Pearl GTL ... a technological marvel

Pearl GTL ... a technological marvel

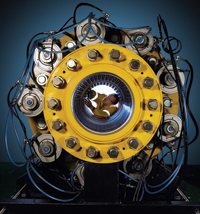

THE Pearl gas-to-liquid (GTL) plant in Qatar is the world’s largest and built at a cost of $19 billion.

Banking on more environment-friendly and efficient GTL products compared with conventional oil refinery products, Shell together with its state-owned partner, Qatar Petroleum (QP) planned to spearhead the development of this niche industry into a larger scale commercial success.

Natural gas is processed to produce various synthetic oils such as gasoil, naphtha, kerosene, paraffin and base oils. GTL fuels are cleaner as they are free of sulphur, nitrogen and aromatics that reduce tailpipe emissions and pollution. GTL has a slower pace of development due to the complex nature of the gas refineries that are expensive to build. In the case of Pearl GTL, is it adjacent to low-cost feedstock, plus the Qatari government has an appetite for large scale infrastructure projects.

Chairman and managing director of Qatar Shell Companies Wael Sawan is optimistic of the future of this niche gas sub-sector.

“Currently, we are very happy with the global appetite for our GTL products. But we are also aware that the market is still in the process recognising and understanding what these products can do.

“It’s really about getting the product into the market and getting customers to try out and be innovative with the products. Hopefully, in five to 15 years, the products will be well entrenched into the market. The bulk of demand will come from the east but the US and Europe will have their fair share as well,” he says.

For Pearl GTL, Shell and the Qatar government are in a development and production sharing agreement whereby Shell will fund the development cost of the plant. Refering to its Bintulu GTL plant as the “grandfather” of the Pearl GTL, Wael says the success in Bintulu’s operation gave the company the confidence to venture into the larger scale of development in Qatar.

Shell has already blended some of its GTL gasoil from its plant in Bintulu into the Shell V-Power diesel and it is being sold worldwide. For GTL gasoil, the Pearl GTL will be able to produce about 50,000 barrels per day (bpd) of GTL gas oil, enough to fill 160,000 cars every day.

“It is proven that GTL gasoil has a noise reduction capability for trucks,” says Wael.

GTL base oils is used in lubricants that maintain vehicle engines, gear boxes and transmissions. Pearl GTL is slated to be the world’s largest source of lubricant base oil producing about 30,000 bpd.

GTL kerosene, that can be used for heating and lighting, has found its greater use in aviation. A Qatar Airways Airbus A340 made the first commercial passenger flight using a 50-50 blend of GTL and conventional jet fuel known as GTL jet fuel, in October 2009. GTL paraffin is used in the production of detergents.

Traditionally, companies have to extract paraffin from oil-based kerosene and return the remaining kerosene to refineries. But, GTL paraffin eliminates this need for extraction and offers companies cost and location advantages. GTL naphtha is an alternative feedstock to conventional naphtha for chemicals plants that make the building blocks for plastics.

It has higher paraffin content than conventional naphtha, which means 10 per cent higher yields of desired products. In terms of technology, Shell has spent more than 35 years researching GTL technology, filing 3,500 patents, and has experience since 1993 operating a commercial-scale GTL plant at Bintulu and selling the GTL products worldwide.

According to Wael, demand will come from China, India and Indonesia. “This march towards urbanisation and higher standard of living will create demand not only for GTL products but for natural gas as well,” he says.

Gas demand will grow at 2 per cent per annum over the next 20 years and 40 per cent of demand will come from Asian countries. It is estimated that global gas demand will grow to 5,000 billion cubic metres (bcm) in 2030 from 3,100 bcm in 2010.

In terms of pricing, although natural gas is generally cheaper than crude oil, historically, it tends to track oil prices. But this is slowly changing as oil becomes more expensive, users will switch to gas. That can be the catalyst to push gas price up too.

Nymex natural gas is currently selling at $3.70 per million British thermal units (mmBtu) but the prices are different in different geographies. It’s $16 per mmBtu in Asia and $10 per mmBtu in Europe. Besides Pearl GTL, Shell is also involved in LNG production in Qatar through Qatargas 4, a $2-billion development.

Qatargas 4 is Shell’s first entry into Qatar LNG sector and brings to seven the number of countries where Shell participates in LNG supply.

This plant has the capacity of 7.8 million tonnes per year (mtpy) of LNG and 70,000 bpd of natural gas liquids. For LNG transportation from Qatar, Shell was appointed by Qatar Gas Transport Co Ltd to manage its fleet of at least 25 new LNG carriers on a long-term charter contract.