Alhoti ... seeing solid prospects

Alhoti ... seeing solid prospects

The company is looking at expansion plans over the coming 18 months which will look at firstly doubling capacity from the present 6,000 tonnes to 12,000 tonnes

Saudi-based Titanium and Steel Manufacturing Company (TSM Arabia), a leading process equipment manufacturer in the kingdom, has achieved a phenomenal growth rate this year and sees huge prospects for 2018.

The company, which has been growing at an astounding pace since it was established in 2014, posted around 160 per cent growth rate in the first 10 months of 2017 backed by high demand for its products and services from Saudi majors like Aramco and Sabic, says Ayman A Alhoti, general manager, TSM Arabia.

"The demand for our products and services remain undiminished despite the low oil prices. We are looking at expansion plans over the coming 18 months which will look at firstly doubling capacity from the present 6,000 tonnes to 12,000 tonnes and then increasing to 18,000 tonnes in this period," he says.

Besides, TSM Arabia is starting to penetrate the market for skids in a big way. The company’s strategy for skids is partnering with an engineering company within the kingdom, says Alhoti.

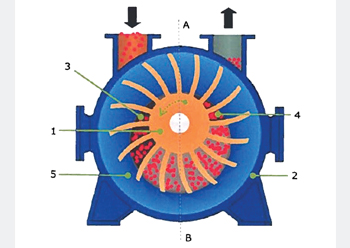

Till now, TSM’s concentration has been on process fabrication. "We are already an approved process manufacturer for all major companies and EPC contractors. We have also carried out work on heat exchangers for shutdown and maintenance work with Sabic," he says.

TSM Arabia’s prime market is Saudi Arabia. "100 per cent of our production is for the Saudi market and we didn’t yet export mainly because of the huge demand locally and our growth plan," he says.

"Our main customer is Aramco we see solid prospects for the coming five years," he says adding that TSM Arabia supplied equipment to major Aramco projects including the Fadhili Gas Plant, Ras Tanura and Jizan, Hawiya and Haradh expansions.

"We are looking forward to develop our working relationship with Sabic. We feel that as a Saudi company we are a distinguished manufacturer equipped with first class machineries and a highly skilled workforce mainly dedicated to deliver heat exchangers of an exacting quality."

Alhoti says the company’s objective is to be No 1 in quality and engineering in the local market. "The size of our factory is considered to be smaller than our competitors; but what we lack in capacity we make up through our quality and engineering competency. Quality is our company’s mission statement," he says.

Referring to the technology transfer agreement with South Korean technical partner TSM Tech, he says the technical assistance agreement is for 10 years and expires in 2021. "We are in fact on track to be technological independent before the target date of 2021. While the objective of technology transfer is complete we ensure that we maintain our edge by ongoing upgrades to latest tooling as and when they become available for the heat exchanger manufacturing equipment."

Currently 30 per cent of TSM Arabia’s workforce consists of Saudis. The company aims to increase this to 50 per cent and more over the coming three years. "We recruit Saudi nationals with some or minimal experience. After a strenuous training programme for three to six months they are put into the workforce."

Referring to Saudi Vision 2030, he says it was TSM Arabia’s 10-year plan on formation to achieve 70 per cent of local content by 2022. 2030 is a target to deliver on all aspects of the chain that the company is involved. The leading challenge toward 100 per cent localisation for TSM Arabia is the raw material sector involvement "as we lack the presence of local raw material mills", he says.

"The nature and success of our business depends on our people. While growing in a developing world there is no replacement for skilled fabricators and welders. Developing this skilled workforce as well as adapting the latest technology is our challenge for the future growth of the company," he adds.

.jpg)