Al-Morished ... extending support to local suppliers

Al-Morished ... extending support to local suppliers

In line with the Vision 2030 goal of increasing private sector contribution to 65 per cent of the national GDP, Tasnee is maximising local content contribution in its own production lines through an internal support program

Saudi Arabia’s National Industrialisation Company (Tasnee) has bolstered its position in the global downstream sector through a number of strategic deals and investments.

After closing the Cristal/Tronox acquisition deal last year, the company shifted focus to its core downstream business and petrochemical assets in addition to refinancing its debts.

Tasnee has a diversified and integrated downstream sector with a varied products portfolio ranging from plastic sheets, packaging films, geomembranes and automotive batteries, to water, agriculture, handling, and pipes solutions. It is one of the first to develop plastic pallets to replace wood, in addition to being the largest pipe-making facility in the world, with diameters going to 3 m.

In August last year, Tasnee got listed on the MSCI Index of Emerging Markets as one of 30 Saudi-listed companies, allowing it increase its institutional investor base and limiting share fluctuations.

The company has also forayed into the titanium manufacturing business, and has started making parts for heat exchangers and the aerospace industry, Mutlaq Al-Morished, Tasnee CEO, tells Abdulaziz Khattak of OGN.

In September 2019, Tasnee made it to global ranks after it successfully commissioned its titanium sponge plant in Yanbu industrial city. The plant has an annual production capacity of 15,600 tons, which is about 10 per cent of world production. Titanium sponge is mainly used in aviation industry, space industries, sports and medical industries, and 3D Titanium printing powders.

The project, costing SR6 billion ($1.6 billion), is a joint venture between Tasnee-owned Advanced Metal Industries Cluster (AMIC) and Japan’s Toho Titanium Company

Al-Morished says the titanium sponge project and ilmenite smelter in Jazan are major downstream projects in Tasnee’s titanium value chain.

The ilmenite smelter project, equally owned by Tasnee and Cristal (79 per cent owned by Tasnee), can produce 500,000 tons of high grade Titanium feedstock and 235,000 tons of pig iron. It is the largest of its kind and uses the latest technology in the field.

|

Tasnee’s ethylene cracker in Jubail |

The smelter is currently undergoing repairs after technical issues surfaced in 2018 in the first furnace. The plant is expected to restart during H2 2020.

The smelter’s second furnace will be commissioned after completion of the commercial production of the first furnace, he adds.

Separately, Tasnee is producing innovative solutions for the agricultural sector. In December 2019, National Nipras Technology Company (NNTC), an affiliate of Tasnee based in Jubail Industrial City, produced the soil enhancer, ‘Dibal’ using German Geohumus technology.

'The technology is a world first and was transferred for the first time to the Middle East and to Saudi Arabia. The product helps reduce water consumption by increasing the moisture content in soil,' says Al-Morished.

NNTC has an annual production capacity of 5,000 tons of Dibal.

TASNEE AND VISION 2030

In line with Saudi Arabia Vision 2030’s goal of increasing the private sector’s contribution to 65 per cent of the national GDP, Tasnee is keen to maximise the local content contribution in its own production lines through an internal support program (for local content).

'This has been part of our management KPIs for years and we are making sure that we are progressing in this regard. When it comes to replacing imported content with local alternatives, Tasnee is a leader. As a result, Tasnee was awarded with King Khalid Award for Responsible Competitiveness in the Core Area of Local Suppliers,' says Al-Morished.

Furthermore, Tasnee has displayed a variety of investment opportunities for more than 300 local suppliers and investors through the ‘Tasheel’ programme, which was held in December 2019 at the Chamber of Commerce and Industry in Dammam. Tasnee gave a comprehensive presentation on the investment opportunities available and mechanism for suppliers’ registration and responded to their inquiries.

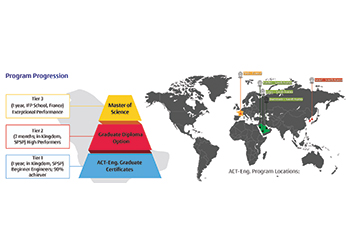

On another front, Tasnee is actively employing and training Saudis. According to Al-Morished, at its titanium sponge plant in Yanbu, all trained Saudi staff have been demonstrating extremely high competency levels. Moreover, he adds, all production supervisory roles were given to trained Saudi engineers, replacing Toho Titanium’s seconded employees from Japan.

In 2019, a total of 3,217 employees were trained through 1,166 classroom training programmes. Additionally, world-class e-learning trainings have been launched where 5,126 online courses have been completed by employees.

Also during 2019, Tasnee inducted 48 fresh Saudi talent from universities and colleges into its various sites across the Kingdom, through several programmes, including the Tamheer program.

In another comment with regard to Vision 2030, which Al-Morished says focuses on economic diversification and reducing reliance on oil, Saudi’s local downstream sector still has its problems.

These problems, he adds, include the small local market, which makes it difficult to consume products locally; and the increase in production costs compared to other global competitors.

COVID-19 IMPACT

To mitigate against the impact of the global viral pandemic, Tasnee has put in place a proactive Business Continuity and Resilience Management (BCRM) to ensure there are no major disruptions to the company’s operations, services and products.

'Our leadership teams have worked closely for a common roadmap and understanding of the situation and priorities, to reduce the inevitable impact of the disease on our operations.

'We have taken some immediate actions, including ensuring the supply of feedstock and chemicals, full sustainability and material availability, keeping plants operating as per schedule, rescheduling turnarounds and maintenance projects, updating our key risks register, and introducing cost rationalisation and cash flow management action plan with definite measures,' says Al-Morished.

He adds: 'During the pandemic, both our supply chain and sales teams have been working remotely with Tasnee customers and supply chain partners to ensure that our customers around the world get their supplies with least disruption, and in full coordination with government authorities, shipping lines, transporters and banks. We support our customers to meet their contractual terms and keep them updated about potential delays.'

Al-Morished says their main concern, however, while facing this pandemic is the safety and well-being of their workforce and community. 'Consequently, we are contributing to minimising the spread of the virus by complying with the Ministry of Health’s instructions, raising awareness of our people, issuing temporary HR policies, disinfecting work locations, postponing external participations, and enabling remote-work tools and technologies.'

Meanwhile, commenting on the deteriorating global economic scenario, Al-Morished says it is difficult to evaluate the current situation and what the future impact will be on oil and gas prices and consequently on the petrochemical sector.

'Historically, all potential crises create a kind of combination between threats and opportunities. However, the current unusual context and the combination of the fall in oil prices and the Covid-19 pandemic has resulted in a different situation,' he opines.

He further explains: 'Any extended collapse in oil prices will affect stock markets and debt repayments, and maximise threats to unpredictable extents. And no one will be able to benefit from such a situation, not even public consumers of fuel because they might be unable to use it during curfews and shutdowns.'

And with regard to the global petrochemical sector, Al-Morished says: 'Because of the dual crisis, we are facing a decreased demand for petrochemicals in 2020. I fear a global recession, which might be similar to the depression of the 1920s.'

He says for Saudi petrochemicals, China is a major market and any improvement in the Chinese economy will be positively reflected on the demand for petrochemicals. On the other hand, any change in naphtha prices will affect the competition in petrochemicals production and pricing.

Nonetheless, Al-Morished concludes the coronavirus situation needs a longer time for recovery. 'The earlier the world recovers from the pandemic, the faster global economies will be back to work, and we might barely catch the 2020 train.'