Nwosu ... focus on technology in energy sector

Nwosu ... focus on technology in energy sector

The oil and gas industry has been impacted severely due to the Covid-19 pandemic. However, with the industry now actively embracing the digital transition and moving to new grounds to sustain itself, business continuity amidst the current downturn has a pivotal role to play.

Participating in an online Adipec Energy Dialogue Webinar, Chikezie Nwosu, CEO of WalterSmith in Nigeria, a world class integrated energy solutions provider, said although the oil and gas industry has previously experienced similar shocks to supply and demand, the impact of the Covid-19 pandemic is being felt over a much shorter period and far more aggressively than before.

"The Covid-19 pandemic has clearly shown us that oil price is not in control of any oil and gas company or country, as even the largest oil-producing countries such as Saudi Arabia and Russia are ill-equipped to adjust to what we are experiencing today," Nwosu explained. "The focus for companies now is to control their costs to ensure business continuity for when the oil prices eventually recover. This can be done by continuing with the structural costs changes that were made during the pandemic."

However, Nwosu warns that bad habits often return when oil prices show signs of recovery, something he has seen happen on numerous occasions in the past.

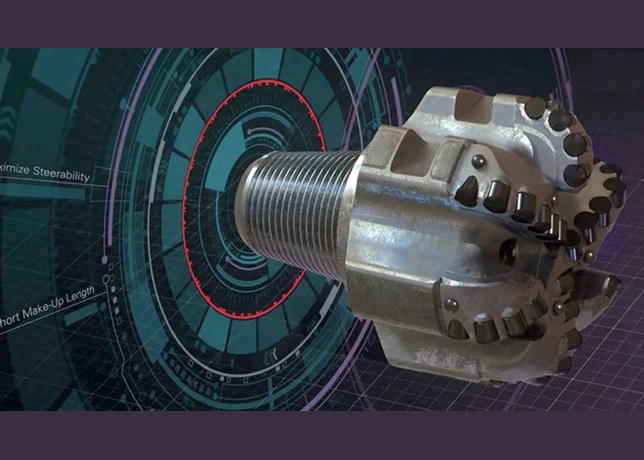

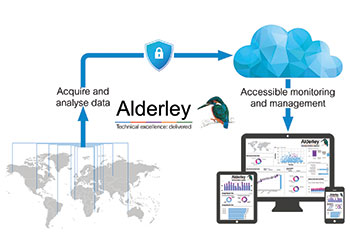

Discussing the role of technology in navigating the unfamiliar economic conditions, Nwosu said that WalterSmith has been able to successfully continue operations using a combination of effective logistics planning for maintenance and operations, and the use of technology for remote monitoring of assets.

"Reliance on technology in field operations in Nigeria is slowly continuing to grow and, while drones were already being deployed for surveillance in the field operations before the Covid-19 outbreak, many previously manual tasks will now be automated or can be remotely accessed," he said.

Turning the dialogue towards the specific challenges faced by oil and gas companies in the time of a pandemic, Nwosu highlighted several issues including the lack of direct access to field operations, managing expectations for restricted community access to operations, not having expert personnel in the field to do necessary production optimisation, in addition to dealing with skeletal services from regulators and government partners which means that all approval processes are taking much longer.

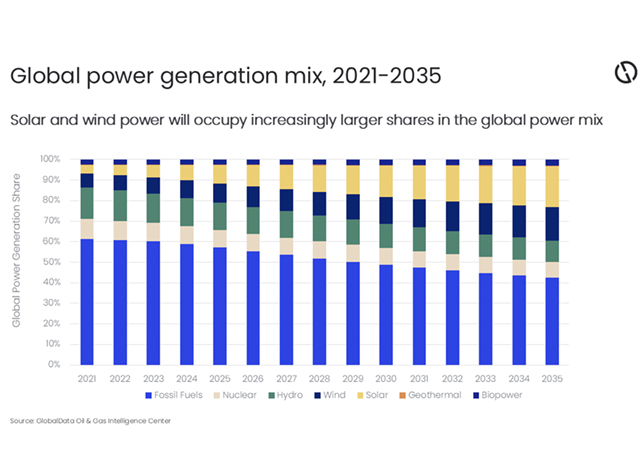

Looking into the future, WalterSmith will no longer be an oil and gas company; but rather an integrated energy company where the focus is on delivering energy from cleaner sources. As part of this process, Walter Smith has partnered with the United Nations Industrial Development Organisation (UNIDO) to build a 500-ha Eco-Industrial Park in which the company will transition from 300 MW of gas power, first to 500 MW, then 1,000 MW of solar power by 2025/2026. By this time, all the power that the company requires for operations and consumer distribution will be through solar energy.

Nwosu believes that while international energy companies are taking the energy transition extremely seriously, the advantage for WalterSmith is that as an independent, small player in the market, the company can be more nimble than the oil giants by making the right changes now, and driving the energy transition forward with the right partners.

The Adipec Energy Dialogue is a series of weekly online thought leadership events featuring key stakeholders and decision-makers in the oil and gas industry, the dialogues focus on how the industry is evolving and transforming in response to the rapidly changing energy market.

In another wide ranging interview, Musabbeh Al Kaabi, CEO of Petroleum and Resources at the UAE's Mubadala Investment Compan, shared his outlook on the recovery of oil and gas markets and the long term impact of demand post Covid-19 on energy supply and demand.

He said Covid-19 caused oil demand to drop by 30 per cent in March and April, from a peak of 100 million barrels per day at the end of 2019. However, demand has started to recover, he added, reaching levels seen in the 1990s and will rise further over the coming 12 months.

"Predicting the oil market is very challenging. Covid-19 has created major disruption to demand and we expect to see the continuation of that disruption in 2021. But if you project the horizon to 2030, we will go back to an acceptable level of growth, potentially peaking in 2030," said Al Kaabi.

Addressing concerns over future supply issues, Al Kaabi said climate change pressures, concerns over ESG and government policies are impacting the investment decisions by big international oil companies, which could result in episodes of disruption of supply. But he added, this would create space for national and privately owned oil companies to invest in the upstream sector.