Riyadh Cables Group, a regional pioneer in the wire and cable industry, has announced its intention to proceed with an initial public offering (IPO) and list ordinary shares equivalent to a 22% stake on the Saudi stock exchange (Tadawul).

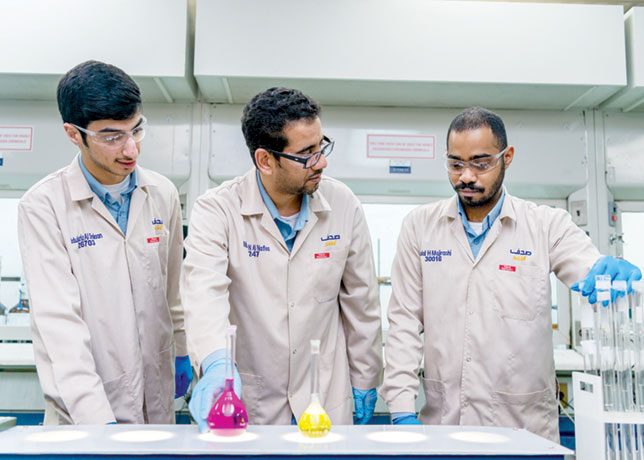

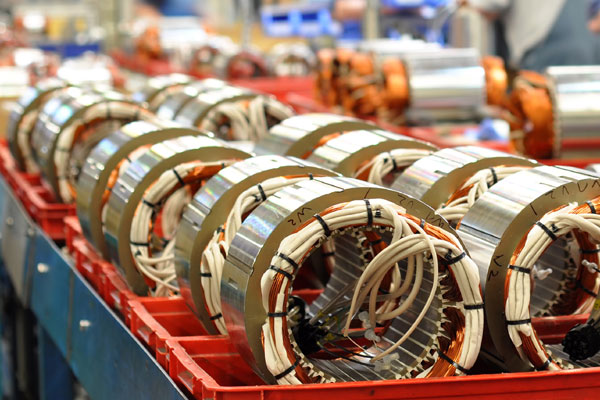

The largest cable manufacturer in the Middle East and North Africa, Riyadh Cables Group operates 15 manufacturing facilities spread over 1,500,000 sq m area.

Its production infrastructure is integrated across the value chain including six factories to manufacture raw materials used in the cables industry to support the nine cable factories in Saudi Arabia, UAE and Iraq.

This makes it self-reliant while also improving RCGC’s manufacturing efficiency by being able to control the cost and quality of its manufacturing ingredients.

Unveiling the IPO plans, Riyadh Cables Group said it had obtained the approval of the Capital Market Authority (CMA) this month on its application to offer 33 million ordinary shares, representing 22% of its share capital of SR1.5 billion ($399.15 million) for public subscription.

The company’s financial performance has been outstanding during the past years. Revenues have

consistently exceded SR4 billion and it has always remained profitable throughout its almost 40 year history.

In addition to the growth of its revenue, Riyadh Cables demonstrated its ability to translate this growth into a robust increase in its profits, which grew at a rate of 10.7%, 10.0% and 10.4% in the fiscal years 2019, 2020 and 2021 respectively. Its net profit grew to SR240 million last year.

A major manufacturer of cables, electrical wires, overhead conductors and fiber optics, Riyadh Cables is also involved in electrical contracting projects for high and extra-high voltage cables in Saudi Arabia and other Arab countries.-TradeArabia News Service