Baker Hughes ... making gains in the Middle East

Baker Hughes ... making gains in the Middle East

The region that includes the Middle East is Baker Hughes’ second-largest market in terms of revenue, trailing North America. The company that helps explorers drill and maintain oil wells boosted quarterly sales for the first time since the end of 2014

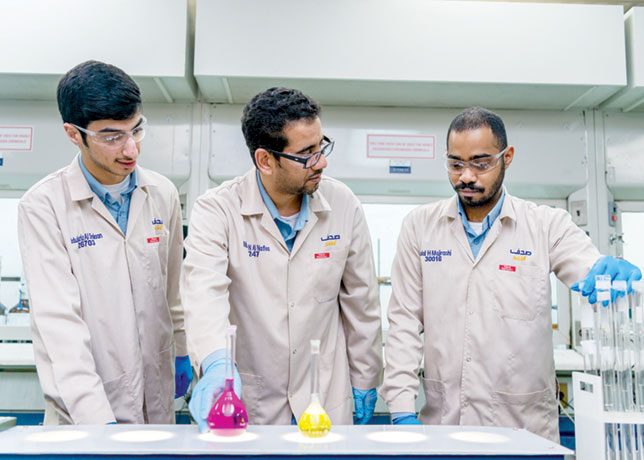

Baker Hughes Inc, which will soon be the world’s second-largest oil services provider, called the Middle East a positive environment for expected work in the first half this year. The region was one of the main reasons the company stopped a sales slide of seven straight quarters at the end of last year.

"There’s a bit of a disconnect between the Opec cuts that were announced and what we’re forecasting at least for the next six months in terms of activity," Martin Craighead, chief executive officer at Baker Hughes, told analysts and investors on a conference call. "We see no pullback that would correlate to the announcement on a production cut. We still expect it to be relatively steady. A couple pockets of the more midsize to smaller players in the Middle East are actually going to increase."

The healthy outlook for drilling in the region underscores the temporary nature of the output cuts, and the potential for production to recover swiftly after global prices rebounded to above $55 a barrel. The deal between the Organization of Petroleum Exporting Countries and several non-members to reduce supply will last for six months before being reviewed.

The biggest source of the planned cuts is Saudi Arabia, which has said more than 80 per cent of targeted reduction has been implemented. Some customers in the Middle East haven’t wavered from their output goals for 2020 and 2025, he said.

The region that includes the Middle East is Baker Hughes’ second-largest market in terms of revenue, trailing North America. The company that helps explorers drill and maintain oil wells boosted quarterly sales for the first time since the end of 2014, thanks in part to year-end growth in the Middle East, it said in an earnings statement.

The number of active rigs in the Middle East fell in December to the lowest since August 2013, Baker Hughes data show. Baker Hughes is expected to close by mid-year its merger with the oilfield unit of General Electric Co to become the No 2 service and equipment supplier.

Opec and other producers are likely to fully comply with the curbs, bringing global crude markets into balance early this year, according to Kuwait’s oil minister.

The market is "becoming a bit more comfortable that Opec may very well deliver the cuts it promised," Bart Melek, the head of global commodity strategy at TD Securities in Toronto, said by telephone. "Opec has continued to inform us that they are accelerating the cuts, so this market from the supply side looks well-disciplined."