Heat exchangers market ... highly fragmented

Heat exchangers market ... highly fragmented

THE global market for heat exchangers market is projected to be worth $19.5 billion by 2019, says a report.

According to a recently published report by TechSci Research, “Global Heat Exchanger Market Forecast and Opportunities, 2019”, the global heat exchanger market revenues are forecast to grow at a CAGR of 9 per cent during 2014 to 19.

The market is likely to be driven by growing industrialisation across the globe and increasing demand from developing economies over the next five years. Moreover, the demand for HVAC equipment is also increasing in emerging economies, largely driven by growing urbanisation in these countries due to which the heat exchanger market is also expected to benefit from growing demand for replacement applications during the next five years.

One of the key factors contributing to this market growth is the increasing industrial activities in developing countries. The global heat exchanger market has also been witnessing the increasing adoption of energy-saving equipment. However, the increasing competition due to entry of new vendors could pose a challenge to the growth of this market.

Heat exchangers are essentially used for efficiently transferring heat from one medium to another. These devices are widely deployed in a number of industries such as chemical, HVAC, food and beverage, etc. On the basis of configuration, heat exchangers are broadly classified into four basic types that include shell and tube type, plate and frame type, air coolers and cooling towers.

Shell and tube and plate and frame heat exchangers are the most commonly deployed exchanger types. Shell and tube heat exchangers held the largest share in the global heat exchanger market in 2013 as they are among the most widely used exchanger units in a range of industries. However, these exchanger types are expected to grow at a slower rate as compared to plate and frame and other types of heat exchangers during the forecast period. The demand for welded-type plate heat exchangers is expected to remain high over the next five years, mainly due to their compact size and ease of maintenance.

One of the major factors supporting this growth trend includes rising demand from emerging economies.

Heat exchanger market in Europe and the Americas is expected to witness slower growth than Asia-Pacific, with demand in these two regions largely emanating from the replacement segment. Heat exchanger demand from Asia-Pacific is likely to register sharp growth as compared to other geographical regions, mainly due to growing industrialisation and increasing demand from developing countries such as China and India. China is expected to witness strong growth in its heat exchanger market due to growing demand from chemical as well as HVAC and refrigeration industries. The global market for heat exchangers is highly fragmented, with Alfa Laval AB, GEA Group and Xylem being few of the major manufacturers.

“Heat exchanger demand from Asia-Pacific is forecast to grow at a faster rate as compared to mature markets such as Europe and the Americas, with China and India expected to dominate. Additionally, potential technology advancements are expected to significantly drive the adoption of heat exchangers during the forecast period.” says Karan Chechi, research director with TechSci Research a research based global management consulting firm.

EUROPE

Europe has always been a strong market for heat exchangers and globally, this market has been a leader for heat exchangers with respect to demand as well as production capacity. The region has the presence of most of the global leaders in heat exchanger manufacturing. Heat exchanger consumption in the region is estimated to grow at a CAGR of around 4.7 per cent from 2013 to 2018. This region has a relatively slow growth rate as a result of its dominant market size and slow economic activity as compared to the other regions. The demand in this region is boosted mainly due to the increased replacement demand for the heat exchangers.

ASIA-PACIFIC

Asia-Pacific, being the fastest growing heat exchanger market globally, is estimated to grow at a CAGR of 10.6 per cent for the next five years. Asia-Pacific is witnessing high industrial growth, which hints at an ever-increasing demand of heat exchangers for its diverse applications. China dominates the heat exchanger market in Asia-Pacific region, being a major consumer and the fastest growing country in terms of heat exchanger demand. Currently, a high share of heat exchanger is consumed by the chemical industry and the demand of heat exchangers through chemical industry is expected to grow in the next five years at a CAGR of more than 11.5 per cent from 2013 to 2018.

After China, countries, including India and other Asian countries, are showing increasing growth in demand for heat exchangers. Moreover, increasing number of heat exchanger manufacturers from Asian countries are putting vigorous efforts for developing a strong base of heat exchanger market, with a target of reducing heat exchanger imports.

Other vendors include API Heat Transfer, Chicago Bridge & Iron Company, Hisaka Works, Modine Manufacturing Company and SPX Corporation.

