Energy leaders are calling the current energy crisis the worst

Energy leaders are calling the current energy crisis the worst

As the UAE plans to invest heavily in clean and renewable energy sources over the next three decades to help realise its net zero target, new research from global professional services company GHD has revealed that 61 per cent of UAE senior energy leaders agree that the global energy crisis has accelerated their investment in increasing their renewable energy mix.

As the upcoming host of COP28 later this year, there are international expectations on the nation to uphold its net zero aspirations and facilitate the energy transition.

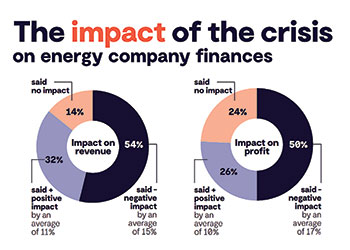

The study says the energy crisis that has rocked the world over the past three years has created a perfect, multidimensional storm of sector-wide shocks including a capital crunch that has severely depleted investment levels.

Shocked, an extensive global opinion research study undertaken among energy sector leaders, also reveals that 94 per cent of energy leaders believe the current energy crisis is the most severe their market has ever experienced. And according to energy sector CFOs, investment levels between 2020 and 2022 were an estimated $203 billion lower than they otherwise would have been.

Extreme market volatility and geopolitical tensions have put energy security high on the global agenda, with three-quarters of energy leaders reporting that this is the number one concern for their organisation.

This disruption has had a significant impact on economies and communities around the world and societal pressure on the energy sector to provide reliable, affordable, low-carbon energy has never been greater. Three-quarters of energy leaders (74 per cent) believe energy prices are currently the biggest contributor to inflation, and 76 per cent say the energy crisis is reducing the standard of living across the globe, the report said.

The climate shock continues to force an acceleration of the energy transition, but progress towards net zero is being impacted by the complex dynamics at play. While 42 per cent say the current energy crisis has accelerated their organisation’s net-zero plans, almost half of energy leaders (47 percent) state that the crisis has decelerated their net-zero plans by an average of six years.

And while the crisis may have put the brakes on net-zero strategies for many companies, the resulting volatility in natural gas prices has driven the diversification of energy assets, with 70 per cent of energy sector leaders reporting that the volatility in natural gas prices over the past 12 months has accelerated their business’s adoption of renewable energy generation assets.