Qatar Petroleum ... investing in new gas finds

Qatar Petroleum ... investing in new gas finds

THE world’s largest exporter of natural gas, Qatar will see ambitious megaprojects surge ahead, with $120 billion worth of projects to be undertaken until 2020. Much of the government spending on megaprojects will be funded by revenues from oil and gas exports, which last year accounted for 70 per cent of state revenues.

“Our energy sector has played a central role in supporting the economy of Qatar. Last year, oil and gas exports accounted for 50 per cent of GDP (gross domestic product) and 70 per cent of government revenues. The government will continue to rely on these revenues in the future,” says Dr Mohammed bin Salah Al Sada, Minister of Energy and Industry.

Qatar is experiencing a construction boom, with more than $220 billion of projects planned or under way. Much of the country’s spending is driven by its need to prepare for the 2022 Fifa football World Cup, which will require 12 stadiums, 90,000 hotel rooms and the infrastructure to accommodate more than 400,000 fans.

Dr Al Sada says that Qatar is seeking to double its production from the field Bulhanin maritime oil sea from 45 to 90 thousand barrels per day (bpd), adding that the project is now at the engineering and designs phase. Reviewing Qatar Petroleum’s maritime efforts, Dr Al Sada, who is also chairman of the board of directors and managing director of Qatar Petroleum, says that the project comes within a number of initiatives currently taken by Qatar to develop its offshore fields projects.

|

Dr Al Sada ... taking Qatar to the top |

Dr Al Sada says that in the future Qatar will increase its production of oil extracted from maritime fields by improving processes and the adoption of the appropriate technology that provides efficiency and safety and preserve the environment.

He points out that with regard to the development of offshore gas fields Barzan project is currently being developed to produce about 1.4 billion cubic feet per day (bcfd) for domestic consumption, explaining that the largest three platforms will be built in the North Field. He says the project is scheduled for completion in 2014.

According to Dr Al Sada, Qatar has completed 50 years of oil offshore fields operations with complete unprecedented safety processes, noting that Qatar took into account the preservation of the environment during the development of its maritime operations through several environmental initiatives aimed to preserve the marine life there.

He points out that Qatar has developed infrastructure and industrial facilities in Halul and has a project to extend two maritime cables, each of them 100 km long, from the city of Ras Laffan to the island to supply it with estimated 100 megawatts of electricity each, noting that the project is scheduled for completion by mid-2016.

Qatar produced 740,000 bpd on average in 2011 with the average price per barrel of onshore oil being $110 and that of offshore, $107, according to Qatar Petroleum (QP) which looks after the country’s vibrant oil and gas industry.

Joint projects are currently being implemented in coordination with international companies specialising in geological surveys and well-drilling to help develop oil reserves.

As for liquefied natural gas (LNG) of which Qatar is the world’s top exporter, its production capacity had reached 77 million tonnes a year in 2011 with the two major producers, Qatargas and RasGas, boasting 14 LNG trains.

In the petrochemical sector, the country hopes to reach a production level of 19 million tonnes a year of various petrochemical products over the next few years, the QP statement says.

A comprehensive strategic plan for the development of petrochemical and industrial projects (2011-12) has been completed and approved by the Supreme Council for Economic Affairs and Investment, the state’s apex policy-making body.

The plans include a petrochemical complex for Shell to be operational in 2017, and a petrochemical complex for Qapco (Qatar Petrochemical Company) with an annual production capacity of up to 1.5 million tonnes of ethylene, a million tonnes of high-density polyethylene and 500,000 tonnes of polypropylene, to be operational in 2018.

|

Qatargas ... keeping production steady |

The plans also include other key projects like an aromatics complex, Ras Laffan Refinery 2, hydrogen-diesel processing unit, gas oil loading facilities, Qafco-5 (Qatar Fertiliser Company), among others.

This year, Qatar Petroleum International (QPI), an investment arm of QP that makes strategic commercial investments across the energy value chain around the world, has a team of specialists reviewing the company’s strategy to achieve acquisitions worth up to a staggering $5 billion. Studies and negotiations are on to acquire electricity and gas assets in the Philippines, Greece, Oman and France, in addition to petrochemical projects in Egypt, Vietnam, China and Tunisia.

QP implements plans to increase the reserves of crude oil and increase the production capacities of the oil fields through continuous efforts in collaboration with major international oil and gas companies, most notably Occidental, ExxonMobil, Maersk Oil Qatar.

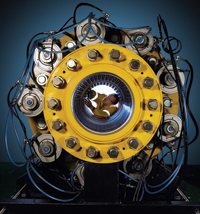

In the area of production and development, QP is implementing a comprehensive plan to raise the efficiency of onshore and offshore fields and to increase their production capacity. Onshore Dukhan is a large oil and gas field extending over an area of approximately 80 kms by 8 kms and is located about 80 kms to the West of Doha. It produces crude oil, associated gas, condensate and non-associated gas. Currently, QP is implementing integrated studies of oil reserves in the field.

The results of these studies will lead to a long-term development plan. High quality crude and associated gas are produced from the offshore Maydan Mahzam and Bul Hanine fields which began production in 1965 and 1972, respectively.

