KPC ... new growth initiatives in place

KPC ... new growth initiatives in place

Kuwait’s current oil production capacity is around 3.15 mbpd, and it has long said it plans to raise this to 4 mbpd by 2020 and maintain this level to 2030

Kuwait is investing $100 billion to improve the efficiencies of its upstream and downstream facilities in line with its five-year plan, the Social & Economic Objectives 2015-2020, even as about 34 per cent of all project investments in the country currently are in the oil and gas sector.

As part of its strategy to to extend and modernise the refining capacities, the Kuwait National Petroleum Company (KNPC), the national oil refining company of Kuwait, plans to invest $40 billion, so as to increase the total refining capacity to 1.4 million barrels per day (mbpd) in 2022, which includes the new Al-Zour refinery and the Clean Fuels Project.

Among the investments, Al Ahmadi’s Olefins III gets the biggest share with $9 billion. This is followed by the Package 1 and 2 of the Clean Fuels Project at the Mina Abdullah Refinery ($8 billion), Package 3 of the Clean Fuels Mina at the Al Ahmadi Refinery ($5 billion), and the Package 1 of the Process Plant at Al Zour Refinery ($5 billion).

Around $16 billion are expected to be spent on the Al-Zour New Refinery Project (NRP) (capacity of 615,000 bpd), that will supply both the domestic and international demand for ultra-low-sulphur petroleum products.

KNPC had awarded $11.5 billion worth of contracts for five EPC packages. Tecnicas Reunidas, Sinopec and Hanwha Engineering and Construction will build the main process units of the refinery (contract worth $4.2 billion). Package 4 (tankages, road works, buildings, pipelines, water and control systems) was awarded to Saipem and Essar Projects Ltd. Package 5 (offshore export facilities) was awarded to Hyundai Engineering & Construction and SK Engineering & Construction. The refinery will be completed in 2019.

The Clean Fuels Project aims to upgrade and expand the Mina Abdulla and Mina Al-Ahmadi refineries to raise their capacity by 64 000 bpd to 800 000 bpd by mid-2018; they will be integrated in a single complex with Shuaiba, which will be shut down in April 2017. KNPC has awarded a $4.82 billion contract for Mina Ahmadi to a consortium led by JGC and two contracts for Mina Abdullah ($3.8 billion to Petrofac and $3.4 billion to Fluor).

In May 2016, KNPC obtained a $4 billion loan from the National Bank of Kuwait and the Kuwait Finance House to fund the first tranche of the Clean Fuels Project. KPC is in the final stages of negotiations with international credit agencies regarding the financing of the second tranche of loans (around $6.4 billion).

|

KNPC ... investing in refineries |

Meanwhile, Opec-member Kuwait plans to raise its oil production capacity to 4.75 mbpd by 2040 as part of a strategy to expand its downstream investments.

Nabil Bouresli, the managing director of international marketing at Kuwait Petroleum Corp (KPC), says those investments included adding refining and petrochemical production in Kuwait and abroad.

Kuwait’s current oil production capacity is around 3.15 mbpd, and it has long said it plans to raise this to 4 mbpd by 2020 and maintain this level to 2030.

Kuwaiti oil production averaged 2.7 mbpd in January 2017, following a 131,000 bpd cut agreed with Opec in November 2016. The cuts may increase to 148,000 bpd to allow for maintenance on the Burgan field – accounting for about 60 per cent of national output – and northern oil fields.

With an officially acknowledged production capacity of 3.2 mbpd, Kuwait Oil Company (KOC), the KPC subsidiary responsible for domestic operations, ramped up output to compensate for the loss of Kuwait’s share of shut-in production since October 2014 from the Khafji and Wafra fields in the Partitioned Neutral Zone (PNZ) with Saudi Arabia.

Reasons for the shutdown were a combination of environmental concerns on the part of Saudi Arabia and Kuwait’s displeasure at the Saudi renewal, without consulting Kuwait, of Chevron’s contract to operate Wafra. A December 2016 visit by Saudi King Salman to Kuwait, ostensibly to seek Kuwaiti support for Saudi military operations in Yemen, failed to resolve the issue.

Aside from Burgan that produces 28 deg-36 deg gravity crude, other production comes from the south-western 22 deg-26 deg gravity Umm Gudair, Darif, Minagish and Abduliyah fields, the northern 11 deg-18 deg gravity Ratqa – an extension of Iraq’s Rumaila field – Raudhatain and Sabriya fields, and from the heavy crude PNZ Wafra field when onstream.

First launched in 1997 and revised regularly up to 2014, ‘Project Kuwait’ aims to increase oil production capacity to 4 mbpd by 2020, principally through developing heavy oil reserves. International investors are invited to participate in the projects via technical service contracts with KOC.

Gas production hovers around 1.3 bcfd, of which 130 mmcfd is non-associated gas from northern fields. All the gas is consumed domestically in refining, petrochemicals, power generation and enhanced oil recovery (EOR). Kuwait is the Gulf’s largest LNG importer, with 50 cargoes totalling 7.045 million cm in the 10 months to November 2016 – 10 per cent higher than the previous year. It will also import a further 200 million cfd of gas from Iraq under a recent agreement.

