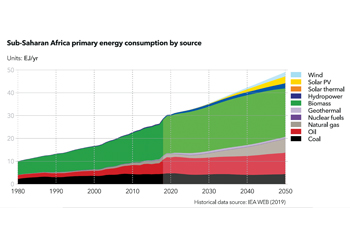

Biomass will remain the dominant source of energy in Sub-Saharan Africa

Biomass will remain the dominant source of energy in Sub-Saharan Africa

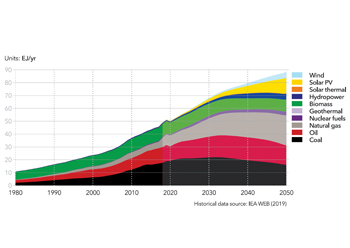

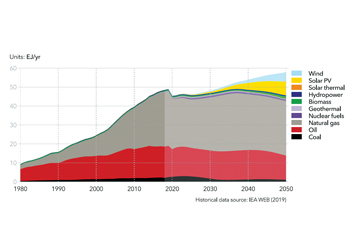

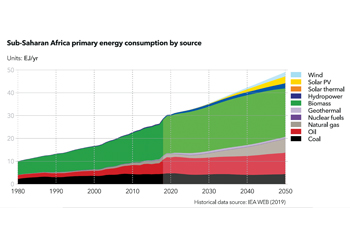

Amidst a two-fold increase forecast in the region’s population in 30 years tripling the demand for energy, lower renewable-energy costs will create affordable opportunities for the region

Only 42 per cent of Sub-Saharan Africa has access to electricity. However, the region with rich resource potential is seeing a growing demand for energy as both the population and local economies grow, according to DNV GL’s Energy Transition Outlook 2020 report.

Urbanisation growth rates in the region, which consists of all African countries except Morocco, Algeria, Tunisia, Libya and Egypt, are among the fastest in the world. In the next 30 years, the region’s population will swell to 2 billion in from 1.09 billion in 2018, with urban dwellers outweighing rural residents. The region’s GDP is projected to grown to over $15 trillion by 2050.

In terms of resource distribution, Nigeria and Angola are the largest petroleum producers, while 93 per cent of the region’s coal production is from South Africa, where it is the main primary fuel for power generation. Congo has high hydropower potential, and the continent has abundant solar radiation and wind resources.

Energy deficiency is an impediment to economic development. The region requires power generation and infrastructure to supply unserved and growing populations. Supply has not kept pace with population growth and

industrialisation.

The energy demand will keep growing over the coming decades. The largest rise in energy demand, a tripling, comes from manufacturing as the region starts to scale up manufacturing production. Energy demand for transport will almost double as a much higher share of the population gains access to modern transport.

Electricity’s share in the final energy demand will rise from 7 per cent in 2018 to 18 per cent in 2050. Despite this growth, the 2050 share is the lowest of all regions. Solar PV’s 33 per cent share dominates the 2050 grid electricity mix. Adding in off-grid PV, solar’s share is almost 40 per cent by mid-century. Infrastructure challenges are a major obstacle to faster electrification.

Biomass will remain the dominant source of energy, though its share will decrease. It brings many challenges including adverse health effects, inefficiencies, and availability of traditional biomass impoverishing arable land.

Oil and coal will decrease slightly in absolute terms. Natural gas will see the largest growth, with increased demand for it in buildings, manufacturing and power generation.

• Future prospects: The largest relative growth, however, will come in solar PV, off-grid PV, and wind, but as electricity’s share in final demand is relatively low, uptake of these renewables is also less than in many other regions.

To support utility-scale renewables, partnerships and development banks will play key roles in energy projects, clean energy corridors for interconnections, and power pools.

Encouraged by foreign funding (particularly from China and Japan), decision makers will continue to favour large, centralised energy plants, thus perpetuating coal use, hydropower expansion, and greater use of natural gas.

Ghana and Kenya both aim to boost renewables through feed-in tariffs. Kenya aims to raise electricity capacity ten-fold to 23 GW by 2033. Tanzania’s goal is for renewable power to reach 70 per cent by the mid-2020s, but its Power System Master Plan emphasises the role of coal and gas-fired power generation until the 2040s. Political and economic turmoil regarding coal dominance in South Africa may steer the generation mix towards lower-cost renewables and gas from Mozambique.