Process gas compressor ... mature technology

Process gas compressor ... mature technology

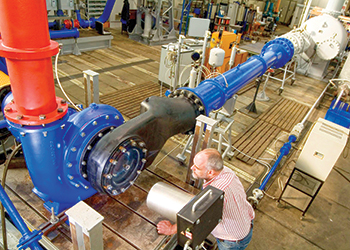

The oil and gas industry is the largest revenue contributor and primary driver of the global process gas (PG) compressor market which earned revenues of more than $6 billion in 2014 and is projected to cross $8 billion in 2021

Global investment in exploration and production (E&P) of oil and gas (O&G) made 2014 a good year for process gas compressor manufacturers. The upswing is expected to continue with growing shale gas production and increasing demand for liquefied natural gas (LNG) in North America, according to new analysis from Frost & Sullivan.

Shale gas and other unconventional energy E&P in regions such as Asia-Pacific (Apac) and Africa will also help sustain the market.

The oil and gas industry is the largest revenue contributor and primary driver of the global process gas (PG) compressor market. In 'Analysis of the Global Process Gas Compressor Market,' Frost & Sullivan finds that the market earned revenues of more than $6 billion in 2014 and estimates this to cross $8 billion in 2021.

'Power generation is another industry that has given a boost to the PG compressor market,' says Frost & Sullivan Industrial Automation & Process Control Research analyst Sakthi Sobana Pandian. 'While conversion from coal-fired to gas-fired plants has driven demand in North America, need to generate more power to cater to demands of the expanding population and urbanisation trends has fueled PG compressor adoption rates in Apac.'

However, a rising number of gas compressor stations could fuel concerns about air quality. Air monitoring systems have been installed to measure the impact of gas drilling and other infrastructure and limitations could be imposed on investment activity among station owners, thereby adversely impacting market progress.

'Although PG compressor technology is mature, there is scope for improvement in terms of energy efficiency and compliance with environmental regulations,' Pandian says. 'If eco-friendly PG compressors are made available globally, end-users are likely to upgrade their existing systems,' he adds.

For the moment, however, economic gloom across end-user industries has suppressed the purchase of new PG compressors. End-users remain focused on refurbishing and maintaining existing PG compressors rather than investing in new installations.

Chinese market for medium voltage motors dips due to sluggish downstream industry performance.

The Chinese market for medium-voltage (MV) motors is confronted with strong headwinds due to the adverse impact from end markets, according to Shirly Zhu, analyst for industrial automation, at IHS Technology. Considering the high correlation between MV motors and the downstream industries of cement, chemical, metallurgy, mining, oil and gas, power and so on, the performance of end markets has a major influence on MV motor market trends in China.

The Chinese market for MV motors is estimated to have generated approximately $1.9 billion in revenue in 2013, with more than 26,000 units shipped during the year. IHS estimates that MV motor market revenue in China fell by 6.6 per cent to nearly $1.8 billion from 2013 to 2014. The contraction is attributed to a sharp decline in pricing and unit shipments as a result of the economic slowdown and sluggish end-market performance.

Looking forward, IHS predicts the decline in the market will decelerate in 2015 to some extent. The price drop is predicted to ease because the cost of raw materials is unlikely to continue plummeting.

However, demand from downstream industries will remain stagnant despite some focused stimulus measures from the Chinese government to fuel end markets. For instance, the One Belt and One Road (OBAOR) strategic project is expected to partly benefit the cement and metal industries through infrastructure projects.

In the long-term, the market is expected to gradually grow starting in the middle of the forecast period. IHS forecasts that the Chinese MV motor market will grow at a CAGR of 2.0 per cent from 2013 to 2018, reaching $2.1 billion in revenue in 2018.

Despite the general growth trend for Chinese MV motors during 2013 through 2018, subsectors within manufacturing industries are forecast to have diverging performances during the period of 2013 to 2018.

The process manufacturing sector is the major downstream industry for MV motors in China. Subsectors predicted to outperform the average growth of the entire process manufacturing sector include water and wastewater, oil and natural gas, chemical and power generation. The above-average growth will be driven by increasing demand for these products along with the economic development.

Conversely, the sectors faced with problems of oversupply, outdated capacity and environmental pollution—that is, cement, metal processing and mining—are forecast to underperform the market average, causing their market share to shrink from 2013 to 2018.