Kuwaiti oil analyst Kamel Al-Harami believes the country should import more gas from Iraq via the existing pipeline from Iraq’s Zubair field to the Mina Al-Ahmadi port in Kuwait, use that gas for power generation and re-export the surplus power to Iraq’s Basra region.

|

KOC ... expanding production |

However, the government’s main ambition is the Jurassic Production Facility Project, a plan to develop tight, deep, non-associated gas from Jurassic reservoirs in the northern Raudhatain, Sabriya and Umm Niqa fields. These are low porosity, low permeability carbonate gas reservoirs in the Jurassic Marrat, Najmah and Sargelu reservoirs at depths greater than 13,500 feet, amid sour conditions and high pressure and temperatures of around 11,000 psi/138 deg C.

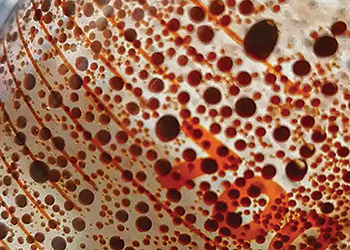

Dolomitisation improves reservoir quality in parts but production is controlled by natural fractures. Hydrocarbons present in these reservoirs are near critical gas condensate and volatile oil.

KOC wants to increase non-associated gas production to 1.5 bcfd by 2020 and 2.5 bcfd in 2030, but this has been riven by technical and political problems. Discovered in 2006, gas in the northern fields came onstream in 2008 with typical well production of 5,000 bpd of liquids and 10 mmcfd gas, reaching a plateau of 130 mmcfd. Shell and KOC signed a $1.5 billion technical service agreement in 2010 to boost gas production here to an initial 500 mmcfd.

But one year later, Kuwaiti legislators voted for a corruption probe into the contract. Investigations passed to the public prosecutor in 2012 and were dropped in April 2016.

Al-Harami says actions by the parliament were a complete waste of time. ‘The investigation by parliament was a mistake. The contract with Shell should have been from the ground to over and above the ground because of our total lack of experience in free gas.’ Instead, the Shell contract was transferred later in 2010 to local company Kharafi National, owned by a former speaker of the parliament and with no expertise in producing tight gas. Kharafi appointed Italy’s Saipem as subcontractor, replacing it with UK-based oil services company Petrofac.

The project later stalled as Kharafi failed to obtain financing. Eventually, Schlumberger was awarded a $480 million contract in January 2016 to produce gas from the Sabriyah and Niqa fields. In November 2016, Schlumberger and local company Spetco International, owned by the Al-Qaddumi family, were award the East and West Radhautain gas production contracts respectively for a combined $758 million.

Further ambitious projects have been delayed or stalled by politics. The $12 billion Clean Fuels Project (CFP) to expand the Mina Abdullah and Mina Al-Ahmadi refineries is delayed until 2019 as KNPC needs to find financing.

A $30 billion project to build an LNG import and regasification terminal in the Al-Zour area, a petrochemical complex and new 615,000 bpd capacity refinery will be bundled under a newly formed company, Kuwait Integrated Petrochemical Complex, and 50 per cent privatised under an IPO.

The Al Zour refinery was first planned in 2007 and the project has been subject to failed tenders, scandals and tender and contract cancellations, most recently in February 2017 when the oil sector regulatory body, the Supreme Petroleum Council, cancelled a scandal-ridden $789 million refinery feed pipeline tender.

In addition, Kuwait’s largest trade union, the Oil & Petrochemical Industries Workers Confederation, fiercely opposes austerity and privatisation in defence of jobs in the largest national employer. An April 2016 strike halted 60 per cent of oil production and cost $200 million. Union member protests and criticism of the government filled social media in January 2017 following hydrogen sulphide leaks from northern fields that caused KOC to call a state of emergency.

Now the union wants Oil Minister Essam Al-Marzouq to be grilled by the parliament over government plans. But this depends on the parliament’s lifespan – a precarious matter in Kuwait.

Kuwait Petroleum Corporation (KPC) is a state-owned integrated energy company, that has operations throughout oil and gas value chain including, exploration, production, development, refining and marketing, and transportation business activities related to petroleum products.

Its significant focus on research and technology has enhanced its business operations. Operational incidents are a cause for concern to the company. New growth initiatives coupled with increasing demand for oil and petroleum products could provide the company new growth initiatives.

However, lower oil price, exploration and development risks and strikes could affect its operations.

The company has a significant focus on research and technology. KPC’s research and development centers include GC-01 Kuwait Integrated Digital Field (KwIDF) project in South &East Kuwait; Burgan Collaboration Center; and Q8 Research & Technology Centre located in the Netherlands.

The company takes up various research and development projects, including a project in cooperation with the Kuwait Institute for Scientific Research (KISR), for service on the evaluation and combating the growth of microbes at fuel storage warehouses in Ahmadi and Shuaiba refineries; and a project regarding an environment-friendly catalysts used for industrial gas flaring about Kuwait University.