Baker Hughes ... a leading player in the oilfield services market

Baker Hughes ... a leading player in the oilfield services market

The company’s wide product and service portfolio is its core strength and a key differentiating factor in the competitive oilfield services industry and services. However, intense competition is likely to erode its market share

Baker Hughes is a supplier of oilfield services, products, technology, and systems to the worldwide oil and natural gas industry. The company also provides industrial products and services to the downstream chemicals, and process and pipeline industries. The company has a wide product and service portfolio, which are its core strength and a key differentiating factor in the competitive oilfield services industry. However, intense competition is likely to erode the market share of the company, says Datamonitor in a strengths, weaknesses, opportunities and threats (SWOT) analysis of the company.

Wide product and service portfolio: Baker Hughes has a wide product and service portfolio catering to the worldwide oil and natural gas industry. The company manufactures and supplies drill bits and fixed-cutter polycrystalline diamond compact (PDC) bits. It also supplies drilling and evaluation services which include directional drilling, measurement-while-drilling (MWD), and logging-while-drilling (LWD) services. The company provides wireline formation evaluation and wireline completion and production services for oil and natural gas wells.

Baker Hughes provides its services in wellbore construction, cased-hole completions, sand control, and wellbore intervention. Wellbore construction products and services include liner hangers, multilateral completion systems, and expandable metal technology. Cased-hole completions products and services include packers, flow control equipment, subsurface safety valves, and intelligent completions.

The company provides specialty chemicals to the oil and gas industry. It also supplies specialty chemicals to several industries and provides polymer-based products to a range of industrial and consumer markets. The company provides oilfield chemical programs for drilling, well stimulation, production, pipeline transportation, and maintenance programs. Baker Hughes also manufactures and supplies electrical submersible pump systems (ESPs) and progressing cavity pump systems (PCPs). The company also provides permanent monitoring systems and chemical automation systems. The company’s wide product and service portfolio is its core strength and a key differentiating factor in the competitive oilfield services industry.

Strong focus on research and development (R&D): The company has strong R&D capability to promote market driven solutions. Baker Hughes maintains a consistent and a strong focus on research to develop new products, processes, and services; and improve existing products and services, to design specialised products to meet specific customer needs, and to enhance manufacturing and production methods and improve service. It spent $556 million on R&D in FY2013. R&D costs increased 12 per cent in FY2013 compared to FY2012. R&D costs of new products and services were $370 million, $337 million, and $324 million for the years ended December 31, 2013, 2012, and 2011, respectively.

The company’s strong R&D capabilities have enabled Baker Hughes to develop new products. In March 2011, Baker Hughes launched GeoForm sand management system with shape memory polymer (SMP) technology. In April 2011, it launched Centrilift FlexPump ESP, Centrilift Electrospeed Advantage next-generation VSD, and Centrilift PowerMonitor module, which are designed to enhance the operating range and reliability of electrical submersible pumping (ESP) systems and to reduce operating expenses associated with ESPs.

Further, in May 2011, Baker Hughes launched JewelSuite reservoir modeling software, an integrated reservoir modeling tool that uses patented 3D gridding technology to build accurate reservoir models for fields with complex geology. In June 2011, the company launched X-Treme Clean XP system, a wellbore clean-up and displacement system designed to improve efficiency and reduce operational risks in high-cost environments, such as: deepwater applications; horizontal, extended-reach, and deviated wells; deep wells; and wells with high dogleg severity. In October 2011, it launched TORXS system, the only expandable liner hanger system that is installed and released prior to the cement job, which eliminates the risk of the running tools becoming fixed in place during cementing, requiring fishing or well abandonment.

In February 2012, Baker Hughes launched AutoTrak Curve Rotary Steerable System, a tool that can drill vertical, curve, and horizontal sections in one fast run to maximise available pay zones and reduce the number of trips. In March 2012, a Baker Hughes’ subsidiary chartered a new pressure pumping vessel that can provide offshore stimulation services to Maersk Oil in the North Sea.

In November 2012, Baker Hughes, through its subsidiary Baker Hughes Oilfield Operations, converted a fleet of its Rhino hydraulic fracturing units to bifuel pumps in order to improve operational efficiency, lower costs, and reduce health, safety and environmental impacts. Further, the company’s ProductionWave solution, improves reserve recovery in unconventional oil plays by combining the superior drawdown of the company’s electrical submersible pumping (ESP) systems with products and services from its completions services and upstream chemicals product lines.

The company continued to ramp up its R&D at its technology centres in Brazil and Saudi Arabia in FY2013. As a result, Baker Hughes commercially launched 129 new products and services.

Diverse geographical presence: Baker Hughes has wide geographical presence. The company’s global operations are organised into a number of geomarket organisations spread across various locations, including the Americas, Europe, Asia Pacific, Africa, and the Middle East regions. Further, the company has technology centres located in the US (Claremore, Oklahoma; and several location in Houston, Texas and surrounding areas), Germany (Celle), Brazil (Rio de Janeiro), Russia (Novosibirsk), and Saudi Arabia (Dhahran).

