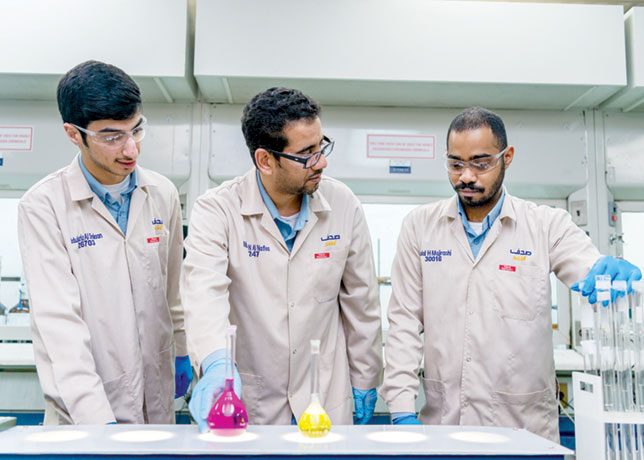

Asian oil firms look set to report strong profits for refining crude in the second quarter as plant maintenance and recovering demand lifted fuel prices, while the third-quarter outlook looks positive.

Margins averaged above $8 a barrel for turning crude into oil products, around double the first quarter and above the $5-$6 level this time last year, as stronger Chinese and Indonesian demand for imports met supply trimmed by refinery shutdowns.

“Demand is going strong and if you throw in a couple of curve-balls from hurricanes and refinery problems, you could have a strong third quarter,” said Victor Shum, downstream analyst at Purvin and Gertz in Singapore.

Margins at Asia’s largest refiner Sinopec and Indian state-run refiners such as Indian Oil Corp. (IOC) will be improved by larger-than-expected retail price hikes in past weeks. But these will still not be enough to raise their refining business out of the red, analysts say.

But refining looks rosy for upgraded exporting refiners such as Reliance, Singapore Petroleum, SK Corp and Nippon Oil Corp, though share prices for many refiners have weakened in the past two months amid a sell-off in emerging stock markets.

Refining margins for cracking benchmark Dubai crude at a Singapore plant averaged $8.16 a barrel in the past month, after topping $10.00 in May and nearing $8.50 in April. This is up from an average $4.56 in the first quarter, calculations show.

Simple export-oriented refiners in Singapore – a proxy for the region as a whole – have also made a profit after averaging above $2.00 a barrel in April and May, following losses in the first quarter of 2006.