Abu Dhabi-based investment and holding company ADQ and Oman Investment Authority (OIA) have identified investment opportunities worth over AED30 billion ($8.17 billion) in new projects within Oman.

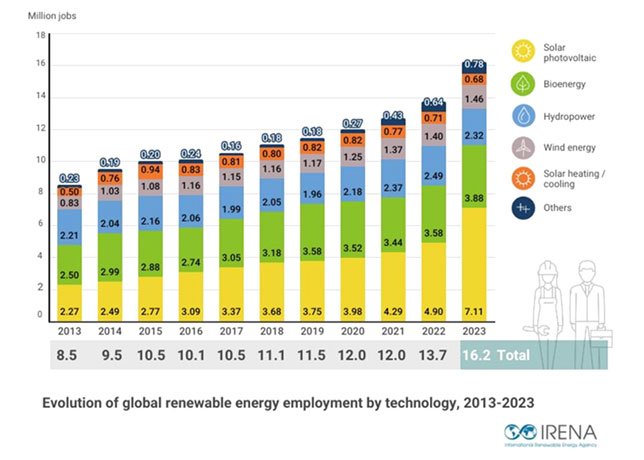

The investment opportunities are across a variety of sectors including hydrogen, solar and wind power generation, green aluminium, and steel, as well as water and electricity transmission lines.

Officials from both organisations discussed areas of joint investment collaboration on the sidelines of the visit of UAE President HH Sheikh Mohamed Bin Zayed Al Nahyan to Oman, said a statement.

ADQ and OIA recently signed an AED10-billion partnership agreement to facilitate investments between the UAE and Oman in various sectors.

Additionally, ADQ and Oman Information, Communication and Technology Group (ITHCA), a wholly owned subsidiary of the OIA, signed an MoU to establish an AED592-million venture capital fund to invest in high growth technology companies in Oman.

ADQ is also exploring investment in other sectors that include but are not limited to food and agriculture, logistics, technology, and healthcare. This is in line with ADQ’s ambitions to expand its power, water, and industrial platforms throughout Oman to capture synergies that achieve long-term and sustainable value creation for both nations.

Mohamed Hassan Alsuwaidi, Managing Director and Chief Executive Officer at ADQ, said: “As part of the UAE’s longstanding bilateral relationship with Oman, we discussed several potential strategic opportunities that can unlock significant synergies and value through joint collaboration across key industries in the Sultanate. Today’s engagement builds on our recent efforts and commitment to develop tangible investment partnerships in key markets, such as Oman, that complement our investment strategy and growth aspirations. We are confident that this visit reinforces the significant economic potential of ADQ’s partnership with OIA.”

Abdulsalam Al Murshidi, President of Oman Investment Authority (OIA), said: “Our partnership with a like-minded institution, such as ADQ, showcases our shared commitment to building long-term sustainable relationships. Our discussions today will not only create a platform to enable us to explore mutually beneficial co-investment opportunities, but facilitate knowledge sharing to strengthen our respective organisations’ investment platforms.”

As a strategic partner to the government, ADQ undertakes value accretive co-investment programs with key regional partners through its Sovereign Investment Partnerships platform. These partnerships accelerate investments that unlock mutual value across ADQ and its portfolio businesses. – TradeArabia News Service