In addition, it generates its revenue from well spread locations. For FY2013, North America accounted 48.6 per cent of the total revenues of the company from its oilfield operations, the Middle East and Asia Pacific 18.1 per cent, Europe, Africa, and Russia accounted for 17.2 per cent, and Latin America 10.3 per cent. The remaining 5.8 per cent revenues were generated from the industrial services segment. The company’s diverse geographical presence reduces its business risks.

Long-term service agreements and alliances: Baker Hughes has entered into several long-term service agreements, and has also formed alliances with other companies to strengthen its production capabilities. For instance, in the fourth quarter of 2012, Baker Hughes and CGGVeritas entered into a collaborative relationship to improve shale reservoir exploration. In October 2013, Petronas Carigali (PCSB) entered into a long-term oilfield service agreement (OFSA) with Baker Hughes to enhance the recoverable reserves and production of hydrocarbons in the Greater D18 fields, offshore Malaysia. In March 2014, it signed an agreement with CGG for RoqScan technology offered by CGG. Further, in April 2014, it formed an alliance with Aker Solutions to develop technology for production solutions that will boost output, increase recovery rates, and reduce costs for subsea fields.

Long-term service agreements and alliances will help the company in strengthening its production capabilities. This in turn will help Baker Hughes in better serving its customers, and thereby increasing customer satisfaction and loyalty.

Acquisition of Perfomix: In recent times, the company has been focusing on strengthening its real-time digital capabilities through acquisitions. For instance, in April 2014, it acquired Perfomix, a Texas-based oilfield software technology company focused on solutions to enhance oil and gas operations’ performance.Perfomix offers a data and advisory services delivery platform to support drilling, pressure pumping, completions and production operations, and regulatory reporting requirements.

Acquisition of Perfomix will expand Baker Hughes’ portfolio of field devices integration, real-time data management, visualisation, and analytics software, thus complementing existing capabilities with a modern technology platform.

Establishment of new research and technology centres: Baker Hughes has opened two new research facilities to expand its global technology network and strengthens its capability to provide local solutions. For instance, in October 2011, Baker Hughes opened a new research and technology center at Rio de Janeiro in Brazil, which has been designed to enable the development of technologies and solutions to unlock the full potential of deep water and pre-salt reservoirs. This facility will concentrate on building a new generation of highly specialised wellbore construction tools and services to economically produce the pre-salt reservoirs in offshore Brazil. Further, in February 2012, Baker Hughes opened another research and technology centre at Dhahran in Saudi Arabia with a focus on R&D of new technologies to unlock the potential of unconventional resources. In February 2014, it opened the Artificial Lift Research and Technology Center (ALRTC) in Claremore, Oklahoma, with an investment of more than $60 million. The research centre is built to deliver testing capabilities for production technology.

Such research and technology centres will help Baker Hughes to expand its global network and also provide cheaper and better solutions, which in turn will increase the revenues and market share of the company.

Intense competition: Baker Hughes faces intense competition in the markets it operates with companies like M-I Swaco, Halliburton, Newpark Resources, National Oilwell Varco, Schlumberger, and Weatherford International (Weatherford).

Baker Hughes’ primary competitors in the provision of products and services for the pipeline transportation industry are Champion Technologies and Nalco Holding Company. The company competes in the ESP market with Schlumberger and John Wood Group. In the PCP market, the primary competitors include Weatherford, Robbins & Myers, and Kudu Industries.

Baker Hughes’ ability to defend, maintain, or increase prices for its products and services is dependent on the industry’s capacity relative to customer demand, and the availability of competitors’ products and services. Such intense competition is likely to erode the market share of Baker Hughes.

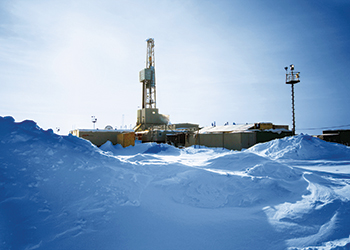

Weather conditions: The operations of Baker Hughes are affected by weather conditions. Weather can have a significant impact on demand as consumption of energy is seasonal. Any variation from normal weather patterns, cooler or warmer summers and winters, can have a significant impact on demand. Adverse weather conditions, such as hurricanes in the Gulf of Mexico, may interrupt or curtail Baker Hughes’ operations, or Baker Hughes customers’ operations, cause supply disruptions and result in a loss of revenue and damage to Baker Hughes’ equipment and facilities, which may or may not be insured. Thus, adverse weather conditions can have a negative impact on the operations of the company.

Volatility of oil and natural gas prices: Volatility in oil and natural gas prices can adversely affect the demands of products and services. It also impact customers’ activity levels and spending for products and services. The current energy prices are important contributors to cash flow for customers and their ability to fund exploration and development activities. Further, expectations about future prices and price volatility are important element for determining future spending levels.

Lower oil and natural gas prices generally lead to decreased spending by customers. While higher oil and natural gas prices generally lead to increased spending by customers, sustained high energy prices can be an impediment to economic growth, and can therefore negatively impact spending by customers.

Furthermore, customers also take into account the volatility of energy prices and other risk factors by requiring higher returns for individual projects if there is higher perceived risk. Any of these factors could affect the demand for oil and natural gas and could have a material adverse effect on Baker Hughes’ results of operations.