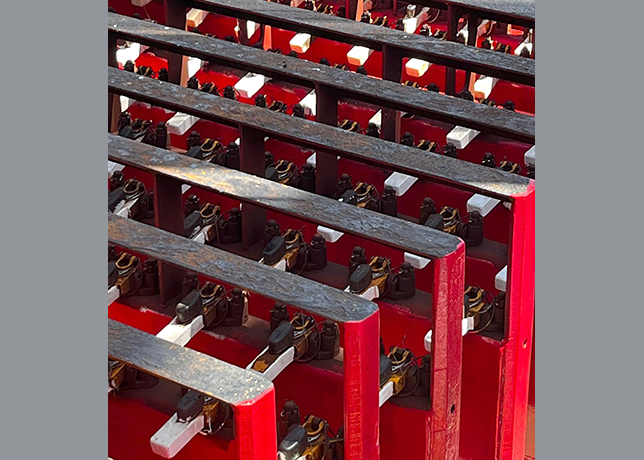

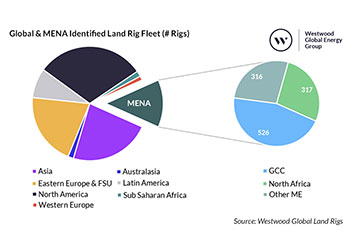

Global and Mena identified land rig fleet

Global and Mena identified land rig fleet

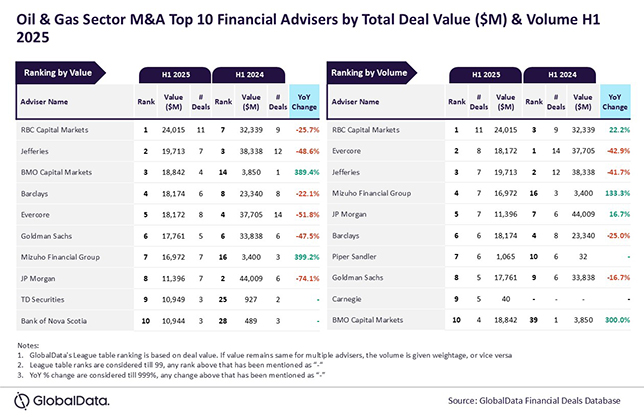

The Middle East and North Africa (Mena) region currently hosts a fleet of 1,159 identified land drilling rigs. With 526 units (45 per cent of the Mena fleet), it is the Gulf Cooperation Council (GCC) that leads supply, while North Africa and Other Middle East contain 27 per cent and 28 per cent respectively. The largest fleets are hosted by Saudi Arabia, Algeria and Kuwait, while Iraq and Iran also host fleets of over 100 units

The Middle East GCC area will see a robust 25 per cent increase in demand for land rigs between 2023 and 2027 as Saudi Arabia and the UAE invest billions to meet production capacity targets, according to Westwood MENA Onshore Drilling Rig Market Forecast report.

Contractors operating in Mena vary from small indigenous contractors to NOC power houses. Two of the key markets for high HP units, Saudi Arabia and the UAE, are dominated by their respective NOCs –Aramco through its JV with Nabors, Sanad, and Adnoc via its subsidiary Adnoc Drilling.

Despite this, the region hosts many international contractors with Sinopec hosting the largest fleet of the international players with 80 land drilling rigs, 44 of which are located in Kuwait. KCA Deutag has also substantially improved its position within the Mena market with the acquisition of Saipem’s onshore drilling fleet, taking its Mena fleet from 45 to 77 units.

The global onshore drilling market has shown a strong recovery from the lows of 2020-2021, with the Mena region at the forefront of this recovery, particularly the GCC countries of Kuwait, Oman, Saudi Arabia and the UAE. Market recovery is projected to continue in 2023, supported by oil prices that are expected to remain above $70/ barrel (bbl) throughout 2023 due to demand and Opec+ production adjustments.

