Inside a 120,000 barrel oil tank

Inside a 120,000 barrel oil tank

ENBRIDGE Energy Partners (EEP) is an oil and gas company that operates gas transmission pipeline network, crude oil transportation pipeline network, natural gas gathering systems, natural gas treatment facilities, natural gas processing plants, storage facilities, and marketing facilities. The company’s high debt and decline in operational performance are areas of concern. The company could benefit from various expansion projects and growth prospects for natural gas in the US. Stiff competition, regulatory requirement and volatility in oil and gas prices could pose various challenges to the company, says Global Data in a strengths, weaknesses, opportunities and threats (SWOT) analysis of the company.

STRENGTHS

Support from Enbridge: Enbridge is the parent company of EEP. Along with Enbridge, EEP seeks to capitalise on the increasing unconventional production of oil and gas in North America. Enbridge is focused on two US Gulf Coast market access pipeline projects, namely, Flanagan South Pipeline Project, and Seaway Crude Pipeline System.

The Flanagan South Pipeline Project will transport volumes into Cushing. The system is scheduled for operations in 2014. The 670-miles Seaway Crude Pipeline System project involves the reversal of 500 miles of pipeline to enable transportation from Cushing to the US Gulf Coast. The system will have initial capacity of 150,000 barrels per day (bpd). These projects could complement the operations of EEP’s Lakehead system. It could lead to expansions of EEP’s Southern Access and Alberta Clipper mainline pipelines.

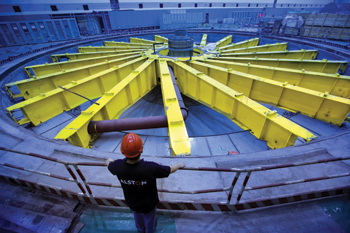

Substantial assets: The company operates crude oil transportation pipeline network, gas transmission pipeline network, natural gas treatment facilities, natural gas processing plants, storage assets, natural gas gathering systems and marketing assets. The Lakehead system pans a distance of approximately 2,200 miles and consists of approximately 5,100 miles of pipeline. It has 64 pump station locations with a total of approximately 920,000 installed horsepower and 72 crude oil storage tanks with an aggregate capacity of approximately 14 million barrels.

The North Dakota system contains about 820 miles long pipelines, 23 pump stations, multiple delivery points and storage facilities with an aggregate working storage capacity of approximately 1.3 million barrels. The Mid-Continent system’s crude oil pipelines cover a distance of over 435 miles. It has total crude oil storage capacity of 20.9 million barrels of oil equivalent (MMboe). The Ozark pipeline connects the Cushing storage facility to the refinery operations at Wood River. The storage terminals comprise 95 storage tanks ranging in size from 55,000 to 575,000 barrels. The Cushing terminal has a storage capacity of 19.9 MMboe.

The East Texas system contains 3,900 miles of natural gas gathering and transportation pipelines, approximately 108 miles of NGL pipelines, six active natural gas processing plants, including two hydrocarbon dewpoint (HCDP) control facilities, eight active natural gas treating plants, three standby natural gas treating plants and one fractionation facility located in the East Texas basin.

The North Texas System contains 4,600 miles of natural gas gathering and transportation pipelines, approximately 60 miles of NGL pipelines, six active natural gas processing plants and one standby natural gas processing plant located in the Fort Worth basin. EEP’s strong infrastructure enables it to transport crude oil and natural gas across US Mid-Continent, US Gulf Coast, and western Canada.

WEAKNESSES

Substantial debt: EEP continued to report high debt in 2013. For the fiscal year ended December 31, 2013, the company reported total debt of $5.29 billion, as compared to $6.03 billion in 2012. The company’s debt to equity ratio stood at 92.5 per cent, as compared to 135.4 per cent in 2012. Highly levered balance sheet could impair its ability to obtain financing for working capital, capital expenditure or general corporate purposes, especially if the ratings assigned to its debt securities by rating organisations were revised downward.

It could restrict the flexibility of the company in responding to changing market conditions and make it more vulnerable during times of slowdown. Another major consequence of the debt is that the company would need to allocate a substantial portion of the cash flow from operations to pay the principal and interest on debt, thereby reducing funds, which could be used for expansion through acquisitions, expansion of product offerings and for marketing.

Operational performance: EEP reported substantial decline in its operational performance in 2013. Decline in operational performance adversely affected overall profitability of the company. For the fiscal year ended December 31, 2013, the company reported revenue of $7,117.10 million, reflecting an increase of 6.12 per cent over that in 2012. All the business segments reported increase in their revenues.

However, the company’s operating expenses as a percentage of its total revenue increased to 93.81 per cent from 86.68 per cent in 2012 due to 14.86 per cent increase in operation expenses year on year. As a result, the company’s operating income declined 50.69 per cent to $440.4 million from $893.2 million in 2012, causing contraction in operating margin, which stood at 6.18 per cent, as compared to 13.31 per cent in 2012.

