Petrobras plans to introduce an additional 14 floating units by 2028

Petrobras plans to introduce an additional 14 floating units by 2028

South America is poised to reinforce its leadership in the floating production storage and offloading (FPSO) market, with significant developments underway in Brazil, Guyana, and Suriname.

These nations are spearheading the region’s dominance in offshore oil production, driven by substantial investments and strategic projects.

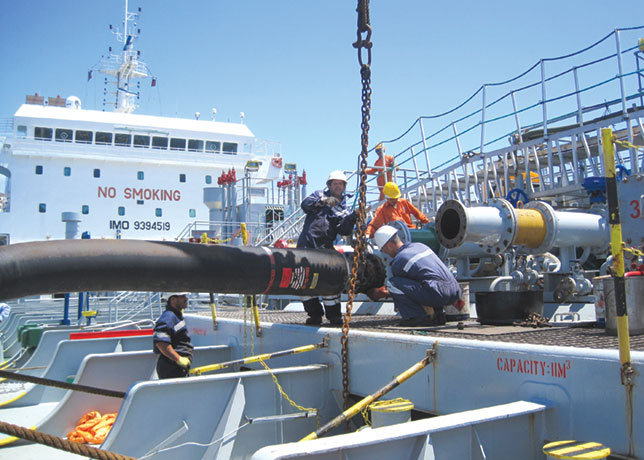

Brazil continues to be a global frontrunner in FPSO deployments, with state-controlled Petrobras playing a pivotal role.

Between 2019 and 2023, Brazil’s oil production surged by over 20 per cent, reaching 3.5 million barrels per day (bpd), largely attributed to the commissioning of 12 floating units with a combined capacity of 1.74 million bpd.

These units have been instrumental in exploiting the pre-salt fields offshore Brazil, particularly in the Campos and Santos Basins.

Petrobras has outlined plans to introduce an additional 14 floating units by 2028, aiming to further bolster the nation’s oil production capacity by 2.31 million bpd.

This expansion positions Brazil to potentially become the world’s fourth-largest oil producer, following the US, Saudi Arabia, and Russia.

Guyana is rapidly emerging as a significant player in the FPSO landscape. The country is set to bring its fourth FPSO, ‘One Guyana’, into operation in the second quarter of 2025.

This vessel, constructed by SBM Offshore, boasts a production capacity of 250,000 bpd and is en route from Singapore to Guyanese waters.

Its deployment is expected to elevate oil production at the Stabroek block to 870,000 bpd, aligning Guyana’s output with that of Venezuela, which has recently produced between 860,000 and 880,000 bpd.

ExxonMobil, leading a consortium that includes China’s CNOOC and US Hess, estimates the recoverable hydrocarbon reserves within the Stabroek block at 11 billion barrels of oil equivalent.

The consortium’s strategic developments have positioned Guyana as a world leader in oil production per capita.

Suriname is on the cusp of a transformative phase in its offshore oil sector. TotalEnergies has awarded contracts worth at least $3 billion for the development of Suriname’s inaugural offshore project.

Italian contractor Saipem secured a $1.9 billion deal for the subsea development of the GranMorgu field, while TechnipEnergies and SBM Offshore were awarded over 1 billion euros for constructing an FPSO vessel.

This $10.5-billion project, approved in late 2024 by TotalEnergies and APA, is anticipated to commence oil production by 2028, with recoverable resources exceeding 700 million barrels.

The FPSO will incorporate advanced technologies to minimise emissions and enhance environmental monitoring, underscoring a commitment to sustainable development.

Argentina is also making strides in oil production, particularly from the Vaca Muerta shale formation.

In September 2024, the country’s oil output reached 738,000 bpd, marking a 15 per cent increase compared to the same period in the previous year.

Nearly 60 per cent of this production originates from Vaca Muerta, which holds recoverable oil reserves estimated at 16 billion barrels.

The adoption of horizontal directional drilling techniques has been a significant factor in this growth, with the number of such wells increasing steadily throughout 2024.

Rystad Energy projects that oil production at Vaca Muerta could surpass 1 million bpd by 2030, further solidifying Argentina’s position in the global oil market.

The strategic developments in these South American nations are not only enhancing their individual oil production capacities but also contributing to the region’s prominence in the global FPSO market.

The substantial investments and technological advancements underscore a robust commitment to leveraging offshore resources efficiently and sustainably.

As these projects come to fruition, South America’s influence in the global energy sector is set to expand, offering promising prospects for economic growth and energy security.