Image by Iryna Melnyk/ iStock

Image by Iryna Melnyk/ iStock

Lower prices helped to drive higher-than-expected OECD gasoil use in the third quarter, driving up overall oil demand, but weak manufacturing and sluggish growth are likely to cap future consumption, the International Energy Agency (IEA) said.

Higher diesel sales contributed to a small, 60,000 barrels per day upward revision in the IEA's 2024 global oil demand growth forecast, the agency said in a monthly report, as lower prices led to stock building ahead of the peak winter season.

"On a product level, gasoil accounts for most of the OECD upgrade, especially in Europe, where third-quarter gains of 80,000 bpd year-on-year were the largest in more than two years," the IEA said in reference to industrialised Organisation for Economic Co-operation and Development nations.

Gasoil, which includes transport and industrial linchpin diesel and heating oil, accounts for the most demand of the products refined from crude oil, meaning it largely determines the global refining sector's profitability.

Wider economic slowdown has prompted a slump in refinery profitability this year, after bumper earnings in 2022-2023 were driven by supply shocks after Russia's invasion of Ukraine, and the release of pent-up demand following the COVID-19 pandemic.

European refinery profit margins for diesel averaged around $16.70 per barrel in the third quarter, LSEG data show, down from $38.43 during the same period of 2023, and $47.96 a year before that.

Despite the third-quarter uptick, the IEA anticipated gasoil would be the "weak point" in global demand, forecasting a 160,000 bpd year-on-year drop in 2024.

"The global manufacturing slump shows no signs of abating, with September manufacturing Purchasing Managers Indexes (PMIs) in contraction in the US, the eurozone and China," the report said.

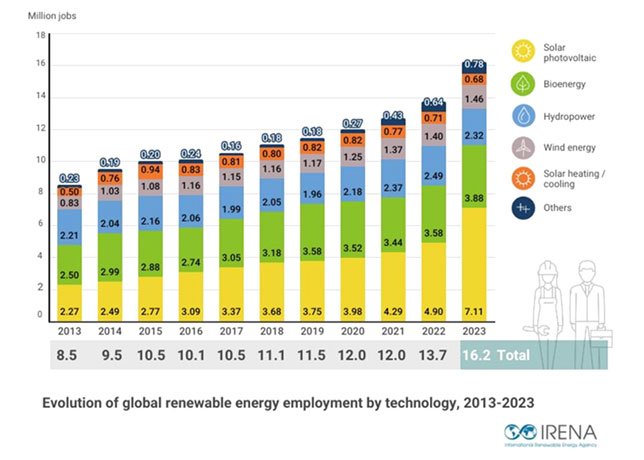

Further eroding diesel demand, the IEA said rapid developments in clean energy technologies were displacing oil in traditional transport markets, notably in China.

"At the same time, substitution away from oil by way of EVs, LNG-powered trucks and high-speed rail is undercutting road fuels use." -Reuters