OPPORTUNITIES

Development projects: EEP is involved in various infrastructure projects. The Bakken Pipeline Expansion project involves expansion of capacity to 325,000 bopd. In March 2013, the project was placed into service providing an additional 145,000 bpd of pipeline export capacity from North Dakota. The company also completed the pipeline station expansion projects and third party pipeline connections under Bakken Access Programme.

The programme expanded the company’s gathering capabilities on the North Dakota system and included new facilities at multiple locations accommodating seven third party pipeline connections and the construction of the Little Muddy Station, enhancing the company’s ability to receive ability to receive more than 300,000 bpd from third party pipelines and more than 500,000 bpd from Enbridge truck and gathering facilities. The Berthold Rail Project enhanced the Bakken Terminal’s storage capacity by 80,000 bopd. It involved construction of crude oil tankage, three unit-train loading facility and other terminal facilities.

In November 2013 Enbridge and Marathon Petroleum announced the joint development of the Sandpiper Pipeline Project and the creation of the North Dakota Pipeline Company. Sandpiper is an approximate 600-mile pipeline project originating at Beaver Lodge Station near Tioga, North Dakota and terminating at Enbridge’s Superior, Wisconsin facilities. In October 2013, Enbridge Storage (North Dakota) placed the first of two 150,000 contract storage tanks into service.

Natural gas export: As recently as 2007, dozens of LNG import projects were proposed to address the gas requirements of the US market. In 2012, the circumstances were dramatically different. Statistics recently published by the US Energy Information Agency (EIA) indicate that natural gas supply in the US will soon exceed demand, allowing the US to become a net exporter of LNG by 2016 and an overall net exporter of natural gas by 2021.

This transformation is mainly due to the growing amounts of shale gas extracted through the process of hydraulic fracturing, also known as fracking.

The export of LNG is an attractive prospect for US producers due to the higher prices that natural gas commands outside the US. While the EIA predicts that long-term US natural gas prices will be around $4 mBtu to $6 mBtu, the current LNG import price for Japan is over $15 mBtu. Even accounting for the costs of construction of LNG export facilities and related infrastructure, these price discrepancies present great opportunities for US producers.

Demand for natural gas: US: The company could enhance its business operations with growth in the natural gas industry in the US. In the past few years, US pipeline exports of natural gas to Mexico have increased substantially, from around 0.9 billion cubic feet per day (bcfd) in 2010 to 1.7 bcfd in 2012.

Mexico has expanded its natural gas fired power generation in recent years, and plans to continue to do so. EIA expects that natural gas consumption will average 70.0 bcfd in both 2013 and 2014. Forecasts of closer-to-average winter temperatures in 2013 and 2014 have led to increase in the use of natural gas for heating in residential and commercial sectors.

The projected increase in natural gas prices contributes to a decline in natural gas used for electric power generation from 25.0 bcfd in 2012 to 23.1 bcfd in 2013 and 22.7 bcfd in 2014. Natural gas production is expected to increase from 69.1 bcfd in 2012 to 69.6 bcfd in 2013, and remain flat in 2014. Natural gas spot prices averaged $3.33 per MMBtu at the Henry Hub in February 2013, relatively unchanged over the previous two months. EIA expects the Henry Hub price will increase from an average of $2.75 per MMBtu in 2012 to $3.41 per MMBtu in 2013 and $3.63 per MMBtu in 2014. Increasing consumption, production and spot prices of natural gas could provide the company various growth opportunities.

THREATS

Environment regulations: The company’s operations are subject to federal and state laws and regulations relating to the protection of the environment. Some of these laws include the federal Clean Air Act and analogous state laws, the federal Clean Water Act and analogous state laws, the federal Resource Conservation and Recovery Act and analogous state laws, and the federal Comprehensive Environmental Response, Compensation and Liability Act and analogous state laws. Any change or breach of environmental or health and safety laws or regulations could expose the company to claims for financial compensation and adverse regulatory consequences. Such high expenses could adversely affect the profitability and the results of operations of the company.

Stringent pipeline regulations in North America: Stringent safety norms and environmental regulations have made it difficult to construct new pipelines. The new regulatory norms on pipelines safety and security mandate huge investments for the maintenance and inspection of existing pipeline systems. It is estimated that 20 per cent of the total investments in pipelines in the next decade will be on the maintenance and up-gradation of existing pipelines and compressor stations.

Volatility in oil and natural gas prices: The company faces the difficult prospect of operating in volatile market environment. Unstable market environment, coupled with geopolitical concerns and demand for oil and gas in emerging economies including China, India and other non-OECD countries, resulted in fluctuating oil and gas prices.

Moreover, political disorder in the Middle-East and Northern Africa has fueled fears of sudden disruptions in oil and gas supply. Besides, the increase in the supply of shale gas in North America has led to downward pressure on natural gas prices. Such volatility could have a significant impact on the company’s performance.