Name of Client : Adnoc Gas

Estimated Budget : $4,500,000,000

Contract Value : $5,000,000,000

Revised Budget : $5,500,000,000

Facility Type : LNG Terminal, Offsite & Storage Tanks, LNG

Sector : Gas

Main Contractor : JGC Corporation/NMDC Energy/Technip Energies

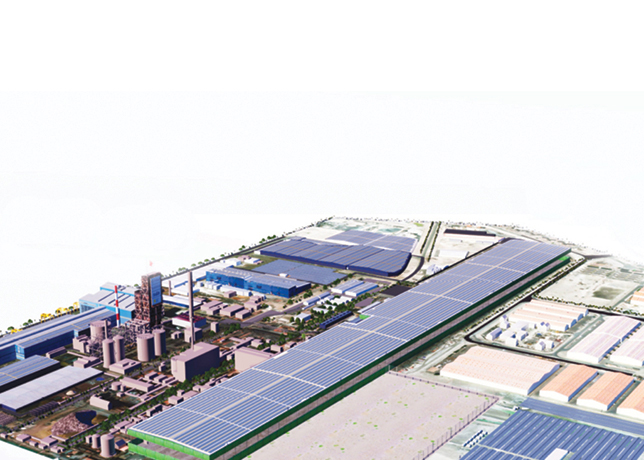

Location : Ruwais, Abu Dhabi, UAE

Award Date : 2024-Q1

Status : Construction

Background

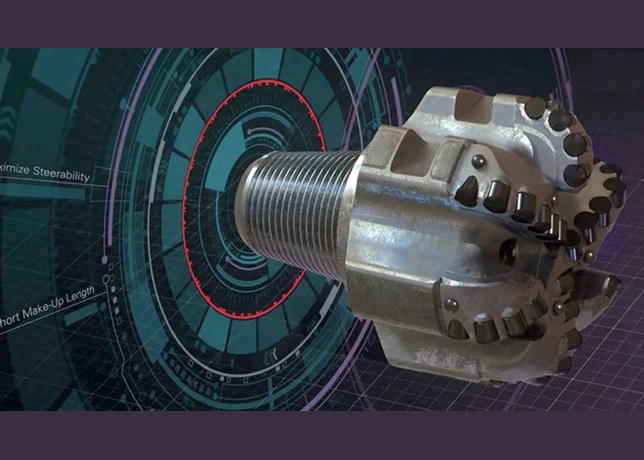

Abu Dhabi National Oil Company (Adnoc) has announced plans to develop a midstream/downstream facility located next to Fujairah Port initially. But the project has been relocated to Ruwais after a comprehensive evaluation of location options. The objective of the project is to construct a liquefied natural gas (LNG) export terminal that would have the capacity to process and ship up to 9.6 million tonnes per annum (mtpa) of LNG to crucial consumer markets of Pakistan, India, China, and other key markets in Asia like Japan and South Korea. The proposed facility is anticipated to more than double the UAE's current LNG production capacity. The Ruwais LNG plant is set to be the first LNG export facility in the Middle East and Africa region to run on clean power, making it one of the lowest-carbon intensity LNG plants in the world. The facility will leverage artificial intelligence and the latest technologies to enhance safety, minimise emissions and drive efficiency.

Project Scope

The project's scope encompasses the construction of an LNG export terminal designed to process and ship up to 9.6 million tonnes per annum (mtpa) of Liquefied Natural Gas (LNG). This includes the installation of two mega LNG trains, process units, storage tanks, and an export jetty for loading cargoes. Additionally, the project features LNG bunkering utilities, flare handling systems, and designs for electric-powered rotary equipment and compressors, along with associated buildings. Furthermore, it involves the construction of a 364-kilometre-long, 52-inch pipeline and marine dredging works.

Project Status

As of January 2025, CB&I's UAE office will be in charge of tank construction, and the Plainfield Illinois office for engineering. Saudi Arabia and Thailand offices are set to provide fabrication and modularisation support, respectively.

Project Finance

Adnoc is the project client. In early March 2023, Adnoc Group appointed its subsidiary Adnoc Gas in charge of managing and executing the planned LNG export terminal project. Shell, BP, Total Energies, and Mitsui (through its wholly owned subsidiary MBK Investment Management) will each take a 10 per cent stake in the project, with Adnoc retaining the 60 per cent majority stake.

Project Schedules

Project Announced : 2Q-2020

Feasibility Study : 4Q-2020

FEED : 2Q-2022

PMC : 2Q-2022

EPC ITB : 1Q-2023

EP : 1Q-2024

Construction : 2Q-2024

Commissioning : 1Q-2029

Completion : 1Q-2029

.jpg)