The global LNG carrier fleet plays a crucial role in the transportation of LNG

The global LNG carrier fleet plays a crucial role in the transportation of LNG

By monitoring the LNGC fleet and orderbook, industry stakeholders can gain insights into the supply-demand dynamics of the LNG market and make informed decisions to support the growth and sustainability of the industry

After liquefied natural gas (LNG) emerging as a transformative force in the global energy landscape, the crucial role of LNG carriers in the transportation of LNG from production facilities to consumption markets around the world can be overstated enough, explores a report by American Bureau of Shipping (ABS).

In the, ‘LNG Value Chain’ report, ABS reports a significant increase in the global demand for LNG over the past decade and is expected to continue growing rapidly in the future.

This surge in demand can be attributed to the increased interest in cleaner energy sources to fuel economic growth to replace coal and traditional oil-based fossil fuels.

LNG, which is produced through the liquefaction of natural gas, has emerged as a crucial component in meeting the energy requirements of various regions across the globe.

One of the key factors driving the development of gas resources in developing countries is the promotion of domestic access to energy resources and the growth of the electricity and industrial sectors.

LNG exports have become a viable option for those countries to secure the financial resources required for developing their gas resources.

Furthermore, LNG export projects typically allocate a portion of the gas for domestic consumption while the rest is directed towards the liquefaction plant.

This approach enables countries to meet their domestic energy needs while also tapping into the global LNG market. As a result, LNG plays a critical role in promoting energy security by diversifying energy sources and reducing reliance on traditional fossil fuels.

In the context of recent events, such as the Russia-Ukraine war, the role of LNG in global energy security becomes even more significant.

This conflict has highlighted the vulnerabilities associated with relying heavily on a single source or route for energy supplies.

With the cut of gas supplies from Russia, the EU needed over 45Mt of LNG to meet its energy needs.

Supply routes shifted from the traditional Fareast consumers to Europe. LNG prices tripled compared to the pre-war within just three months to reach over $95 MBTU.

Furthermore, the LNG import market over the last two years flipped from the Asian market being the largest importer of LNG in 2021 to the European market leading the imports in 2022.

The ability to transport LNG from producing regions to distant countries provides an opportunity to diversify energy supply chains and reduce geopolitical risks.

By unlocking stranded natural gas resources and establishing LNG infrastructure, countries can enhance their energy security and reduce their dependency on specific regions for energy imports.

LNGC FLEET & ORDERBOOK

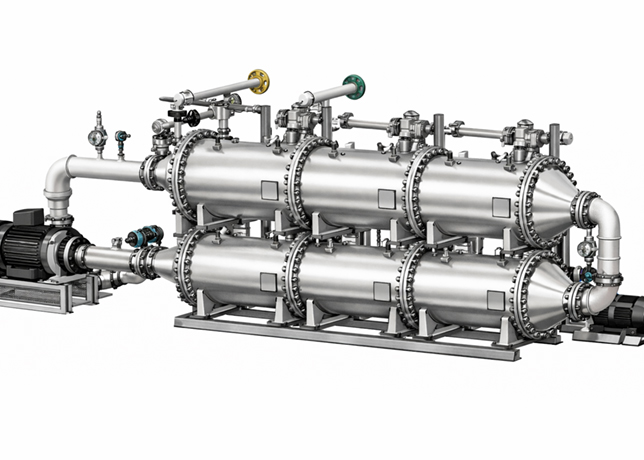

New trends and innovations have revolutionised the LNG industry. The midstream sector – encompassing liquefaction, transportation via pipelines, specialised LNG carriers and small-scale LNG distribution – plays a crucial role in ensuring the efficient and reliable movement of LNG from production centers to end-users across the globe.

Traditionally, LNG liquefaction plants have found their homes onshore, and while some of these facilities were situated in remote areas, they demanded the establishment of entire cities and intricate infrastructures to support the plant operations and personnel.

Venturing into the vast and remote offshore gas fields often posed significant challenges due to the substantial upstream costs, including the construction of extensive pipelines.

The quest for a more cost-effective solution led to the concept of floating liquefaction facilities (FLNGs), where both liquefaction and necessary pre-processing occur on a floating structure that is positioned in proximity to the gas discovery site.

LNG, along with potential by-products like LPG and Condensate, could be directly offloaded onto product carriers, swiftly reaching the market from the floating LNG facility.

The global LNG carrier fleet plays a crucial role in the transportation of LNG from production facilities to consumption markets around the world.

The LNG carrier fleet consists of specialised vessels designed to safely transport LNG at extremely low temperatures and under precise storage conditions. These vessels are equipped with advanced technology and insulation systems to ensure the integrity and safety of the cargo throughout the journey.

The LNG carrier (LNGC) fleet is constantly evolving and expanding to meet the growing demand for LNG. The LNG carriers orderbook shows almost 50 percent growth.

Over 300 vessels have been ordered to the existing world fleet of just over 650 vessels.

This historical orderbook reflects the investments and commitments made by companies to meet the anticipated increase in LNG production and consumption.

By analysing the LNGC fleet and orderbook, industry stakeholders and market analysts can assess the supply-demand dynamics of the LNG market and make informed decisions regarding infrastructure investments and energy strategies.

The size and capacity of LNG carriers vary, with vessels ranging from small-scale carriers to large-scale vessels capable of transporting huge volumes of LNG.

The LNGC fleet includes both single-screw and dual-screw vessels, each designed to cater to specific operational requirements and trade routes.

The fleet is predominantly made up of vessels with membrane-type cargo containment systems, which provide excellent thermal insulation and allow for efficient loading and unloading of LNG.

It is important to consider factors such as vessel age, technological advancements and environmental regulations when evaluating the LNGC fleet.

As older vessels are retired from service, new orders are placed for technologically advanced carriers that offer improved efficiency, safety and environmental performance.

The adoption of new technologies and design features helps to reduce fuel consumption and greenhouse gas emissions, contributing to sustainability efforts in the maritime industry.

The retirement of the older vessels, which are mainly steam propelled, accounts for about of a third of the existing fleet.

This transition is expected to further test the resilience of the LNG supply chain in the coming years while maintaining high prices for LNG.

In recent years, the LNGC fleet has witnessed significant growth, driven by the expansion of LNG production and the development of new liquefaction plants in various regions.

This growth is expected to continue as demand for LNG increases, particularly in Asia, where countries like China, Japan and South Korea have been major LNG importers.

The orderbook reflects this trend, with a substantial number of LNG carriers being built to cater to the anticipated demand from these markets.

It is to be noted that there are some uncertainties related to countries’ commitment in pushing regulations and implementing measures to support their respective pledges to reduce GHG emissions.

With these uncertainties, investors have shied away from reaching financial investment decisions (FID) for several LNG projects.

After 2028, demand overcomes supply mainly because of a lack in investments.

Unless the energy demand is met by new renewable sources of energy, this situation might stress the global energy market further.

In conclusion, LNG will continue to play a crucial role in meeting the future global energy demand.

Its significance is amplified by recent geopolitical events and the need to enhance energy security.

By leveraging LNG as a cleaner and more flexible energy source, countries can diversify their energy supply chains and reduce their reliance on specific regions.

This, in turn, contributes to a more secure and sustainable energy future for the global community.

Strongly associated to the growth of the industry is LNG carriers. The LNGC fleet and orderbook are critical indicators of the current and future state of the LNG industry.

It reflects the investments and commitments made by companies to meet the growing demand for LNG.

By monitoring the LNGC fleet and orderbook, industry stakeholders can gain insights into the supply-demand dynamics of the LNG market and make informed decisions to support the growth and sustainability of the industry.