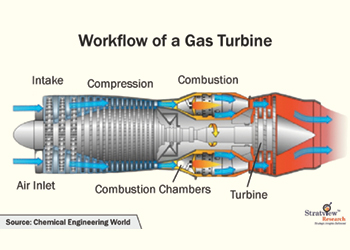

Figure 1 … workflow of a gas turbine

Figure 1 … workflow of a gas turbine

Aeroderivative gas turbines posses the ability to provide cleaner and more efficient power, and will be critical in solving the growing energy needs of the world, Aditya Joshi, Marketing Head, Stratview Research, tells OGN

Gas turbines have been in use to power aircraft for years. These aviation gas turbines heat a mixture of compressed air and fuel under high pressure, causing the turbine blades to spin which drives the generator to create a thrust.

Originally designed for the aviation sector, they have gained growing acceptance in several other industrial applications, including as the energy sector.

Gas turbines that mirror the basic principle of aviation gas turbines are highly flexible, lightweight, and possess mobile properties.

AGTs are one of the two types of industrial gas turbines, the other being heavyweight engines.

GAS TURBINES ARE ROBUST

Gas turbines derive power from their three main components, namely compressor, combustor, and power turbine.

Gas turbines use a continuous intake of air and injection of fuel to create a pressurised and uniformly heated gas flow that expands through the turbine. In the compressor, a series of rotating blades pressurise the incoming air that heats the air.

Chemical energy released from the burning fuel adds far more heat to the combustor that causes expansion through the turbine blades. This pressure causes rotation of the shaft that drives the compressor at the front of the engine to continue the cycle (Figure 1).

Higher pressure ratios between the air inlet and the combustor increase power and simple cycle efficiency (the ratio of discharge capacity to charge capacity in a single cycle).

Simple cycle efficiency adds a number of benefits to the gas turbines making them robust, easy to operate, and reach efficiencies up to 40 per cent at large power levels.

AGTS IN O&G INDUSTRY

Oil and gas is one of the major applications of AGTs. Their functions in the oil and gas sector (streamwise) include:

• Upstream applications include power generation to meet the needs of oil field or platform; advanced technologies to improve oil recovery; gas lifting, by infusing gas into the well to aid oil and gas lifting; injection of water into the reservoir to improve reservoir pressure and production; re-injection of gases into the reservoir to increase its pressure; and gas processing, to remove sulphur, water, and CO2 components, etc.

|

Figure 2 … active number of FPSOs by country location |

• Midstream applications, include pipeline compression to ‘pump’ gas; and pipeline pump to pumping crude or processed oil.

• Downstream: Gas turbines are also used in downstream applications including refineries.

A sizeable amount of the AGTs in oil and gas goes to offshore applications. Due to the harsh operating environments, various factors must be considered while designing the turbines for offshore applications such as low weight and dimensions, minimal vibration, resistance to saltwater, ruggedness, and resistance to pitch and roll, particularly in floating installations.

AGTs APT FOR O&G APPLICATIONS

AGTs have the capability of supplying copious amounts of power given their size, and many other performance attributes. Their unique features which make them ideal for power generation in O&G industry include:

• Higher efficiency: Coupled with simplified installation and maintenance, AGTs save a lot of money for pipeline operators.

• Favourable installation costs: The equipment involved is of a size and weight that it can be packaged and evaluated as a complete unit within the manufacturer’s plant making it convenient and cost-effective for installations.

• Clean burning: Although these gas turbines can use natural gas, fuel oils, and synthetic fuels, their principal fuel remains ‘natural gas’. Clean gas emission is one of the best benefits that these type of gas turbines offer.

• A long life and minimal maintenance.

• Can be brought online to peak production levels in minutes after shutdown: AGTs take about 10 minutes to load fully and if a restart is initiated within 3 hours of the shutdown, a reduced power turbine warm-up is required to bring it back to peak production levels.

GROWTH OF FPSOS IS RELATIVE TO AGT GROWTH

Offshore FPSO vessels have become increasingly popular over time owing to their improved technology allowing for easier access to deep-water oil reserves.

|

Figure 3 … AGT market forecast |

In 2021, there were more than 45 operational FPSOs in Brazil, 13 in the UK, followed by China, with 12 active FPSOs, as shown in Figure 2.

As the market is growing rapidly, different studies estimate that more than 55 FPSO vessels are expected to launch their operations globally between 2022-2027.

Brazil is expected to have more than 20 contracts between 2022-2027 followed by other countries on the list like the UK, Guyana, Nigeria, Australia, etc.

MARKET GROWTH OF AGTs

All industries need power, and hence not only in oil and gas, but AGTs are used almost in all industries including power plants, aviation, marine, etc.

According to Stratview Research, the global market for AGT topped $3 billion in 2021 — with aviation application at the helm — and it is expected to grow 8.8 per cent annually (Figure 3).

Different industries depend on AGTs for power generation (mostly). Increasing investment towards power and heat generation facilities and government supports in terms of rebates, incentives, and subsidies are the prime growth factors for AGTs.

Recent investment announcements and contracts are a clear indication of the growing interest of the industry in AGTs.

• August 2022: GE, a giant in the gas turbines industry announced new orders globally, including two AGTs for West Texas Gas operations and two to support the summer peak power needs at Greek construction company TERNA. The group has also invested $5 million in its leading AGT business to add a second manufacturing unit.

• April 2022: A unit of Mitsubishi Power, Mitsubishi Power Aero, which provides aero-derivative power units will supply five gas turbine units to Life Cycle Power (LCP) according to its recently signed contract.

• May 2022: J-POWER USA and Mitsubishi Power collaborate to achieve an efficient and reliable source of cleaner energy at Jackson Generation. J-POWER USA has achieved commercial operation with the first two Mitsubishi Power gas turbines of 1,200 MW power.

• Dec 2021: Bechtel, an American engineering, procurement, construction, and project management company has contracted Baker Hughes, a key player in AGTs Market, to supply 6 gas turbines and 14 motor compressors for Woodside Energy’s Pluto LNG.

CONCLUSION

According to the International Energy Agency (IEA), the world’s power demands will grow gradually. And gas turbines for power production possess the necessary qualities to meet the world’s demands now and in the future.

With the ability to help the world by providing power in a cleaner, and more efficient manner, gas turbines will be critical in solving the energy needs of a burgeoning requirement.

One of the greatest challenges the AGTs industry may face is the crisis of their primary fuel – natural gas.

Currently, coal produces over one-third of the world’s power. And greenhouse gas emissions from coal-burning power plants contribute heavily to climate change, impacting ecosystems at an alarming rate.

According to the present production rate, the supply of coal may last more than 450 years, whereas natural gas would last for around 50 years only.

Though the world is coming up with ways of producing natural gas, it is difficult to determine if the methods will be sufficient to produce the required amount of natural gas.

Needless to say, the long-term future of AGTs will depend upon the response of the industry to this challenge.

To view full Aeroderivative Gas Turbine Market Size, Share, Trend, Forecast, & Industry Analysis – 2020-2025 report, visit https://www.stratviewresearch.com/1069/aeroderivative-gas-turbine-market.html