Al Zour ... new ventures planned

Al Zour ... new ventures planned

KPC already controls eight subsidiaries, each maintaining separate ownership, management and operations structures. The plan to unite three major downstream operations under one umbrella company would be unprecedented

State conglomerate Kuwait Petroleum Corp has approved a plan to set up a ninth subsidiary to manage its greenfield 615,000 bpd refinery at Al-Zour along with an associated petrochemical complex and an LNG import facility, KPC executives and a former board member says.

The implication of creating the new subsidiary is that KPC intends to push ahead with major investment in downstream ventures where refining and petrochemical profits have been less affected by the prolonged downturn in oil prices than crude oil sales.

But the sources also say they expected the venture to have other consequences, such as triggering the proposed sale or privatisation of KPC’s Petrochemical Industries Co (PIC) subsidiary, which produces fertilisers, aromatics, and olefins with several partners including Dow Chemical.

KPC will also be searching for a major international oil company as a partner in the new subsidiary, presently identified as Kuwait Petrochemical Refining, the sources say.

State-owned KPC already controls eight subsidiaries, each maintaining separate ownership, management and operations structures. The plan to unite three major downstream operations under one umbrella company would be unprecedented, and came as a surprise to some industry analysts who have doubted the feasibility of the concept.

'The KPC board has approved the plan for the new major downstream subsidiary to combine ownership and operations of the new refinery, the proposed petrochemical plant, and the LNG import facilities,' a former KPC board member says. A KPC executive also confirms the approval.

The rationale for the major downstream venture was partially explained by the CEO of state refiner Kuwait National Petroleum Co, Mohammed Al-Mutairi.

Mutairi says Kuwait’s profits from sales of refined products had recently been stronger than from crude, and that demand for refined products was the fundamental basis for the profit margins of Kuwait’s three refineries.

Moreover, certain refinery products, such as naphtha and benzene, are used as petrochemicals feedstocks, he adds.

Kuwait wants to integrate the refining process with petrochemical manufacturing, and the new Zour refinery would be expected to provide essential feedstock for petrochemical plants, Mutairi says.

Since some petrochemical manufacturing processes use natural gas components as feedstock, adding LNG import facilities to the infrastructure would create a fully integrated complex, he adds.

Mutairi’s comments echoed recent statements by his boss, KPC CEO Nizar Al-Adsani, who said that KPC’s focus was on the petrochemicals sector as a means of diversifying its operations and revenue sources. One implication was that petrochemicals development would receive the lion’s share of the total $100 billion that Adsani said KPC was planning to invest over the next five years.

The president and CEO of KPC’s Kuwait Petroleum International downstream overseas investment unit, Bakheet Al-Rashidi, stressed the highly competitive nature of the petrochemicals industry worldwide, which meant large-scale integration between refining and chemicals operations was essential to profitability.

'Competition is very tough, especially on the aromatics side,' Rashidi said, singling out the sector of the petrochemicals industry using oil-based feedstocks.

'Today, the aromatic petrochemicals plant, if it is not part of a huge refinery complex, will not be able to compete,' he added.

For Kuwait to achieve the close operational integration and high cost efficiencies to which it aspires in new refining and petrochemicals developments, access to global best-in-class process technology and project management skills will be essential.

'Most likely they will look for a strategic foreign partner such as a large IOC or a company on the scale of Dow, which it has already partnered with to form Equate,' said the former board member, referring to the Equate Petrochemical group whose major partners are PIC and Dow, with 42.5 per cent each, along with Kuwait independents Boubyan Petrochemical (9 per cent) and Qurain Petrochemical Industries (6 per cent).

But the process would take time, both KPC insiders say.

'Approval still has to come from the Supreme Petroleum Council,' says the executive, referring to Kuwait’s highest oil authority, chaired by the prime minister.

'That approval will take at least six months,' the former board member estimates.

KPC has earmarked some $28 billion for the new company divided into three tranches: $16 billion for the new Zour refinery, expected to come on stream during the summer of 2019; $10 billion for petrochemicals development; and $2 billion for the LNG terminal, the sources say.

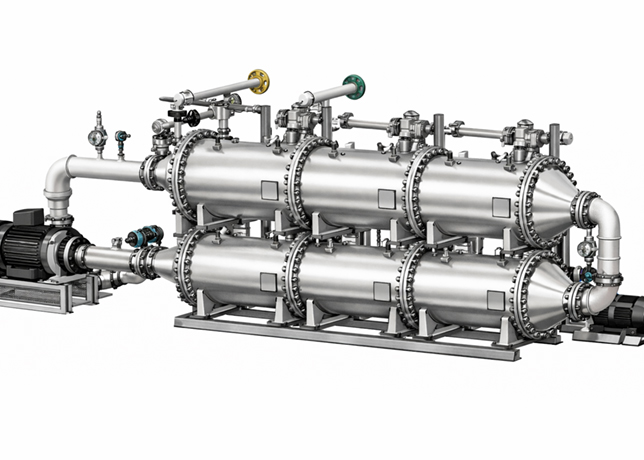

KNPC is in the early stages of building the Zour refinery, which is expected to bring Kuwait’s total refining capacity to 1.4 mbpd. The budget already approved for that is Kuwaiti dinars 4.87 billion ($16.47 billion).

Kuwait’s current refining capacity from three plants is 930,000 bpd with Mina al-Ahmadi processing 460,000 bpd, Mina Abdullah 270,000 bpd and Shuaiba 200,000 bpd. The plan is eventually to close the ageing Shuaiba refinery after Zour comes online.

A petrochemicals plant had also been proposed for the Zour site, but the plan was scrapped due to concerns over cost and feasibility. However, the proposal was back under consideration by last summer, with a panel of economists and industry experts reviewing the project.

'The KPC board has not yet fully addressed the findings of the committee that was studying the plan to integrate the petrochemical plant with Zour,' says the KPC executive.

Other issues likely to complicate the creation of the proposed new umbrella organization would include the potential elimination of 340 to 400 jobs held by Kuwaiti nationals if PIC is closed or privatized as part of the process, the KPC executive says.

KPC’s domestic refining arm KNPC in March 2015 approved a Dinars 1 billion ($3.29 billion) allocation to build a new LNG import and re-gasification facility, Kuwait’s official Kuna news agency quoted a senior KNPC as saying at the time.