Meanwhile, Qatar has announced the discovery of a gas reservoir holding 2.5 trillion cubic feet (tcf) of gas in Block 4N offshore the emirate’s northern coast, according to the field’s owner state-run Qatar Petroleum, alongside partners German BASF-subsidiary Wintershall and Japan’s Mitsui. This is the largest gas find in the emirate since the North Field, the world’s largest gas field, was uncovered 42 years ago. The companies are seek to develop the newly discovered 544-sq-km area in the next few years and have already looked into various engineering options to develop the field, according to Dr Al Sada. Wintershall signed a contract with Qatar to explore Block 4N in 2008. Mitsui bought a 20 per cent stake in the Block 4N project two years later. International oil companies such as Shell, CNPC, Total, and JX Nippon Oil and Gas Exploration are also currently exploring for gas in separate blocks offshore Qatar.

This discovery will potentially enhance Qatar’s role as a prime gas producer and exporter in the years to come. With this discovery, Wintershall will find itself in an excellent position to develop one of its biggest hydrocarbons fields. Remarkably, the discovery at Block 4N is larger than Germany’s total proven gas reserves of 2.2 tcf, according to BP’s Statistical Review of World Energy published in June 2012. However, it remains to be seen how the Qatari government will include the production plans at Block 4N into its overall gas production and export plans. Qatar has yet to make a decision on its moratorium on further development of the North field, which has effectively prevented Qatar from increasing LNG exports since it started operating its 14th and final gas liquefaction plant in 2011.

QP has already started preliminary engineering studies to develop the fields, which will lead to the integration of the development plans of surface facilities, new wells and offshore installations with new ground facilities. QP also operates Al Shaheen oil field which lies 180km north of Doha.

QP had finished a development plan that aims at maintaining the current production rate of the field. In implementation of the plan, 15 new platforms, pipelines to transport oil, water, and gas were installed. The plan also includes two tankers for storage and export of oil and drilling of 169 wells. The average daily production from the field is about 300,000 bpd.

Qatar has huge stockpiles of natural gas as the third largest country in the world in terms of the size of the reserves after Russia and Iran. Qatar’s North Gas Field is considered to be the largest single non-associated gas reservoir in the world. It covers an area of 6,000 sq m, equivalent to about half the land area of Qatar. The utilisation of this field’s massive reserves has become a primary national goal to continue the development and prosperity process in the country.

The most important achievements in the gas sector have been accomplished over the past year. QP signed a partnership agreement for the development of Barzan Gas Project which aims to produce 1.4 bcfd of the North Gas Field to feed the local industries. QP also implemented the Pearl Gas to Liquids (GTL) project which represents one of the largest energy projects. The ambitious project has design capacity to convert 1.6 billion standard cubic feet per day of wellhead gas into 260,000 bpd of products, comprising 140,000 bpd of GTL products and 120,000 bpd of condensate, LPG and ethane.

QPI built an impressive multi-billion dollar portfolio of investments in the global energy market. Investing in upstream, gas and power, refining and petrochemicals as well as other midstream/downstream projects has allowed QPI to emerge as a company of strong vision and discipline. Amid declining production from Qatar’s mature oil fields, QP is eyeing ways to reverse the slump. As the world’s largest LNG producer, gas-rich Qatar can afford to take a more cautious approach toward its oil sector, but QP is quietly pushing forward with a long-term plan to sustain production.

Presenting QP with an opportunity to gain more control over its oil fields, operating licenses at three critical, IOC-operated fields are nearing expiry. These include fields operated by France’s Total, Denmark’s Maersk Oil, and US Occidental and together account for more than half of the country’s current oil output.

Total’s licence to operate the Al Khalij field, slated to expire early next year, was the first in QP’s sights. Total recently renegotiated a 25-year extension to its license to operate the field, but starting in February 2014, its operating stake will be reduced from 100 per cent to 40 per cent, with QP picking up the remainder. The type of contract is also changing, from a production sharing agreement (PSA) to a joint venture.

With Maersk and Oxy’s 100 per cent-operated fields, QP “will most likely follow the same model,” one Total official suggests. Maersk’s licence at the 300,000 bpd Al Shaheen field expires in 2017, while Oxy’s licence to operate the 90,000 bpd Idd Al Shargi field expires in 2019. When the Maersk and Oxy licences expire, “QP has the right to renegotiate new terms,” a senior Qatari official says.

Due to the ongoing production declines at Total’s 25,000 bpd Al Khalij field, company officials suggest that a PSA was not the most effective way to further develop the field’s remaining reserves. “It was the best agreement we could have achieved with QP,” the Total official says. When asked whether Total was seeking to maintain the existing framework, the official says: “We knew it was not possible.” While partly a reflection of the current nature of the field, it was also a reflection of “the Qatari way of doing things,” the official adds.

Despite already spending $6.5 billion on a previous field upgrade targeting output of 525,000 bpd, Al Shaheen is only producing 300,000 bpd. Maersk has now agreed to a new field development plan that will involve spending an additional $1.5 billion in order to “optimise recovery and maintain a stable production plateau.” Evident of the sensitivity over Al Shaheen – Qatar’s largest producing field – industry sources say Maersk is under strict orders from QP to keep quiet about it.