Heat exchangers are widely used in industrial oil coolers, boiler coolers, chilled water systems, transmission and engine coolers, condensers, and evaporators in refrigeration systems. These applications incur excessive loss of energy during the transfer of heat. Many industries are adopting high-end energy-saving heat exchangers to mitigate the erosion of their revenue, which is largely due to the rise in the cost of energy. Heat exchanger manufacturing companies such as Alfa Laval and GEA Group are investing heavily in R&D to develop energy-efficient heat exchangers. This trend is expected to contribute toward the growth of the global heat exchanger market during the forecast period.

Increasing industrial activities in developing countries is a crucial driver boosting the market. Process and discrete industries in these countries have been expanding their manufacturing operations worldwide, which in turn is boosting the Global Heat Exchanger market.

Further, one of the main challenges in this market is the increasing competition brought in by the entry of new vendors. The new vendors offer their products at a cheaper price, which makes the pricing more competitive and erodes the profit margins of the major players.

CONSOLIDATION

The market is currently highly competitive due to the presence of a large number of small and medium scale manufacturers across the globe. However, the consolidation has already started and would start reflecting with major trends in next 3-4 years. Some of the leading players operating in the global heat exchangers market include Alfa Laval AB, GEA Group and Xylem.

Meanwhile, French turbine and train maker Alstom is selling its heat exchanger business to to private equity group Triton for a higher-than-expected 730 million euros ($1 billion), giving a boost to its drive to raise cash to help it cope with weak demand for power equipment.

Alstom has been hit hard by a drop in orders for power equipment from utilities, which are suffering in turn from weak electricity prices. The group says it planned to raise up to 2 billion euros from selling non-core assets to help pay its debts and give it the flexibility to make acquisitions in faster-growing markets, which could include rail signaling.

“The achieved price ... is at the top end of our expectations and it illustrates that Alstom is moving forward with its non-strategic asset disposals,” says Rob Virdee, an analyst at Espirito Santo.

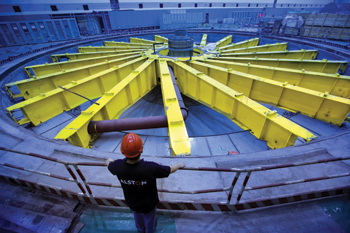

Alstom says the deal was approved by its board of directors on March 31 and would close in the first half of its 2014-2015 fiscal year. The heat exchanger unit makes equipment and conducts after-sales service for product lines used by boiler companies and utilities such as air preheaters, gas-gas heater units for thermal stations and heat transfer solutions.

It employs 1,500 people worldwide with operations in Germany, the US, Japan, China, India, Brazil, Switzerland, Czech Republic, and is headquartered in Germany. It is expected to post revenues of 430 million euros in the year ending March 31, with a double-digit operating margin, Alstom adds.

Also, German industrial machinery and engineering company GEA Group struck a deal to sell its heat exchangers division for about 1.3 billion euros ($1.8 billion) to concentrate on its burgeoning food equipment business.

GEA says it will use proceeds from the sale to private equity investor Triton for acquisitions to sharpen its focus on food-related operations, which will now account for more than 70 per cent of group revenues. Triton is paying about 1 billion euros and assuming pension obligations at the heat exchangers business, GEA says.

GEA had put the heat exchangers business up for sale late last year, saying it offered limited synergies with its other operations, which make products such as industrial meat grinders and automatic feeding systems for the dairy industry.

The deal with Triton values the heat exchangers business, which makes equipment for a wide range of applications from air conditioning to cooling towers, at between 11 and 12 times annual operating profit, according to analysts.

GEA said it expects the deal to close by the end of the year.

Triton’s acquisition will be backed with debt financing totalling about 1.25 billion euros from banks expected to include Deutsche Bank, Commerzbank, ING, RBS and UniCredit, banking sources said.

The financing will comprise a large undrawn component of around 400 million euros of guarantee facilities and about 70 million euros of revolving credit.

The rest of the financing will comprise between 750 million euros and 800 million euros of high-yield bonds, with the total debt financing amounting to about five times the heat exchangers business’s annual Ebitda of about 150 million euros.

Frankfurt-based Triton beat out a rival consortium of buyout group EQT and industrial services group Bilfinger, adding to the acquisition of Alstom’s heat exchangers business for €730 million ($987 million).