Querns ... Mideast needs to increase investment in Digital Twins

Querns ... Mideast needs to increase investment in Digital Twins

Digital twins are projected to witness increased uptake in the Middle East and Asia Pacific region as investments in digitalisation continue to grow, Stuart Querns of Delaware, tells OGN

Despite attention largely turning to green and sustainable forms of energy to help benefit the planet, BP’s Energy Outlook 2020 states that oil and gas will continue to remain the primary source until 2035.

However, the sector now faces a number of significant challenges, from meeting carbon goals associated with the production of energy at lower costs to making drastic reductions in carbon emissions in the wake of net zero targets, says Stuart Querns, Director for Enterprise Asset Management (EAM), Delaware, UK.

Alongside this, oil and gas exploration targets are now becoming increasingly difficult to achieve.

It’s a set of challenges that are creating growing concerns among oil and gas companies in terms of their future relevance.

As much as a third of the world’s oil is produced in the Middle East. This is leading to concerns on the impact on the local economy as much as the world pivots to other energy sources.

This is why it is becoming critical for organisations across the Middle East, Asia-Pacific region and globally to explore methods that help boost production, save costs and reduce carbon emissions during a period of unprecedented scrutiny to be more sustainable.

SUSTAINABILITY IN THE SECTOR

|

In the face of increasing focus on renewables, the oil and gas industry rebounded strongly throughout the course of 2021, with oil prices also reaching their highest levels in six years.

In its findings, Deloitte also discovered that many oil and gas companies are focussing on reinventing their operations by analysing financial health, practicing capital discipline, transforming their business models and making clear commitments to battling climate change. This is opening up two areas of focus where a critical balance needs to be struck.

As is the case of most businesses, ensuring profitability is still king for many of these companies in the sector and will remain so.

In the third quarter of 2021 alone, 24 top oil and gas companies made more than $74 billion in net income.

From January to September of last year, the combined profits of Exxon, Chevron, Shell and BP was $174 billion alone.

Despite strong figures, these numbers aren’t detracting from the growing drive among oil and gas businesses to become more sustainable.

Much of the cause of this is both from investors prioritising firms with strong ESG credentials and the trend for customers to seek out sustainability-led businesses.

So what is the key to ensuring both of these goals can be met? Part of the answer is technology.

HOW DIGITAL DRIVES BENEFITS

Today, digital technologies are being increasingly used to deliver far-reaching benefits for oil and gas companies across an extensive range of operational and maintenance areas.

They can for example help to reduce breakdowns, reduce operational costs and minimise lost production time by providing the right information in the form of defined data analytics that delivers the information on recurring equipment faults, system failures and associated maintenance costs.

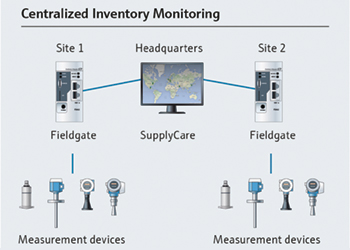

Additionally, digital tools can provide stock availability and usage detail that give maintenance crews the ability to analyse data and attain a more accurate visibility of stock across all assets in the organisation. They can more effectively manage resources that support the maintenance activities, aligning the right people, with the right skills at the right time, ensuring compliance as well as reduced work outage.

Providing technological support to those working in the industry is critical as almost half (47 per cent) of energy workers in the Middle East are debating leaving the industry within the five years, according to a survey of 17,000 energy professionals worldwide by oilandgasjobsearch.com and Brunel.

Integrating repairs processes across the supply chain and work management maintenance teams can help accurate repair costs to be allocated and also enable rental terms and costs to be more easily traceable.

EXPANDING VALUE WITH DIGITAL TWINS

In addition to enhanced data analytics, the use of digital twin technology is one of the most effective ways that oil and gas companies can drive efficiencies and deliver enhanced sustainability today.

This technology effectively empowers these organisations to model new, existing and alternative operational scenarios in a customisable and fully virtual environment to quickly identify improvements and resource usage. They can then apply these changes in the real world.

Research of the market discovered that alongside the Middle East as a key market for the technology, digital twins are projected to witness increased uptake in the Asia Pacific region as investments in digitalisation continue to grow.

By operating a digital twin, organisations can run hundreds or even thousands of trials to achieve a more thorough exploration of capabilities and options, without ever incurring risk as equipment doesn’t need to be used.

Such trials can also be operated remotely in a safe area without any tangible impact on environmental conditions.

Digital modelling also allows the improvement process to become more predictable, helping to reduce cost and assist in optimising the overall performance.

It's with the adoption of digital twin technology that oil and gas companies can play their part in the global drive towards reduced carbon emissions. Testing in the digital environment can identify areas where less energy and water can be used.

It’s via these methods that such companies can drive the ideal blend between operational efficiency and sustainability.

The UAE’s Abu Dhabi National Oil Company (Adnoc), for example, has been able to transform into a dynamic energy company by leveraging digitalisation, creating new revenue streams and maximising profit in the era of Oil and Gas 4.0.

PLOTTING THE WAY FORWARD

While profitability is, of course, crucial for oil and gas companies in the Middle East, Asia-Pacific region and globally to maintain operations and expand growth in a competitive market, it’s only one key factor that will shape their long-term global responsibility and ultimately define their success.

Without doubt, the sector remains beset with challenges, from controlling increasing costs in a volatile global environment, to driving digital transformation in the era of Industry 4.0 and beyond plus boosting sustainability efforts as more countries set targets to achieve net zero emissions by 2050.

To help balance these strategies moving forward, the combination of actionable data and the right digital tools can combine to help them meet operational and environmental efficiency goals in the years ahead.