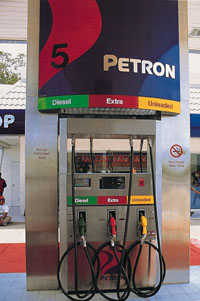

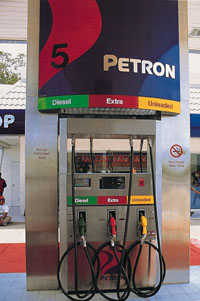

Minimal increases at the pump have led to protests in the Philippines

Minimal increases at the pump have led to protests in the Philippines

The Philippines' largest oil refiner, Petron Corp, has said it expects to make profits this year after a difficult year last year.

The company has yet to report its full-year 2000 earnings, but officials said they expected to end the year with a loss.

In the first nine months of last year, Petron accumulated a net loss of 1.29 billion pesos ($25 million) because it could not fully pass on costs from a weak peso and high prices of imported crude.

Petron reported net income of 2.4 billion pesos in 1999 and 3.7 billion pesos in 1998.

''We expect to turn a profit (in 2001). The current declining trend in crude prices and the various cost-optimisation measures initiated in 2000 will certainly help,'' Petron said.

Petron said it expects a negative return-on-rate base of 4.4 per cent for last year because of its huge loss in the first nine months.

''Petron acquires its crude in dollars and any depreciation in the peso will automatically rebound to higher local prices,'' it said.

''The peso has significantly depreciated, averaging 40.62 pesos to the dollar in December 1999, and... averaging close to 50 to the dollar (in December 2000).

''Our benchmark Dubai crude also increased, reaching a high average of $30.25 per barrel in October 2000 from as low as $10 per barrel in February 1999,'' it added.

It also said public outrage over fuel price increases has made it difficult for the company to pass high costs fully to consumers.

''The political and social climate is such that even minimal increases in our pump prices have led to protest actions.

''This constraint has resulted in substantial deficits between local and pump prices and our acquisition costs, which we still have to recover,'' Petron said.

Petron said it plans to defer major capital expenditures and limit expenses this year.

''While we are eager to invest in refinery improvements and more stations to safeguard our market position, we are making a cautious stance at this time considering the present economic situation,'' it said.

''Before pursuing our capital projects, we have to ensure that the business environment is conducive to long-term investments and that we would be allowed to attain our desired margins and returns,'' Petron said.

Petron said any expansion plans also hinged on the stability of the peso.

See related story - Top firms slash prices.