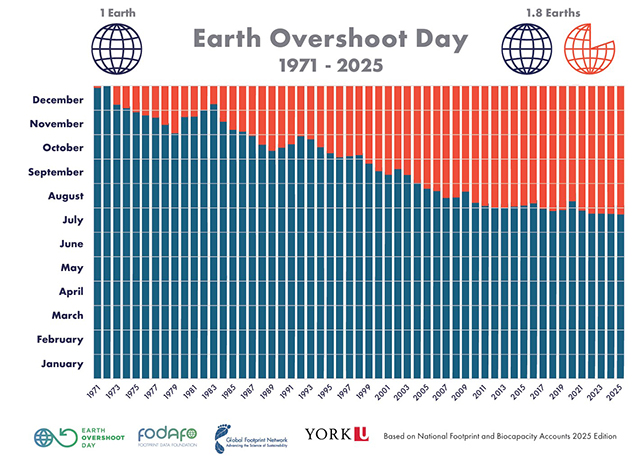

|

Change in land rig demand compared to 2019 base case (%) |

Demand varies significantly throughout the Mena region. When comparing demand pre-Covid (2019), to 2022, the GCC recovered well from the downturn. The Other Middle East and North Africa sub regions, however, have struggled to recover with leading countries (Iraq and Iran) suffering due to civil disputes and sanctions. Demand in GCC managed to remain relatively steady during the downturn and by 2022 was already seeing activity above the levels seen in 2019. Meanwhile the Other Middle East and North African regions saw greater impact with 12 per cent and 24 per cent drops in activity between 2019 and 2022, respectively.

Westwood anticipates that the GCC will continue to grow strongly throughout the five-year forecast, with demand in 2027 expected to be 53 per cent higher than 2019. This will be driven by production capacity increases at all major onshore producers, with many of the projects required already having passed FID, supporting the forecast. In comparison, a -12 per cent change in demand in the Other Middle East region and an 8 per centincrease in North Africa are forecast over the same period.

This increased demand is already translating into new supply of rigs into the market. Kuwait and Saudi Arabia are among the countries that have announced major rig fleet increases to cope with the level of demand they are expecting. Westwood predicts rig supply to grow by 11 per cent over the 2023-2027 forecast period to meet demand, most not ably in the GCC where the rig fleet is expected to increase by 20 per cent.

Utilisation across Mena is forecast to average 39 per cent in 2023, increasing to 42 per cent by2027. However, rates in the GCC are significantly higher, with utilisation forecast at70 per cent in 2023 increasing to 78 per cent by 2027. Comparing this to North Africa and Other Middle East, Westwood expects Algeria and Iraq to lead the way in utilisation rates with Algeria increasing from 47 per cent to 60 per cent and Iraq from 37 per cent to 46 per cent over the next five years.

While significantly below the GCC powerhouses, there is significant upside potential to both. Algeria is emerging as a new hotspot for gas exportation to Europe and Iraq meanwhile continues to set ambitious production targets, which will require a major increase in utilisation of its fleet, far beyond Westwood’s current forecast.

Day rates across the Mena region vary significantly due to the wide range of rig equipment available; North Africa hosts an older, lower powered fleet than the GCC and therefore attracts lower average day rates. The long-term nature of rig contracts in the Mena region also means that any significant changes in rates take years to materialise.

The GCC has a small proportion of lower spec (<1,500 HP) equipment, with equipment generally higher spec (>1,500 HP) and having greater capabilities than the equivalent powered rigs in North Africa and Other Middle East. In countries such as Iraq and 4/4.

Oman, significant international competition and the introduction of an increasing number of Chinese rigs has led to more competition for contracts and subsequently more competitive rates. Day rates for lower spec rigs in North Africa average just $18,000, compared to $23,000 in the GCC.

Upper end day rates are dominated by GCC countries, with leading edge day rates of $40,000-$45,000 seen in the UAE, however, Adnoc Drilling’s dominance in the UAE drilling market restricts international contractors’ ability to compete for contracts. Greater variance in day rates is seen with the higher spec equipment due to top-end rigs boasting leading edge technology and desert manoeuvrability functions to achieve maximum efficiency.