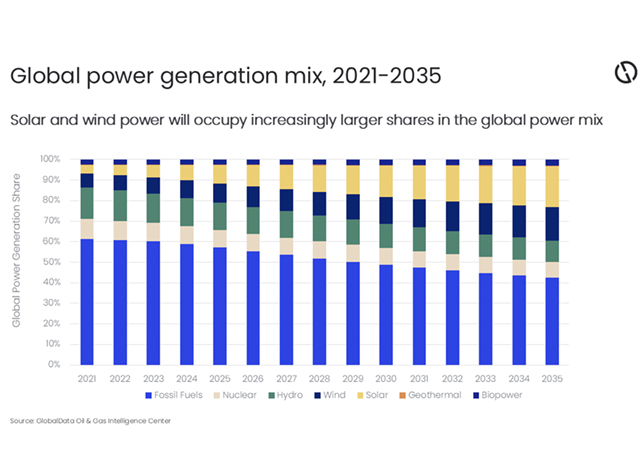

The region will need a diversified mix of generation options to meet growing electricity demand, and while natural gas will remain the dominant source of power generation in the medium term, there will be fast uptake of renewable technologies

Economically and politically, Middle East and North Africa (Mena) region is diverse and has vast petroleum resources, the largest being in Saudi Arabia, Iran, Iraq, UAE, and Kuwait.

Being at the core of the geopolitical system of extraction and trade in oil and gas, the Organisation of the Petroleum Exporting Countries (Opec) members in the region are trying to maintain a delicate balance of keeping oil prices and revenues high. Volatilities in oil prices and conflicts have hampered economic growth in recent years.

The region faces challenges associated with socioeconomic development, youth unemployment, and the need to meet rapidly growing energy demands while considering water and food security, climate change, and local air pollution.

The dominance of fossil-energy resources drives policy in many of the region’s nations. Electricity, gasoline, and water subsidies are widespread, driving high consumption per capita and draining government finances.

The region is taking serious steps to realise its vast renewable-energy potential and diversify its energy sources but continues to face external criticism for ignoring the sustainable-energy agenda. Saudi Arabia’s Vision 2030 strategy plans large investments in renewables. Jordan, Morocco, and Tunisia have set targets to transform their energy mixes. Egypt, Iran, and Turkey, which are the most populous nations in the region, have streamlined their policies to progress clean-energy sectors and renewable generation, and to attract foreign investors.

The region is also taking steps to implement demand-side management measures, including subsidy and tariff reforms, building retrofits, energy-management systems, and private-sector involvement.

POINTERS TO THE FUTURE

• The geopolitical shift towards a more electrified world, the rise in unconventional sources, and the tapering off of oil demand will force this region’s fossil-fuel producing countries to adopt more diversified economic models.

• With these nations now feeling the effects of climate change, rising water scarcity, and a need to liberate fossil fuels for export, key policies will aim ‘to green’ supply chains and reduce per capita energy consumption. Water constraints will give a further push towards renewable energy, for example, solar PV and wind, for which water is neither a major input nor cost component, and which could be used to replace fossil fuelled desalination.

• The region has vast renewables potential, particularly solar PV. The renewable build starts from a very low base, but investment and uptake will mature. Egypt aims to obtain 42 per cent of its electricity from renewables by 2035; Turkey has raised its target to 50 per cent renewable power by 2023; Saudi Arabia targets 30 per cent by 2030; and UAE is calling for 70 per cent decarbonisation and 44 per cent clean-energy power generation by 2050.

• Rising power demand and increased variable renewable generation will see grid interconnections established between the Gulf nations and the rest of the Middle East, despite political tensions. Cooperation will have to overcome a historical preference for self-sufficiency for security reasons, distortions in electricity prices due to subsidies, and state owned monopolies not yet run on a commercial footing. Battery energy-storage will expand to support flexibility and renewables integration.

• Systemic subsidisation of energy will likely reduce slowly owing to growing budgetary pressures linked to growing population and consumption. Reduced fossil-fuel subsidies will be the first step towards a price on carbon, but we foresee slow adoption of, and low, carbon prices for the region.

