Image by 1715d1db_3/ iStock

Image by 1715d1db_3/ iStock

Both US and global oil production are set to rise to slightly larger record highs this year than prior forecasts, the US Energy Information Administration said.

A surge in oil supply has run into weakening demand growth this year, dragging oil prices to their lowest since 2021 despite large production cuts from the Organisation of the Petroleum Exporting Countries and its allies in Opec+.

US oil output is now expected to average 13.23 million barrels per day (bpd) this year, about 300,000 bpd higher than last year's record of 12.93 million bpd, the EIA said. The agency earlier forecast US oil output to average 13.22 million bpd this year.

US oil production will grow to 13.53 million bpd next year, the EIA said in its November Short-Term Energy Outlook (STEO), a slight reduction from the 13.54 million-bpd forecast in its October STEO.

The agency bumped up its global oil output forecast for 2024 to 102.6 million bpd, from its prior forecast of 102.5 million bpd. For next year, it expects world output of 104.7 million bpd, up from 104.5 million bpd previously.

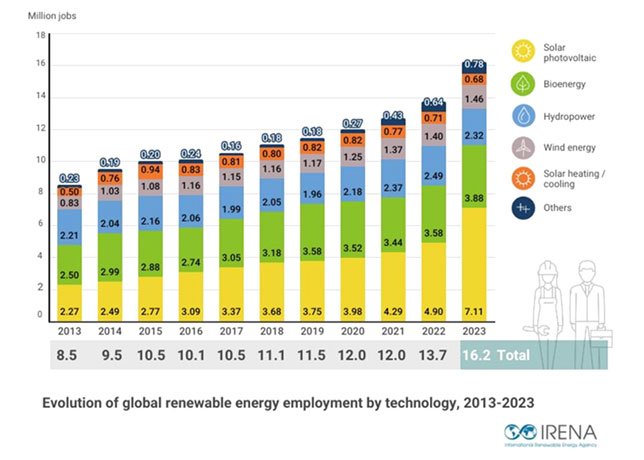

Oil demand growth has been a source of major disagreement between leading oil forecasters, due to differences on China's consumption and on the pace of the transition to alternative energy sources.

EIA now expects global oil demand to grow by about 1 million bpd in 2024, up from its prior forecast of about 900,000 bpd.

Opec this week lowered its 2024 forecast for the fourth consecutive month, but still expects a much higher pace of 1.82 million bpd. Paris-based International Energy Agency expects growth of 860,000 bpd.

Opec+ production cuts should help lift global oil prices through the first quarter of next year, the EIA said. However, it warned that members of the group could be growing weary of the cuts, which have been in place for more than two years.

"Although we assess that Opec+ producers will likely continue to limit production below recently announced targets in 2025, the potential for weakening commitment among Opec+ producers to continue cutting production adds downside risk to oil prices," the EIA said.

Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman underscored the importance of continuing a "close coordination" within the Opec+ group of oil producers during a phone call, the Kremlin said. -Reuters