ENERGY TRANSITION

Recent data by DNV GL shows Middle East and North Africa (Mena) final energy demand growing throughout the forecast period. The growth is distributed across all sectors, though efficiency gains in transport will see energy use peak there first. Efficiency improvements will limit growth of final energy demand in all sectors, thereby counteracting the effect of population and economic growth.

The share of electricity in final energy demand continues to increase, from 17 per cent in 2018 to 38 per cent in 2050. Buildings see the strongest electrification, with transport and manufacturing following later in the forecast period. The 2050 electricity mix will be dominated by solar PV, natural gas and onshore wind. Even in this oil and gas rich region, variable renewables will produce more than half the power in 2050.

Data also shows natural gas and oil dominating the primary energy mix through to 2050. Whereas oil use will see a slight decrease after 2040, natural gas’s contribution will stay about constant at 2018 levels, and with around 40 per cent of the gas going to the power sector. Solar PV and wind increase, but the uptake before 2030 is very limited. Coal, nuclear, hydropower and biomass are all minor players.

ENERGY TRANSITION INDICATORS

DNV GL data presents Mena developments on three main energy-transition indicators: electrification, energy-intensity improvements and decarbonisation. Accordingly:

• The region will see a strong increase in the share of electricity in its final energy demand mix after 2030 in an order of magnitude of 17 per cent.

• Energy intensity in this oil and gas rich region will reduce by more than 40 per cent between 2018 and 2050.

• The high share of fossil fuels in the energy mix will counteract further carbon-intensity reductions, reaching little more than 40 tCO2/TJ in 2050 and representing highest value of all regions.

EMISSIONS

DNV GL projects the region’s average carbon price to be $20 per tonne by 2050. There will be limited explicit carbon-pricing instruments; negative carbon prices currently exist, and the likely first step towards carbon pricing will be to eliminate fossil-fuel subsidies.

Energy-related emissions from the Middle East and North Africa follow an almost flat course over the next three decades. Data shows little change in the contribution from the three demand sectors, with a small decline in manufacturing emissions and a small increase in transport emissions.

Among the energy carriers there is also little movement, with only emissions from natural gas showing a small increase and coal and oil a small decline. As the carbon price remains low, the expected uptake of CCS is negligible in the region; at 31 Mt CO2 per year in 2050, 1 per cent of total emissions.

NDC pledges imply a regional target for emissions to increase by no more than 305 per cent by 2030 relative to 1990. Our Outlook indicates that energy-related emissions will be limited to a 175 per cent increase by then. There are some uncertainties in the comparisons of targets and forecasts as some countries are unclear about whether the targets reported in NDCs also include non-energy related CO2 emissions.

Mena’s forecast emissions of 3.4 ton CO2 per person in 2050 are two-thirds of the present level, and among the highest of all regions. This fossil rich region has a relatively slow transition, with emissions reducing less than in other regions with the same standards of living.

FAST UPTAKE OF RENEWABLES

Electricity demand in the Middle East and North Africa will almost triple from 1,680 TWh in 2018 to 4,900 TWh in 2050. Due to the uptake of EVs, transport shows the greatest electricity demand growth, followed by cooling and non-substitutable electricity in buildings. Climate change will have significant implications for future electricity demand due to the expected rise in demand for cooling and water desalination.

Though rich in fossil-fuel resources, the region will need a diversified mix of generation options to meet growing electricity demand. While natural gas will remain the dominant source of power generation in the medium term, there will be fast uptake of renewable technologies.

Wind and solar resources currently have a combined contribution of just 2 per cent to generation, the lowest among all regions. We see wind’s contribution reaching 26 per cent in 2050.

For solar PV, the region will see the largest relative increase, 178-fold, between 2018 and 2050. Since the levelised cost of solar PV continues to decrease, due to the reliable year-round sunshine and a high capacity factor, its share in the generation mix will reach 35 per cent by 2050, the second highest of all regions after the Indian Subcontinent’s 36 per cent.

The large contribution of variable solar and wind resources will require expansion of electricity- storage technologies. We estimate that the region will require a utility storage capacity of 133 GW by 2050, utilizing 141 TWh of electricity. This utility-scale storage, together with additional storage from grid-connected EVs, will provide a total resupply of 388 TWh to the power system, representing about 7 per cent of total electricity generation by 2050.